327763322 1129530594410101 3564304957537508822 n

SAS Scandinavian Airlines expects to start the equity solicitation process no later than April which should result in attracting fresh funding from investors. This is a major step that, if successful, should lead to SAS exiting Chapter 11 restructuring in the second half of the year, the airline said today during its Q1 FY23 earnings call.

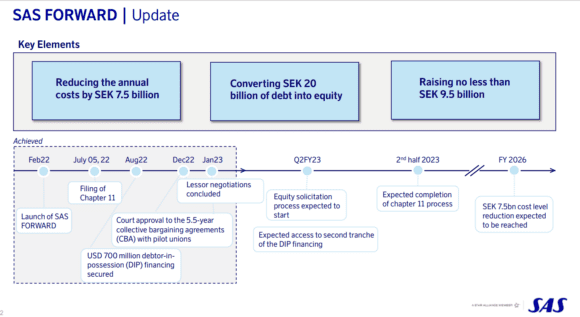

SAS is now almost eight months into Chapter 11, having filed for voluntary bankruptcy protection with the New York Southern District Court on July 5 last year. This followed a prolonged period of financial losses and, initially, the failure to conclude agreements with pilot unions and those of other staff to reduce costs as part of the SAS FORWARD restructuring plan.

Since July, significant progress has been made. SAS secured Debtor in possession or DIP-funding in August, with the first tranche of $350 million paid that allowed it to continue the business. The New York Court also approved the 5.5-year collective labor agreement with the pilot unions that was eventually reached last July after a costly strike. And it approved lease restructurings with fifteen lessors for 59 aircraft, with some remaining in the fleet under different terms and others lease rejections. Both agreements are instrumental in SAS’s objectives of reducing structural costs by SEK 7.5 billion per year, which should be fully reached by FY26. Another is reducing net debt by SEK 20 billion.

Next on the Court’s agenda is the approval of the second tranche of $350 million in DIP financing, which is due this Q2 of SAS’ financial year 2023 that runs from February to April. This depends on the airline meeting certain conditions, on which it is working hard every day. The equity solicitation will follow not long after DIP has been approved. With the Danish state the only stakeholder that is willing to participate in a new equity plan (Sweden and Norway are only prepared to swap debt for equity), SAS is expected to be largely dependent on capital markets to raise the projected SEK 9.5 billion in fresh funding.

Although it has secured lease restructurings and rejected lease contracts on a number of aircraft, SAS still has new aircraft deliveries scheduled over the coming years. This FY23, it expects five more used Embraer E195s for SAS Link plus thirteen Airbus A320neo-family aircraft. Seven more neo’s plus the final two A350-900s are due in FY25, while it will get four neo’s in FY26.

Mounting losses

That SAS is financially still very weak was confirmed by its Q1 (November-January) results reported today. Despite an increase of revenues to SEK 7.896 billion from SEK 5.545 billion in the same period of FY22 thanks to higher capacity, the negative operating income or EBIT almost doubled to SEK-2.634 billion from SEK-1.329 billion. At SEK-2.449 billion, the income before tax was slightly better over SEK-2.597 billion, but the net income was worse again at SEK-2.709 billion compared to SEK-2.442 billion. SAS tried its best to reduce costs, but higher expenses on all fronts weren’t helpful and pushed total expenses up to SEK 10.5 billion from SEK 6.9 billion. Operating cash flow outflow was SEK 1.7 billion, up from SEK 0.1 billion the year before. Cash and cash equivalents stood at SEK 5.3 billion, and net debt at SEK 33.8 billion.

Still, CEO Anko van der Werff was pleased with the operating environment. The number of passengers carried was up 48 percent year on year to 4.6 million, which is encouraging as this is the weakest period of the year. Currency-adjusted passenger yields were seven percent better. “Economic uncertainties with increasing interest rates and cost inflation are likely to affect the travel industry going forward but the overall underlying demand for travel remains healthy and continues its strong trend”, Van der Werff said.

SAS is preparing for aggressive growth in the summer period and already announced the launch of twenty new routes, which grows the network to 100 destinations and 5.000 weekly flights. New (seasonal) services include those from Gothenburg and Aalborg to New York, so outside the hub airports like Copenhagen and Stockholm from which SAS usually operates transatlantic routes. A few weeks ago, it reinstated Copenhagen-New York, while since December, it is flying to Shanghai again.

Brighter future

The appetite for flying makes SAS positive for FY23. It reiterates that revenues for the full year will reach SEK 40 billion and the income before tax should be between SEK-4 and -5 billion, an improvement over SEK -7 billion in the financial year 2022.

The airline is currently reviewing its long-term projections, but a preliminary assessment makes SAS confident that its results in FY26 will be better than those projected last September. Revenues should reach SEK 49 billion and income before tax return positive already in 2024 and reach SEK 3 to 4 billion in FY26. Demand for short-haul leisure travel should have fully recovered in FY24, although short-haul business travel will only reach eighty percent.

“Assuming successful implementation of the SAS FORWARD plan, SAS expects to attain a strong financial position and the company aims to be nearly net debt free by the end of fiscal year 2026,” the airline says in the Q1 report.

Views: 1