285006270 1712406035775787 384968689707981148 n

Qantas CEO Alan Joyce isn’t the first to have used these words in the context of airline operations and profitability, but the financial year 2022 which closed on June 30 has been “extremely challenging” for the Australian airline group. Qantas reported its third consecutive statutory loss since the start of the pandemic but is now seeing the strongest recovery ever in its history. If it is enough to return to profitability, given the various headwinds, remains to be seen. Qantas is only looking ahead toward a full recovery.

The group reported a $-1.895 billion underlying loss before tax for FY22 compared to $-1.774 billion in the previous year. The statutory loss before tax was $-1.191 billion compared to $-2.299 billion, flattered by a one-off benefit from the Mascot land sale. As Joyce said in a speech to Qantas staff: “That brings our total losses since the start of the pandemic to more than $7 billion and takes lost revenue to more than $25 billion. To put that in perspective, on a statutory basis, COVID cost us more money in the past three years than we made in the five years before that.”

Underlying EBITDA was a positive $281 million versus $410 million in FY21. Thanks to total revenues of $9.108 billion, up from $5.934 billion, the operating cash flow was also positive at $2.670 billion, up from $-386 million in the previous year. Passenger revenues were $5.951 billion (2021: $3.766 billion), cargo revenues $1.963 billion ($1.316 billion). Unit costs came down slightly to $6.24 from $6.72. Operating costs excluding fuel increased to $6.853 billion from $4.560 billion and mainly reflect more flying and restarting costs. Fuel costs were up to $1.848 billion from $835 million, also due to more flying and soaring prices.

A couple of numbers demonstrate how quickly Qantas’ financials changed. From an $-245 million EBITDA in HY1, it improved to $546 million for HY2. At the start of FY22, capacity was just 33 percent, but it stood at 68 percent in Q4 (April-June) and continues to improve. As Alan Joyce said: “Twelve months ago, almost all of Australia’s borders were closed. Most of us were stuck at home. International travel felt like a very distant prospect. Now, our flights are full, and we can’t bring aircraft out of storage fast enough.”

By segment

Domestic capacity even recovered to 98 percent in the final quarter and is fully back to pre-Covid levels. Premium leisure revenues are even ahead of 2019, and business travel is also getting back strongly. Qantas Domestic including the operations by Alliance currently operates 132 routes, more than the 101 in FY19. The segment generated $3.448 billion in revenues (2021: $2.475 billion) and produced an Underlying EBITDA of $-25 million ($159 million) or an Underlying EBIT of $-765 million ($-575 million).

Qantas International has come a long way and has only started to recover from November onwards when Australian borders reopened and passenger services were resumed. Until then, the segment mainly relied on cargo revenues. The airline restarted nineteen routes since then, including nine new ones. The average capacity was seventeen percent but was 49 percent in June. Total revenues were $3.706 billion, up from $1.598 billion. The Underlying EBITDA was $448 million, up from $117 million, and the Underlying EBIT was $-238 million versus $-548 million.

Subsidiary Jetstar is now also back in full force, having brought back all its Airbus and Boeing aircraft and operating on all pre-Covid routes except Korea. HY2 capacity was 92 percent. The carrier produced a positive Underlying EBITDA in Q4, but for the full year, the result was $-448 million (2021: $-129 million), of which $-167 million from domestic Australia, $-157 million from international as it suffered significant losses in New Zealand and Singapore, plus, and $-124 million from Jetstar Japan. Total revenues were $1.440 billion, up from $1.140 billion. Underlying EBIT was $-796 million versus $-541 million in FY21. Jetstar took delivery of its first Airbus A321LR in July.

