old iran

As we have stated before, Iran is the last juicy-sized market that needs an airline re-fleet. Other markets have been able to acquire aircraft as needs evolved. Iran has seen its airline fleet nearly frozen in place from the late 1970s.

Iranian airlines have acquired aircraft over the years and even spares. But nobody wants to discuss that – over here or over there. US sanctions are strict and any leaks of how these deals were pulled off mean severe fines and perhaps jail terms. So, nobody wants to talk – even though the acquisition stories may be among the most fascinating in commercial aviation history. Perhaps, one day we will get to hear about these stories.

Meanwhile, there was a brief window at the end of the Obama Administration where Iran could acquire western commercial aircraft. Airbus and ATR got orders and were able to get in a few deliveries. Boeing got a decent-sized order, but with the Trump Administration starting that was quashed.

Yet the need to update Iran’s commercial airline fleet has only grown more crucial by 2021. With the Biden Administration speaking with Iran again, there could be the hope of a rapprochement.

What does Iran need?

An academic survey for Iran’s CAO revealed Iran requires over 300 aircraft in the next ten years. None of Iran’s airlines were polled because, like their global counterparts, fleet planning is closely guarded information. These requirements come with a need for financing. Financing could be the most difficult issue to overcome given US banking sanctions.

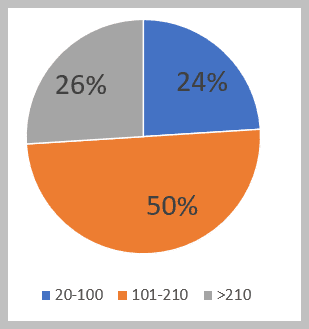

When we break down the requirements by seat segments, our sources indicate three segments are being considered.

- Aircraft under 100 seats, essentially turboprops and regional jets, are about one-quarter of the requirement. The choices here are likely to prioritize ATR and Embraer. Embraer could see interest here in its E175-E2.

- A quarter of the requirement is for aircraft with more than 210 seats. These would be used for long-haul markets. Iran currently serves markets as far away as China using A340-600s. But like all A340-600 operators, Iran desires something more fuel-efficient. In this segment, Airbus and Boeing both will benefit. Most likely for A330neo and 787s. But used aircraft are not out of the question as aircraft in this segment are expensive. That puts the 777-300ER into play as we saw in the 2016 Boeing order. Recall the A330s that Iran Air took delivery of came from the parked fleet in order to allow rapid delivery.

- The remaining half of the requirement is a broad spread from 101 seats to 210. If we use other markets as a proxy, then most of this segment would be from 150-210 seats. Essentially 737 MAX and A320neo sized aircraft. Between 101 and 150 seats, the Iranians have excellent choices from Airbus and Embraer. One cannot discount the SSJ or the MC-21 – both of which would likely be relatively cheaper if financed by Russian banks. Indeed, versions of these aircraft without Western avionics and engines are the only options available to Iran right now. Even China’s C919 and ARJ21 can’t be sold to Iran because of Western engines. But despite chatter about Russian aircraft being ordered, nothing has transpired.

Everyone a winner or everyone a loser?

In summary, currently, a market of between 300 and 400 aircraft is a very attractive opportunity for western OEMs. Airbus and Boeing have single-aisle aircraft that could be delivered rather quickly due to whitetails from orders placed by customers that collapsed during the pandemic. For Iran, much of its requirements are probably largely in place and could be delivered rather quickly.

A key issue for the Iranian side: Can they trust Boeing and Airbus, essentially the US and EU, after the previous deals were aborted within a year? How can the OEMs rebuild that trust? From what we hear from Iran: fast delivery and rapid finance processing. Present market conditions, with so many relatively young grounded aircraft, could be a source to rejuvenate the Iranian commercial fleet if the US, in particular, wishes to cut the Gordian knot.

Absent a political sea change in US sanctions – both aviation and banking – the promise of safer (and more economical) air travel for Iranians as well a new market for Western OEMs remains a mirage.

Views: 8