2022 12 15 10 13 34

It’s that time of the year – things should be slowing down. But at Airbus and Boeing, the next two weeks remain busy. It’s the last few work days to win the crucial annual orders and delivery race. What’s the score to date?

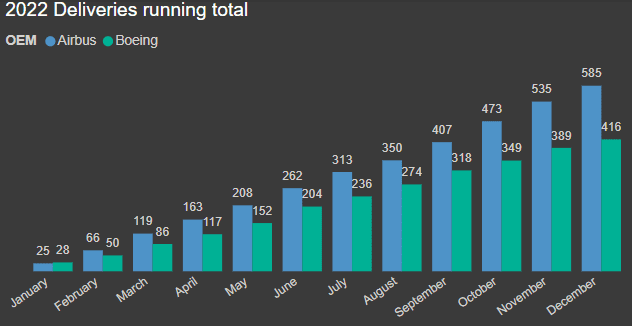

As of December 14, here is what we have. We focus on deliveries as we believe this to be the more reliable number. Orders change, but deliveries are what they are. Airbus had no internal hiccups to overcome, while Boeing moves through MAX deliveries from Renton and parked inventory. Plus, Boeing started delivering 787s again in August since May 2021.

In a typical year, Airbus and Boeing push hard in December to get deliveries out the door. December is crunch time.

To give 2022 numbers perspective, here we list 2021 and 2022 running totals for the duopoly. The chart shows the impact of a constrained supply chain. Note that Boeing is having a much better 2022 than 2021. In terms of the delivery race, Airbus wins. Since each year starts fresh a win this year has no impact on the next year.

Another important data point to consider is the duopoly’s critical mass. The chart below shows its dominance and one has to consider the power the duopoly has over the supply chain. If you’re in the aerospace supply chain, you will do just about anything to be a duopoly vendor. When Airbus and Boeing require a discount or squeeze – suck it up. Where else are you going to go?

What about the other industry OEMs? The next chart ists second-tier OEMs. Russia’s UAC is on life support as you might imagine. No western suppliers mean no new aircraft with new engines. We reported that engine swaps are increasingly common. Embraer had a slower 2022, but COMAC is on a tear.

COMAC has been delivering ARJs at a leisurely pace. COMAC has been busier since the summer. The first C919 was just delivered and we anticipate these will be delivered at a faster clip than the ARJs. The qualifier is CFM LEAP engines – Airbus and Boeing remain at the front of that line. COMAC’s C919 deliveries will be paced by LEAP availability.

Another thought looking at this chart. There was no way Bombardier was ever going to make C Series successful. It took Airbus to make that happen, and Airbus isn’t done squeezing its A220 vendors yet. Airbus now has a nearly five-year-long backlog on the A220. Bombardier wasn’t ever going to get there. Especially after the management turned down Delta’s initial interest in 2010. The forthcoming A220-500 is a more powerful and credible tool wielded by Airbus.

The other side of that A220 backlog? Interest in this segment remains strong and the best option for quick delivery is Embraer. The E2 family is as economically effective as the A220. Embraer should see a good 2023 as operators realize the E2 is the bird in the hand; it offers competitive economics with a global support network.

Views: 0