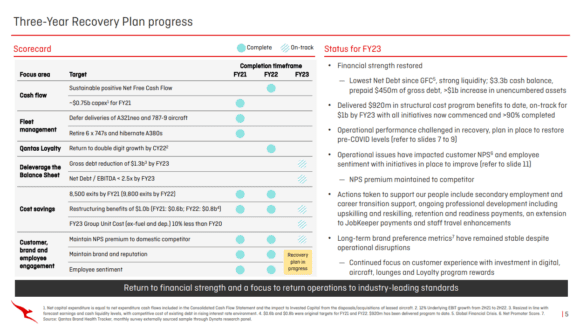

Qantas has ticked most boxes of its recovery plan. (Qantas)

Balance sheet repairs

Qantas has now effectively completed the repair of its balance sheet, having ticked most boxes of the recovery plan that was announced in 2020 following the pandemic. This has produced $920 million in structural annual cost reductions since then, with the $1.0 billion target for FY23 in sight. Net-free cash flow has been positive for three consecutive quarters. Strong revenues and $686 million from the Mascot sale helped the group to lower its debt to $3.94 billion from $5.89 billion, which is well below its target range of $4.2-$5.2 billion. Total liquidity stands at $4.6 billion, of which $3.3 billion in cash and $1.3 billion in committed undrawn facilities that mature in FY24, FY26, and FY27. Qantas will do a $400 million on-market share buy-back to repay shareholders.

But as it built back capacity and repaired the network, Qantas – like many airlines – has been confronted with various disruptions. Despite bringing back all staff in December and recruiting 1.500 new staff since April, the group is suffering from the tight labor market. Like its neighbor Air New Zealand, sick leave reached new highs in July, when 300 pilots were sick or in isolation. The same problem at Air Traffic Control caused 300 canceled flights in July in Sydney, with bad weather not helping either to keep up the schedule. It made Alan Joyce reach out and apologize to Qantas’ frequent flyers last weekend for the bad product the airline has offered recently.

With the focus on recruitment, assisting with the labor situation with suppliers, doubling the number of staff at contact centers, and building resilience into the flight schedule (reducing capacity), Qantas hopes to get on top of the problems and get service levels back to normal. The airline is spending $160 million on customer loyalty, offering members of the frequent flyer program a $50 flight coupon. Another $270 million is invested in improving customer experience, including lounge upgrades. The airline offers $410 million in employee rewards as a bonus and share reward.

Looking for an A330 replacement

With firm orders placed at Airbus for twenty A220-300s and twenty A321XLRs (plus twenty earlier for Jetstar), and twelve A350-1000s for Project Sunrise, next on the agenda is the renewal of the A330-fleet. The airline will submit tenders to Boeing and Airbus in the coming twelve to eighteen months for the replacement of the eighteen A330-200s and ten -300s, which are now between fourteen and eighteen years old. Expect the A330neo, A350, and Boeing 787 to be evaluated, although the 787 is of course a familiar member of Qantas and Jetstar.

Three Dreamliners are expected in FY23, together with nine A321LRs for Jetstar and another nine in FY24. The first seven A220s will also join in FY24, together with three converted A321P2Fs. The A321XLRs will not come until FY25, making it unlikely that Qantas and Jetstar will be affected by any delays from the program.

A graphic outlining the short-term fleet deliveries to Qantas and Jetstar. (Qantas)

Qantas will deploy the 787-9 on the service to New York JFK that it will recommence on June 14, 2023. Flight QF3 will depart Sydney for a short stop-over in Auckland before continuing to New York, offering direct competition with Air New Zealand on the Auckland-New York route. Qantas International expects to grow capacity from fifty percent in Q1 FY23 to ninety percent in Q4, or an average of 75 percent for the full year. The Airbus A380 will play a major factor in this, with five more aircraft coming out of deep storage to resume services in December 2023. The entire international fleet should be back in service in FY24. Qantas Domestic should recover capacity from 94 percent in Q1 to 106 percent in HY2.

FY23 will see additional cost and revenue initiatives to improve Qantas’ financial position and should help it offset rising fuel prices, which are expected to cost the group $5.0 billion despite hedging. The reduction in capacity in HY1 will result in temporary unit cost inefficiencies. The coming financial year will be a bridge year towards meeting previously set targets for FY24, which includes an EBIT margin of eighteen to 22 percent for Qantas/Jetstar Domestic, and a return on invested capital of ten to fifteen percent for International.

Views: 6