Southwest Boeing 737 MAX 8

In June 2019 we wrote about how the Airbus decision to buy the C Series program put that program in a powerful position. The issue was clear then – Embraer could not take on Airbus alone. We saw how that Airbus power worked out at JetBlue. A prospective deal for the E2 was stymied by a fresh offer from Airbus that offered the airline a “deal it could not refuse”. Embraer, with all its technical expertise and clever marketing, cannot win a fight with Airbus if it is alone.

Today we see yet another example of how this plays out with Czech. While Czech is a “captive” Airbus customer, were the airline facing a straight competition between the CS300 and the E2, the choice would not have been so easy. It is almost like a Jetblue re-play. Precisely because Airbus has more tools in its toolbox, it can offer Czech a better mix. A Boeing mix of MAX and E2 would have been a tougher choice and come at, most likely, better pricing for Czech.

How did we get here? In a word – MAX. Embraer Commercial Aircraft should be Boeing Brazil already. Were this the case you can be sure that Czech would have been given a powerful option to consider. But we are not there and Airbus has a shoo-in deal.

The MAX crisis is trickling down into the future of the E2 program. Making it not only difficult for Boeing but also stymying the deals that the E2 should be able to go toe-to-toe with Airbus over. The damage is big and growing bigger.

There is another aspect to consider. The MAX7 has little market traction and is likely to attract not much more than it has from airlines, it’s future is possible as a BBJ, if anything. Boeing clearly needs to come up with something between the E195-E2 and the MAX7 that the market wants. Airbus has shown there is a market. If there is a market, that market wants choice and competition.

Given the strategic choices Boeing faces with MAX and NMA, an obvious way forward is for Boeing to focus on fixing MAX and getting NMA to market. The MAX7 replacement solution is to get the brilliant Embraer team to come up with a 140-150 seater. With their track record, we think they can do this faster than Boeing. Even the mighty Boeing company has limits, as we can see. Embraer, with its KC-390, done and in production, its E2 program rock solid and in production has design and development talent looking for its next program. The MAX7 replacement is the obvious project.

The failure to execute on Boeing Brazil has a potential rising cost with Southwest looking at Alaska and Jetblue as potential acquisition targets. How desperate is Southwest, if the reports are true? There is only one reason Southwest would even consider such a move – MAX. This is the airline that would consider nothing other than a Boeing product. But Boeing does not have what it needs – a light 150-seater. (It has 30 MAX7s on order out of 276 MAX orders) So the MAX7 isn’t that and the E2 isn’t that either, but the A220 is. The fastest way to get an A220 is buying somebody who has them or is getting them soon – like JetBlue. This means Alaska is a less likely target and it is also a MAX customer.

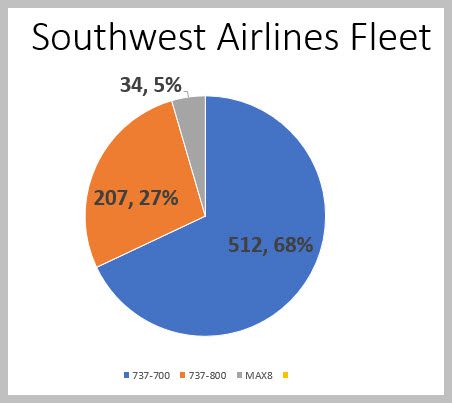

This is what Southwest’s current fleet looks like.

Southwest’s commitment to the sub-150 seat segment is clear. There are many markets it serves where the -800 and MAX8 are too big. The airline has previously guided us to consider the sub-150 seat segment to stay ~60% of its needs.

We are not done seeing the damage of the MAX debacle yet.

Views: 0