A321neo ACF Turkish Airlines

Turkish Airlines reported a strong third quarter, in which capacity, the operating result, and net profit exceeded those of 2019. The airline produced these results despite “increasing geopolitical tensions and global inflationist pressure while facing unprecedented operational problems,” it said on November 3. Turkish Airlines Q3 results exceed those of 2019.

Turkish operated in the center of the geopolitical problems, with the war in Ukraine right on its doorstep. The carrier suspended flights to Ukraine and Belarus. At the same time, it was one of the few European airlines that continued to operate in Russia as Turkey didn’t follow the sanctions of the European Union. With Russian airspace open to Turkish operators, Turkish Airlines was able to benefit from the strong traffic between the two countries, although it doesn’t disclose the numbers in the Q3 report.

The “unprecedented operational problems” with which Turkish was confronted were “insufficient workforce and infrastructure”, mostly outside Turkey. Yet, the airline says it only had to cancel 0.3 percent of its flights during the quarter compared to on average 1.7 percent at other European airlines. Istanbul’s new Sabiha Göckcen Airport produced one of the best on-time departure rates.

Turkish Airlines operated at 116 percent capacity of 2019 in Q3 and carried 22.9 million passengers. The domestic load factor was 91.4 percent and that of the international was 85.3 percent. Revenues were $6.068 billion compared to $3.405 billion in the same quarter of 2021. Passenger revenues were $5.083 billion (2021: $2.372 billion), and cargo revenues were $877 million ($969 million). Expenses increased to $4.198 billion ($2.414 billion), of which fuel was $2.107 billion. The operating profit was $1.586 billion, up from $850 million last year. The net profit was $1.515 billion ($735 million), with a margin of 25 percent.

By comparison, these are the results of Q3 2019: revenues of $3.999 billion, expenses of $2.917 billion, operating profit of $776 million, and net profit of $655 million.

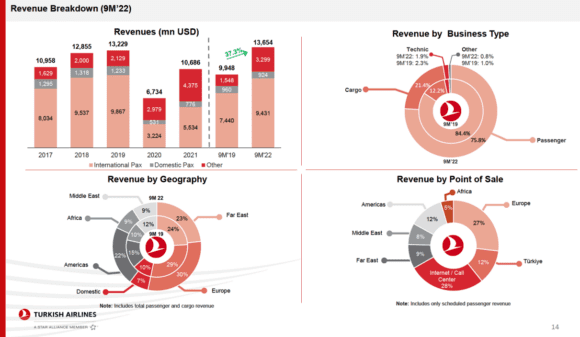

Revenue breakdown for the January-September period. (Turkish Airlines)

Between January to September, Turkish Airlines carried 53.9 million passengers, of which 34.5 million were on the international network. It reported $13.654 billion in total revenues (2021: $7.377 billion), expenses of $10.335 billion ($5.864 billion), an operating profit of $2.372 billion ($996 million), and a net profit of $2.252 billion ($734 million). With the Turkish lira in a weak position, the airline was exposed to the dollar, euro, and yen and lost $2.2 billion in currency risks. Excluding currency effects, revenue yields were $10.15 versus $7.39 in 2019. In HY1, Turkish reported a $737 million net profit.

Turkish says that it has significantly grown its market share in the cargo market, to 5.7 percent in August. But like most airlines, it suffered from lower demand. It carried 1.259 million tonnes between January-September compared to 1.398 million tonnes in 2021. In a business environment with strong yields, revenues were $2.921 billion, up from $2.734 billion.

Turkish Airlines had 390 aircraft by the end of September. It inducted eight Boeing MAX 8s this year to date, four Airbus A321neo’s, three A320neo’s, and six A350-900s. These aircraft were originally purchased by Aeroflot but were undeliverable after sanctions were imposed on Russia. Subsidiary Anadolujet operated 63 aircraft and SunExpress 68 aircraft.

Views: 15