2021 05 13 13 04 50

Now that the MAX is back being delivered how is the delivery competition between these two families doing? We are focusing on deliveries as that is where the rubber hits the runway, so to speak. It also gets rid of the pesky “net orders” issue.

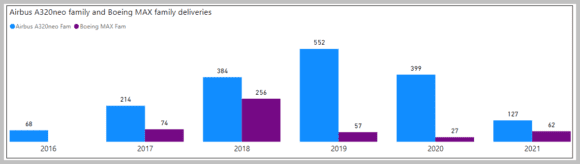

Our first chart looks at delivery history through April 2021.

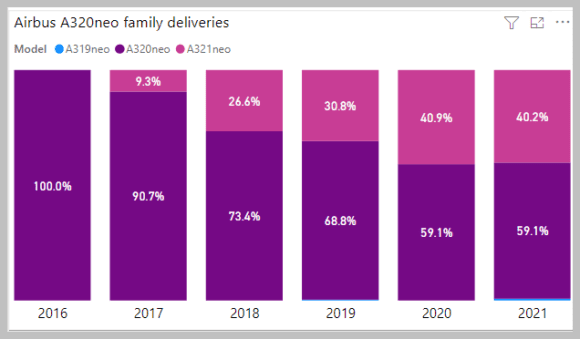

First, let’s look at Airbus. As the chart illustrates, Airbus is seeing a steady rise in A321 deliveries. Customers have clearly bought into the upsizing argument.

Considering the popularity of the A320neo, this is a significant move. It probably caught Airbus by surprise, too.

It’s clear Airbus benefitted from the lack of a Boeing replacement for the 757. When the A321XLR starts deliveries we can expect the A320neo share to decline more. Airbus has three A321s on offer compared to one A320.

We should see the A321 remain popular now that there is a second life as a freighter.

Next, let’s look at Boeing. MAX deliveries started a year later than the NEO.

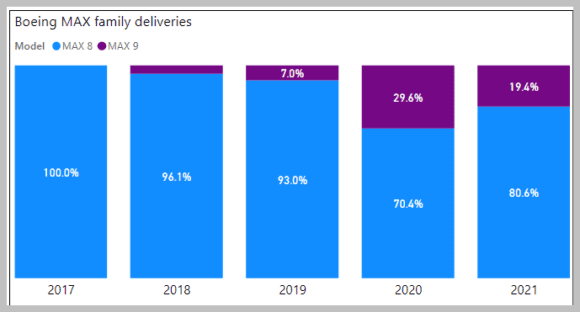

The MAX is Boeing’s fastest-selling model. This gave the program rapid critical mass. Then came the grounding.

Grounding aside, notice the difference in market interest in model sizing. Boeing’s MAX 8 is by far the most delivered model. Most interest in the MAX 9 has come from Alaska and United. United is also down for the MAX 10. However, as we have seen repeatedly, orders are less important than what gets delivered.

Tracking MAX numbers are not easy because Boeing does not identify the versions in their O&D tables. It takes some sleuthing to find out what actually comes out Renton and gets delivered.

Then we need to track what the lessors are doing. This is important given the thin data Boeing and lessors provide. Boeing’s O&D visibility used to be great, but their new data visibility is not nearly as good, especially on the MAX. Here is what our lessor sleuthing has found so far.

The delivery difference between the NEO and MAX suggests that Boeing is not offering what the market wants, whereas perhaps, Airbus is. But what we see is likely to change – Southwest selected the MAX 7 and as mentioned, Alaska and United have upsized. These influential US carriers could influence other markets. Will Boeing see its larger MAX models at 40% of deliveries?

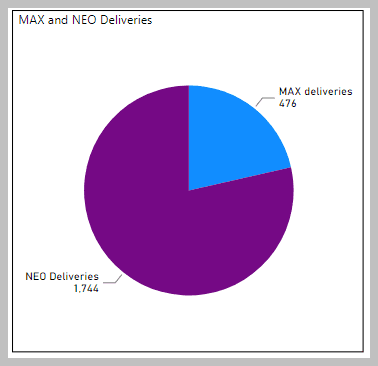

A final chart illustrates how the gap between the duopoly has grown. These models are the core of what Airbus and Boeing deliver. These are, financially, the most important models produced.

Clearly, Airbus delivered hundreds of NEOs during the MAX grounding. The more important point here is the sheer volume of these models that were delivered over the period – 2,220 in five and a quarter years. This number underscores the crucial role these models play in commercial aviation. These are the most popular commercial aircraft in service.

We can expect these numbers to rise sharply as the pandemic impact starts to wane. Airbus is already planning a production increase. Boeing has over 300 MAXs being readied for delivery even as it continues to produce at its current lower rate. The market is going to grow considerably before replacement models are developed.

Views: 1