2024 12 18 07 54 46

On December 10, via X, Boeing stated: “We’ve restarted 737 production after weeks of methodical preparation to ensure our teams, parts and factories are ready. Our production team loaded fresh 737 MAX fuselages into the Renton factory, and teammates who helped prepare the factory are in place to resume production.”

This was the news the industry had been waiting for.

Supply Chain stress remains

Even with the strike over, supply chain firms are still making layoffs.

The aviation supply chain is highly sensitive because of the contract language. Vendors bear all the risk. That risk is upfront because there is a long tail before an airplane is built. Sure, the parts business has a long tail after delivery, but you must first get through the risky part upfront.

Any disruption, like a strike, causes so much damage. Precisely because there is so much risk, supply chain firms calibrate finely. Before parts are manufactured, raw materials have to be sourced. Typically, this could be a year ahead. An exogenous shock throws the whole process into chaos. The firms that absorb the shock are frequently those least able to do this.

That is why Boeing’s recovery is so important. Thousands of highly skilled people spread across the global economy depend on a stable duopoly. Airbus, COMAC, and Embraer need this supply chain to hum quietly.

Deliveries recovering

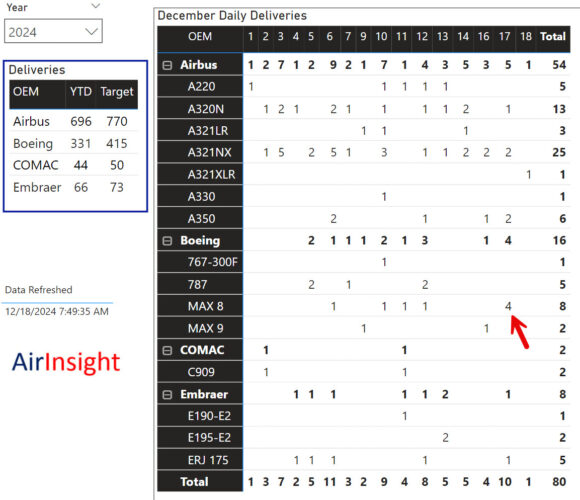

Here is a chart we publish daily on our social media channels. We often update the chart twice daily because of the time differences between Airbus FALs (China, EU, and North America) and Boeing’s US FALs.

This morning, we added the red arrow highlighting Boeing’s MAX deliveries. This good news can improve even more by sunset today.

Boeing has a large MAX inventory from undelivered Chinese orders. Akasa and Air India Express have been the primary beneficiaries, receiving deliveries far faster than they might have if Chinese airlines had taken them. India’s airlines almost certainly took these deliveries at sharper prices, too.

Production context

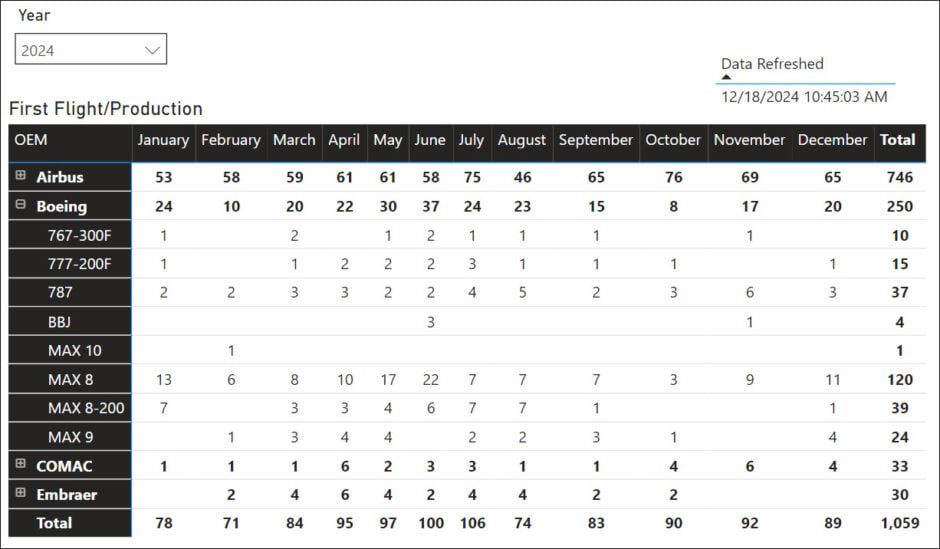

The following table provides helpful context. The numbers are for aircraft that made their first flight in 2024 by month. The table was updated just before posting this story.

We split out the Boeing models so readers can view the monthly volumes. The 787 volume bumped up nicely from November. Regarding MAXs, it’s clear Boeing has a way to go. But we believe it has turned the corner and expect much better volumes as we move into 2025.

As you follow industry news, it is handy to have this detailed data.

Views: 374

Hello Addison,

Thanks for your great updates. Are you able to share the airlines to whole the 787s and 737s are being delivered to as well?

Thanks