MicrosoftTeams image 3

Norwegian reported a strong third quarter, with revenues and operating results all performing well. It is also bullish about the 2023 summer season but first will need to get through the low winter period when it will reduce capacity by 25 percent. Norwegian produces robust results in Q3.

The low-cost airline reported a NOK 909.7 million Q3 net profit on October 26 compared to NOK 168.7 million in the same period last year. This reflects how traffic grew to 6.1 million passengers from 2.5 million last year, with load factors touching 95 percent in July and on average 88.8 percent. Revenues were NOK 7.116 billion versus NOK 1.927 billion. The operating profit or EBIT was NOK 1.032 billion versus NOK-295.5 million in Q3 2021. This compares to NOK 1.359 billion in the second quarter.

For January-September, Norwegian reported a NOK 1.124 billion net profit (2021: NOK 1.759 billion), operating revenues of NOK 13.9 billion (NOK 2.518 billion), and an EBIT of NOK 1.542 billion (NOK-2.523 billion). Results were impacted by high fuel costs (up five times to NOK 2.6 billion) and the strong US dollar. Norwegian started hedging fuel only this month. Liquidity stood at NOK 8.2 billion and interest-bearing debt at NOK 2.7 billion at the end of September.

CEO Geir Karlsen said that the results demonstrate that Norwegian is able to deliver robust financial results. “This quarter has demonstrated our position as the reliable Nordic option for customers traveling to their holidays, to visit friends and family, or for business purposes. Many corporate customers choose to fly with Norwegian, and the number of business travelers is now on par with pre-pandemic levels for our most frequented domestic business routes.”

The airline’s punctuality dropped, with the number of flights departing on time at 73.6 percent compared to 78.8 percent in Q2 and 91 percent in Q3 last year. This was caused by disruptions across Europe.

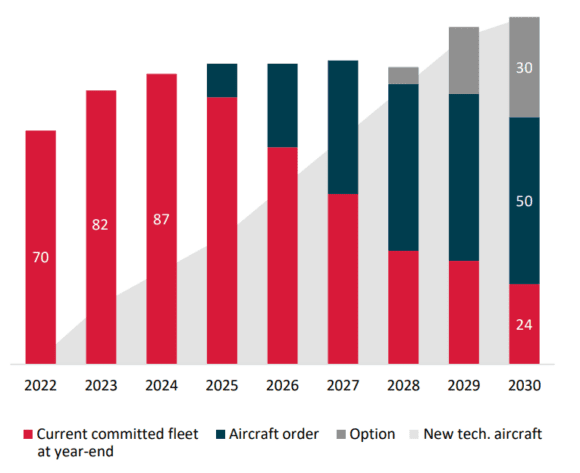

Norwegian’s fleet plan until 2030, when it expects to have grown to 104 aircraft. (Norwegian)

Looking forward, Norwegian sees “encouraging booking trends” despite inflation and increased interest rates. However, it will have to get through the weak winter season first, although bookings are stable. Thanks to its flexible leasing contracts that include power-by-the-hour agreements, the airline can reduce capacity by 25 percent next winter at almost no financial cost. For next summer, Norwegian plans to grow the fleet to 85 aircraft compared to 69 that were in service at the end of September. Next summer, its network will include 239 routes: 131 out of Norway, 51 each from Denmark and Sweden, and 17 from Finland.

The airline has secured leases for eleven Boeing MAX 8s for 2024. The fifty aircraft on direct order will be delivered between 2025 and 2028, with options on another thirty for delivery from 2028 through 2030. If all are being delivered, this would grow Norwegian’s fleet to 104 aircraft. Last February, Karlsen said that a fleet of 95 to 100 aircraft by 2024 would be the optimum size to get cost per available kilometer (CASK) down. In the updated fleet plan presented today, Norwegian gets to 87 aircraft in 2024.

Views: 1