2019 07 11 12 17 54

Lessors get an inordinate amount of attention when it comes to aircraft orders. Lessors play a crucial role in commercial aviation; they create market liquidity and have to squeeze in between the OEM and airline. Lessors can offer a small airline a better deal than an OEM directly through larger purchases it makes compared to the airline itself. As Lessors have grown, they buy in such quantity that they can offer well-priced deals to the big airlines.

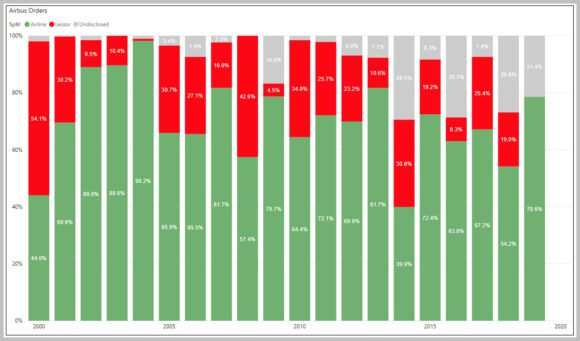

What does the impact of Lessor orders look like? Let’s start with Airbus.

The number of Airbus orders from Lessors over the period averages 22.8%. The chart shows how 2014 the number of orders defined as “Undisclosed” has jumped. This has pushed down those that we can ascribe to either an airline or Lessor.

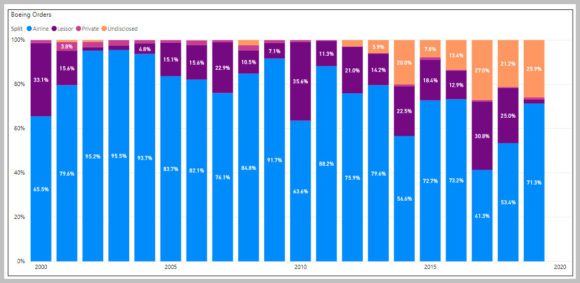

Next, let’s look at Boeing.

Boeing’s orders from Lessors average 18.9% over the period. Boeing separates out its orders for Business Jets which we list as “Private. As was the case with Airbus, note the sharp increase in “Undisclosed” orders in recent years.

Lessors account for roughly one in five orders. That is a larger slice than any one single airline can match. This heft drives Lessors influence. Which is why we see the A330neo and A321XLR being launched by a leasing firm. Or the NMA program described more openly by a Lessor rather than Boeing.

Views: 0

I think the rate could be even higher: some 40 to 50 percent of the world’s commercial aircraft fleet is leased, according to lessor’s information and described in my story ”Buying or leasing: that’s the question” in January on Airinsight