2020 10 29 15 12 40

A report from TAC about a fifth-generation 737 has the industry abuzz today. Boeing’s reaction to the rise of the A321 has been ponderous. The MAX9 and MAX10 do not appear to have the payload/range numbers to beat the A321neo/LR and XLR. Airline and lessor interest is strongly in favor of the A321neo and variants.

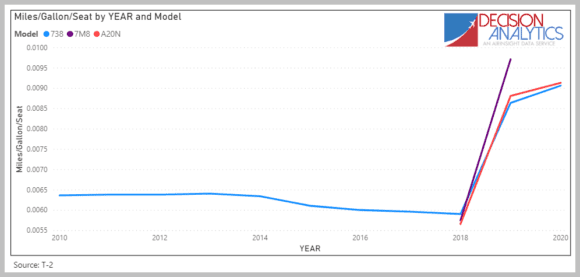

This market reaction to the A321neo and variants has created a hurdle Boeing has to leap to be competitive. Despite the negative aura around the MAX, it is important to note that the MAX8 has exceptional economics. We pointed out this before and feel the need to reiterate those numbers with this chart.

Although the MAX has been parked for 18 months, we have some performance data from the prior period. In 2019 data we show the MAX8 at 0.0097 Mile/Gallon/Seat and the MAX9 at 0.0094 Mile/Gallon/Seat. Although the A320neo has seen its improvement slow in 2020 to 0.0091 Gallons/Seat/Mile, there is every reason to believe the MAX8 would at least match it’s earlier performance. In 2019 the MAX8 was better by 12.8% in fuel burn than the 737-800. It is clear Boeing got the economics on the MAX8 right and that it offers operators what they were looking for.

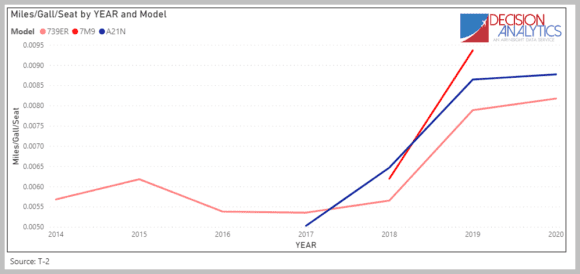

Here’s what we see for the MAX9.

The MAX9 offered a 19% better fuel burn in the short time it operated compared to the 737-900ER. At United, the only US airline flying the MAX9, we saw a 20.5% improvement in fuel burn over the 737-900ER. The chart also shows is the A321neo’s improved numbers. There are three US operators of the A321neo. Here is a table showing the fuel burn performance of the A321neo among these airlines.

As we see, Hawaiian is getting the best numbers out of the aircraft. This is because its operations are on routes that exploit the aircraft’s performance. Five-hour legs with most of that at cruise. Note also each year the aircraft’s numbers have improved.

The A321LR and XLR should have even better numbers than what we see at Hawaiian. With even longer routes that could be expected. But the other consideration is that the A321LR and XLR can be expected to have fewer passengers in order to exploit maximum ranges.

The hurdle Boeing needs to beat is 0.088 Miles/Gallon/Seat with an equal payload. On the A321neo, Hawaiian has 189 seats, American has 196 seats and Alaska has 190 seats. In other words, 757-sized capacity. Looking at the numbers for the 757-200, we note a US industry average of 0.0066 Miles/Gallons/Seat and for the 757-300 0.0045 Miles/Gallon/Seat. The following table lists the payload and range numbers the OEMs have published.

The data suggests the MAX9 and MAX10 are short on range, with equivalent passenger loads. But adding range is a tradeoff of weight, aerodynamics, and fuel capacity. producing a new fifth-generation model requires optimization of those factors. Whether it will beat the A321neo family remains to be seen.

The current crisis in commercial aviation has led airlines to focus on flexibility and we have seen a steady rise among US airlines to make greater use of the A321s. Based on the numbers we have to date, it looks like the MAX9 and MAX10 won’t match the A321LR and XLR, though they might come close to the A321neo. Boeing has a good start in the MAX, which has segment-leading fuel burn numbers.

Views: 0