DZC 57OUMAAvvta

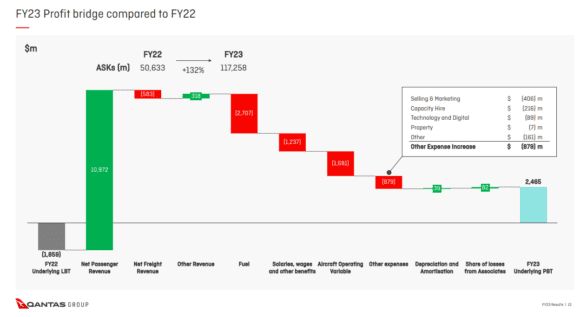

Qantas turned in its first profit in three years, reporting an underlying profit before tax of $2.472 billion for FY23 which closed in June. The airline benefitted from continued strong domestic demand and rebuilding of its international network, which is still in the recovery phase. The operational performance was considerably more solid, with fewer cancelations and disruptions.

“These results show a substantial turnaround in both our finances and service over the past year. We safely flew almost 70 billion more seat kilometers and doubled the number of people we carried to 46 million compared to the year before. Travel demand is incredibly robust and we’ve taken delivery of more aircraft and opened up new routes to help meet it,” CEO Alan Joyce said in the earnings release.

The $2.472 billion consolidated underlying profit before tax compares to a $-1.191 billion loss in FY22 when Qantas was still in the recovery phase after the lengthy closing of Australian borders during Covid. The net profit is $1.744 billion versus a $-860 million loss. The group operated at 77 percent capacity of 2019 levels. The net free cash flow was $2.460 billion.

Thanks to fares that peaked in Q2 (October-December 2022), total revenues improved to $19.815 billion from $9.108 billion, of which $16.923 billion is from passengers, $1.380 billion from cargo, and $1.512 billion from other revenues. Unit revenues were up by thirty percent, and unit costs excluding fuel were down by 22 percent. Total expenditures were $17.126 billion, up from $9.998 billion last year.

Domestic

Qantas Domestic, which includes QantasLink and Jetstar, operated at 103 percent capacity by the end of HY2. On average, capacity was at 99 percent in HY2 and 93 percent in HY1. Domestic already reached the EBIT target set for FY24 with an underlying EBIT of $1.270 billion compared to $-765 million last year. Revenues doubled to $6.980 billion from $3.448 billion.

The operating margin improved to 18.2 percent, thanks to the good results and the effects of completing the transformation plan that includes structural network changes. This improved revenues per available seat kilometer (RASK) and also generated $472 million in structural cost benefits.

Joyce is most satisfied that on-time performance was 77 percent in HY2, which outperformed its competitors in eleven out of twelve months. Thanks to product upgrades like improved lounges, the network, the loyalty program, and even Wi-Fi onboard, Domestic kept a strong market share in corporate travel.

International

Qantas International including Jetstar produced an Underlying EBIT of $906 million, up from $-238 million last year. At twelve percent, the operating margin was up eight percent on the FY24 target. Revenues improved to $7.749 billion from $3.706 billion.

Capacity grew from 58 percent in HY1 to 72 percent in HY2 as more aircraft joined the long-haul fleet, including two new Boeing 787-9s, and eight Airbus A321LRs, while a seventh A380 returned to service from deep storage. Routes previously discontinued during the pandemic were reinstated, including those to Tokyo, Hong Kong, San Francisco, and Santiago.

New routes were launched, including Dallas-Fort Worth and Jakarta out of Melbourne and Hong Kong and San Francisco out of Sydney. The seat factor was 85.7 percent but was even 92 percent in Premium cabins.

Jetstar

Jetstar Group reported an Underlying EBIT of $404 million compared to $-796 million last year. At eleven percent, the operating margin was below the fifteen percent target for FY24. Revenues were $4.235 billion, up from $1.440 billion. Ancillary revenues on the domestic network improved by 37 percent.

