max10

Boeing’s largest (and perhaps final) iteration of the MAX family took to the skies last week. With a seating capacity of up to 230, the MAX10 has more capacity than the 707 with which it shares a fuselage and history. The MAX10 will have the shortest range of the MAX family and for some, this is a cause for concern.

At 3,300 miles, is the MAX10 hampered? Does this range limit the aircraft’s market potential?

The short answer is “No” and here’s why.

The MAX10 has a similar capacity to the 757-300 which was not a big seller. The 757-200 was a far better seller (1,096 delivered) and offered a greater range. The MAX10 is aimed at the 757-replacement segment. Boeing hopes the MAX10 will slow the Airbus A321’s growing segment domination.

Along with several observers, we believe much of the 757-replacement segment has been lost to Boeing because the Airbus A321neo and its variants offer more range and were available much earlier. But, even with a great head start, Airbus will not win 100% of this segment.

Range is very useful, and we see that the A321neo at TAP Portugal allows the airline to create new markets it could not operate effectively before, i.e. Lisbon-Washington DC. The A321neo will allow JetBlue to cross the Atlantic. Several airlines intend to exploit the A321neo range and develop new markets because this aircraft offers economic flexibility based on its range.

This type of service was first developed around the 757-200, with primarily US carriers using their 757s to open markets across the Atlantic. Even today, as the 757 starts to fade, we see Delta using the 757-200 between Minneapolis and Reykjavík. As useful as range can be, this sort of deployment has always been a niche. It’s a great feature but has limited markets.

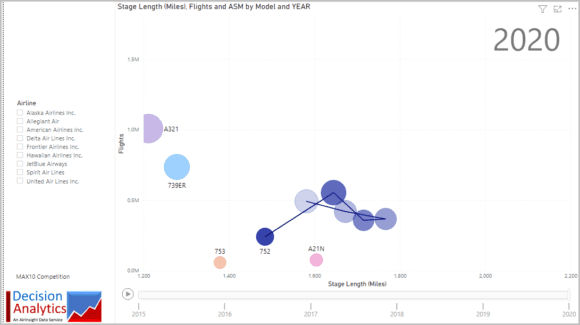

As evidence to support the niche argument, look at the following chart. See how US carriers really use their 757-200s.

A typical flight is under 2,000 miles. Nowhere near the aircraft’s potential. As the 757s age, the range is dropping. The 757-300 in 2015 reached its longest average range deployment at 1,700 miles.

Based on the chart above it should be clear the 3,300-mile range of the MAX10 allows it to  accomplish most of the 757-type missions among US carriers. Moreover, aircraft stretches tend to offer compelling economics. Boeing claims the MAX10 will compete vigorously with the A321 as the next chart illustrates.

accomplish most of the 757-type missions among US carriers. Moreover, aircraft stretches tend to offer compelling economics. Boeing claims the MAX10 will compete vigorously with the A321 as the next chart illustrates.

If we look at the most current US airline fleet that brackets the MAX10 segment we see the following.

Several of these airlines are MAX10 targets – not just the 757 operators, even Alaska as a reluctant A321neo operator. MAX order numbers are not easy to decipher because Boeing does not report MAX orders by variant. The next table lists the MAX10 orders we have been able to track – we expect these could change because of the pandemic. Virgin Australia, for example, already did this.

With nearly 500 orders Boeing’s MAX10 has good critical mass. Note that there are several lessors committed. They have customers behind those numbers. The biggest supporter of the MAX10 is United, and this is consistent with that airline’s interest in the MAX family.

In summary, MAX10 orders are unlikely to be hampered by its range. Several operators don’t need the range but will be attracted by its economics. The MAX10 will be a useful aircraft between large cities up to 3,000 miles apart. There are many of these markets and this niche is likely larger than crossing the Atlantic.

Views: 17