MSN9541 A321neo SAS Scandinavian Airlines F1 scaled

The 15-day pilot strike in July has cost Scandinavian airline SAS some SEK 1.4 billion ($135 million). It erased most earnings from the higher demand and higher revenues that SAS saw in the third quarter (May-July) of FY22. The carrier continues to operate as normal, despite filing for Chapter 11 bankruptcy protection status in early July. SAS is in active discussions with lessors about lease restructurings, which could result in rejecting new deliveries.

SAS was forced to cancel 4.000 flights between July 4 and 19 as pilot unions in Sweden, Norway, and Denmark saw no other way than to go on strike to break a deadlock in negotiations over a new collective agreement and their contribution to the SAS FORWARD restructuring plan. Some 380.000 passengers were affected by the strike. CEO Anko van der Werff referred to Q3 as “a demanding quarter for our customers”, to whom he apologized for the inconvenience. The situation wasn’t helped by disruptions across the airline system.

The strike ended on July 19 with “a solid deal” (Van der Werff) for the next 5.5 years that will see SAS rehire 450 pilots that were previously made redundant, but are needed again as the airline expects air travel to further recover. Parties eventually agreed on terms and conditions to increase flexibility and productivity, which is a key ingredient of meeting the targeted SEK 7.5 billion in annual cost savings from 2024 in the FORWARD plan. SAS still is in negotiations with other unions, including a Norwegian cabin crew union, to get their support. Contracts with other unions and employee groups are long-term and guarantee stability.

Net loss of SEK 1.8 billion

SEK ended Q3 with a SEK -1.848 billion net loss compared to SEK -1.336 billion. The operating loss of SEK -1.148 billion versus SEK -852 million reflects best the income lost from the strike, which cost SEK 1.351 billion. This is despite an increase in revenues to SEK 8.580 billion from SEK 3.982 billion as the airline carried more passengers (4.8 million, up from 2.0 million) by flying more. However, July shows a significant drop to 1.3 million passengers from 1.9 in June and 1.8 million in May. The July number was the lowest since February. The cabin factor for Q3 was 77.7 percent.

The higher capacity (up 27 percent over Q2) translated into SEK 9.7 billion higher expenses on most fronts. Fuel costs were up to SEK 2.9 billion from SEK 618 million in the same quarter last year. Cash flow from operating activities was a negative SEK -992 million, a reversal of the positive SEK 539 million in Q3 last year.

SAS’s nine-month results for November to July show a SEK -5.810 billion net loss compared to SEK -5.779 billion in the same period of 2020/2021. The operating loss was SEK -3.240 billion versus SEK -5.020 billion, with revenues at SEK 21.2 billion versus SEK 8.196 billion. Liquidity stood at SEK 6.148 billion at the end of July, up from SEK 4.268 billion. Net debt was SEK 31.970 billion, up from SEK 26.770 billion caused by a negative effect of currency revaluations and new lease liabilities.

Filing for Chapter 11 has been inevitable

A day after the start of the pilot strike, SAS saw no other option but to voluntarily filed for Chapter 11 bankruptcy protection with the Southern District New York bankruptcy court, with the aim of accelerating the FORWARD restructuring plan. Van der Werff repeated that this step was inevitable, as the airline “had been burdened by a challenging cost structure” and there were major concerns over the continuity of the Scandinavian airline which has been partly bailed out by the three governments during the Covid crisis.

The targets of the FORWARD plan are unchanged since the plan was presented in February: SEK 7.5 billion in annual cost reductions from 2024, the conversion of at least SEK 20 billion of the current SEK 31 billion in debt in bonds and notes into equity, while a future capital increase should generate a minimum of SEK 9.5 billion.