Domestic capacity reached 97 percent and reached 100 percent by the end of HY2. The segment contributed $255 million to the Underlying EBIT. This was $149 million for the international segment, which operated at 73 percent capacity. Jetstar Japan produced a $-54 million loss attributable to Qantas.

While Jetstar said earlier that its dispatch reliability suffered from issues with the auxiliary power units on its aircraft, it reached 99.4 percent thanks in part to the introduction of nine new Airbus A321LRs.

Although revenues of Qantas Freight were lower at $1.380 billion from $1.963 billion, the segment delivered $150 million in structural earnings. This level is expected to be maintained as e-commerce continues to grow. Qantas Freight will continue to grow the fleet, with two A321P2Fs joining before the end of the year.

Qantas Loyalty produced an Underlying EBIT of $451 million, up from $292 million. Revenues were up to $2.189 billion from $1.334 billion, with an operating margin of 20.6 percent. Qantas Frequent Flyer welcomed over one million new members in the past year to 15.2 million.

Reducing net debt

Qantas continues to rebuild its balance sheet and reduce net debt to $2.9 billion, which is under the target of $3.7 to $4.6 billion set out for the year. Debt was restructured by refinancing unsecured facilities for up to seven years, reducing the exposure to expensive operating leases, and securing attractive financing terms for two Boeing 787-9s that were delivered during the year. The Group has various debts that mature in each of the coming years, peaking in FY30. The net debt target should progressively return to pre-Covid levels in FY25.

Thanks to these improvements, Qantas is in a position to invest further in the fleet, the network, and training facilities, said Alan Joyce. In May, Qantas said it expects to improve targets through FY30.

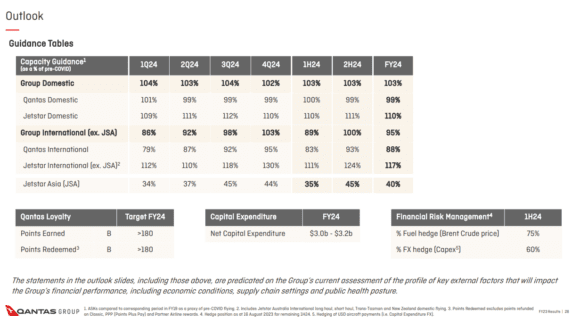

The three-year recovery plan that produced $1.0 billion in permanent cost benefits has been completed. For FY24, Capex is guided at $3.0 to $3.2 billion but will increase in FY25 and beyond as the fleet renewal program continues with the introduction of the first Airbus A350-1000s under Project Sunrise. Earlier today, Qantas announced an order for twelve ‘standard’ A350-1000s plus four Boeing 787-9s and eight 787-10s.

Liquidity stood at $10 billion in June, of which $3.2 billion in cash, $1.2 billion in committed undrawn facilities, and $5.6 billion in unencumbered assets, mostly aircraft and engines. Via an on-market share buy-back, Qantas will return $500 million to shareholders from September, which follows $1.0 billion in previous share buybacks. The group has also set aside $340 million to reward its 21.000 employees, offering each of them $6.000 worth of shares plus $500 in staff travel credit. This is in addition to $5.000 in cash as part of previous agreements.

Capacity for FY24

As reported before, Qantas expects international capacity to recover to 100 percent of 2019 levels in the HY2 of FY24, or around March 2024. Domestic capacity is already well above pre-Covid levels and is expected to remain at this level, as demand continues to be very strong.

The airline is not giving specific financial guidance for FY24, except for the Underlying EBIT margins. The margin of Qantas Domestic is eighteen percent, International eight percent, Jetstar Domestic fifteen percent, and International ten to twelve percent. The group expects to benefit by $400 million from the unwinding of transitionary costs during the year compared to FY23. By the end of the year, Alan Joyce will retire from the airline, with Vanessa Hudson taking over as CEO as she vacates her current role as Chief Financial Officer.

Views: 6