We have made the case before that if you want to understand where the regional jet market is going, look to the US for a guide. China may the land of promise, but it will take a long time to have the same influence on regional jets as it has on the other segments.

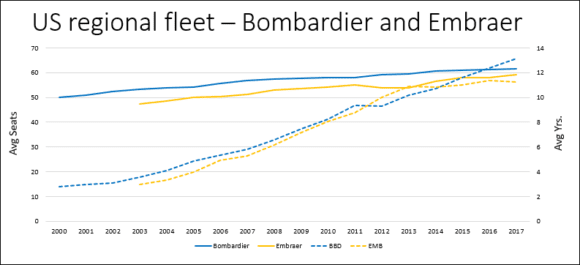

The next chart provides a sense of how the active fleet has grown, but more importantly, how it is aging. These aircraft do more cycles than bigger aircraft and consequently wear out faster.

At first glance, it would seem the fleet size stabilized around 2005, over a decade ago. But this is not the whole story. Regional jet operations in the US are subject to rules imposed by pilots at the mainline carriers. The most notorious of these is “scope clause”. This rule limits the seating capacity and weight of regional aircraft and limits the number that can be put into service.

Given the current pilot shortage, the US airline pilot unions won’t hear of any changes to these rules. Since the mainline airlines are making money and readily reach down into the regional jet pilot pool to ensure they have enough pilots, they are not fighting for an easing in scope.

This why we see the fleet size seem stable but aging. Artificial constraints have limited the market’s potential. Airlines have had to become creative to get around these limits.

The OEMs can be divided into two categories – incumbents and those who exited the industry. The incumbents are Bombardier and Embraer.

In the next chart, we show how the two incumbents have managed to evolve their offerings to grow aircraft size to enable airlines to optimize the scope limits.

The chart shows how the Embraer fleet age slowed relative to that of Bombardier. The reason for this is the spurt of orders Embraer recently won for its E175.

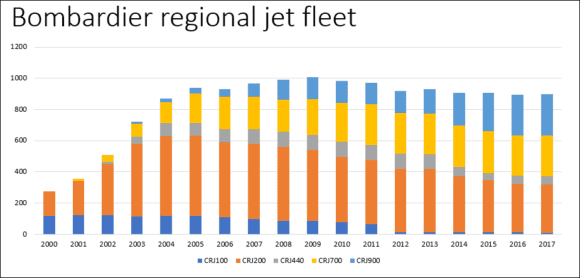

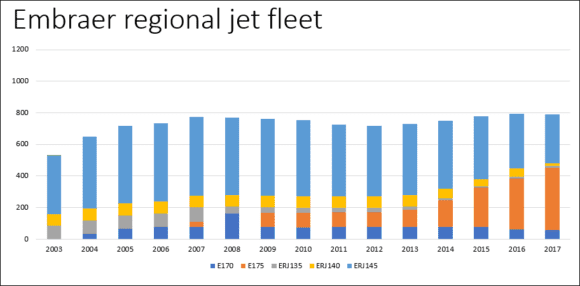

The next two charts illustrate how these two OEMs have refined their offerings for the market.

We can see Bombardier had a tremendous run with its CRJ200. More recently the market has seen better economic values from the CRJ700 and CRJ900. Interestingly, the CRJ700 now is in a size category with no direct competitor. As US regional airlines move from 50 seats the CRJ700 offers a half step before maxing out at 76 seats.

The Embraer fleet benefited from a later start in the regional jet market. This allowed the OEM to develop its E-Jet range which has proven to be popular. In this segment, only the E170 and E175 fit within the US scope limits. The chart shows the growing popularity of the E175 as the E170 faded. US airlines have found the E175 offers competitive economics and provides passengers with a “big airplane” feeling cabin.

Being the early mover, and given its success with the CRJ200, Bombardier did not develop a clean sheet design. The OEM stretched its CRJ design from 50 seats to 100 seats on the CRJ1000. The latter is not used in the US since it exceeds scope limits.

To remain competitive, Bombardier has refined its CRJ line several times. The latest upgrade is to a new cabin layout to better compete with the E175.

The philosophies of these two OEMs have brought them to a watershed moment.

- Bombardier –continues to bet on its CRJ line for a few more years. Their view is that since scope will not change, airlines want to lowest weight and least expensive aircraft. Their CRJ fits this requirement. There is some logic since regional airlines in the US are under tremendous pressure with the lowest margins they have ever faced. Plus, they are the part of the industry suffering from the pilot shortage most acutely. This makes these airlines the most risk-averse.

- Embraer – it has a winner in the E175. But in reaction to Bombardier’s C Series, the OEM developed its updated E2. The E175-E2 is unable to meet current scope limits. This means that customers will have to stay with the current E175. Embraer will produce the E2 and the E1 on their line at the same time. Embraer claims they can do this with no penalty.

The race at present is between the CRJ700 and CRJ900 on the one hand and the E175 on the other. How does that race look as of the end of 2017?

As we can see only two airlines fly both OEMs, Mesa and SkyWest. Bombardier has a fleet of 528 among these airlines. Embraer has a fleet of 453.

Finally looking at the average age of these fleets we get the following.

The Embraer E75 is the youngest of these aircraft and is virtually new across the board. While one might naturally conclude that the market has moved away from the CRJ to the newer E-Jet there are some considerations.

- Big airlines, like SkyWest, cannot afford to only support one OEM. Doing so reduces their pricing capabilities. Which is why we see today that American ordered equal numbers of the CRJ900 and E175.

- Bombardier’s CRJ700 does not have a competitor in its seat capacity.

In conclusion, we expect to see several orders for the CRJ to enable airlines to update their fleet and also ensure OEM “balance”. These deals may not be the regional airline buying directly but could come from a major buying the aircraft to be deployed by their regional partners. The American Airlines deal is such a deal.

Interestingly, the American CRJ order is valued (list) at $719m while the E175 order has a value (list) of $705. Of course, the airline is not paying anywhere close to list.

The new CRJ cabin is bound to attract attention and close the perceived cabin gap with the E-Jet. Indeed, Bombardier claims their new cabin allows more overhead bag storage than the E175. The improved cabin baggage capacity is to be cheered – that bag drop at the door is highly annoying and is a consequence of airlines charging fees for baggage.

Views: 2

Hope LCC can break this artificial barrier and provide good point to point service for smaller markets! Once mainline pilots see loss of market share, then artificial barriers will be removed and the public will get a better product.