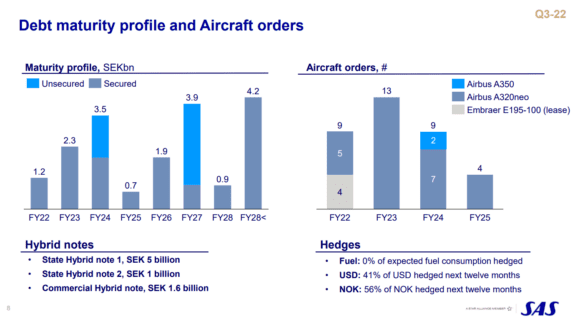

The current debt profile and fleet plans of SAS, but this is subject to change during the Chapter 11 restructuring. The SEK 3.9 billion in debt that matures in FY27 is largely from SEK 3.0 billion in credit facilities from Sweden and Denmark. (SAS)

Getting the agreement with the pilot unions has been instrumental in receiving support from the government shareholders, Sweden, Norway, and Denmark. All three are willing to participate in the debt-for-equity plan that covers almost half of the group’s debt, but only Denmark is prepared to participate in the capital increase. With Chapter 11 still in its early stages, SAS now awaits approval from the New York court for the $700 million/SEK 7.0 billion in debtor-in-possession bridge funding that has been secured with the help of Apollo Global Management. Once approved, DIP financing will kick-start the restructuring that SAS hopes to complete between nine and twelve months. It will also significantly help improve the airline’s financial position, Chief Financial Officer Erno Hilden says.

Support from lessors is crucial

The restructuring counts on the support from aircraft lessors. Their participation is crucial and discussions are ongoing on an almost daily basis, said Van der Werff. He has been to Dublin recently to discuss the airline’s position with them. SAS has sourced aircraft from most major lessors like AerCap, Avolon, Air Lease Corporation, CDB Aviation, Pembroke, DAE Capital, ALAFCO, SMBC, and Fuyo General Leasing. “If we don’t the deals, if we don’t get the debt position, then we are really talking about a very bad alternative, including for the lessors.”

By the end of July, SAS Group had a fleet of 135 aircraft, including four Airbus A220-300s on wet-lease from airBaltic. Van der Werff said that he has a surplus of widebodies and has parked some as it only operates a single weekly long-haul service compared to thirty before the pandemic. “It is very clear we have a surplus of widebody aircraft and we are addressing that with our lessors. This means that we will make changes to our long-haul network, given the uncertainty on a macro-economic level.”

Delays at Airbus permitting, SAS expects to take delivery of nine additional aircraft in FY22, including five new A320neo family aircraft for the parent airline and four more secondhand Embraer E195s for SAS Link. The current fleet plan includes more new aircraft deliveries, but as the carrier already has a surplus of aircraft, SAS could start rejecting some aircraft from lessors once the Chapter 11 process gets on its way, Van der Werff said: “We have a surplus of aircraft, we have been telling that. We will take the next step to make sure that we right-size the fleet and right-price the fleet. That is a matter of now, we have a few months to wrap it all up.”

For now, FY23 sees thirteen neo’s deliveries, FY24 seven, and FY25 four. FY24 should also see the delivery of the final two A350-900s. In Q3, SAS secured new leases for six A320neo’s, one A321LR, and one E195, plus the sale and leaseback of three A320neo’s.

Recruiting 1.000 new staff for summer 2023

In the meantime, SAS continues to operate as normal. August bookings have returned to pre-Covid levels, but after a strong summer with good demand, the airline is cautious about the coming winter. Geopolitical issues, continued Covid-restrictions in China and Asia, fuel costs, exchange rates, and inflation are all reasons for concern. Historically, the airline isn’t hedged for fuel and isn’t in the position to do so now, so all price increases are coming directly to its expenses. The positive side is that fuel prices have come down in recent weeks.

SAS is more confident of a further recovery next summer and plans to undertake substantial recruitment and rehiring of staff. Van der Werff specified that around 1.000, including both cabin and the 450 pilots that will be rehired. He stressed that this new staff will be required for the long-term growth of the airline as it is confronted with the retirement of older staff.

Views: 12