2020 10 06 8 17 46

What patterns do we find among the US airlines as they try to recover and stabilize their schedules in the midst of uncertain traffic flows? Here’s what we find among the major US airlines for single-aisle aircraft, through September YTD. You can view the model that drives these charts here. We update these daily, and you can monitor that from here, using the link to the “Activity Tracker Model”.

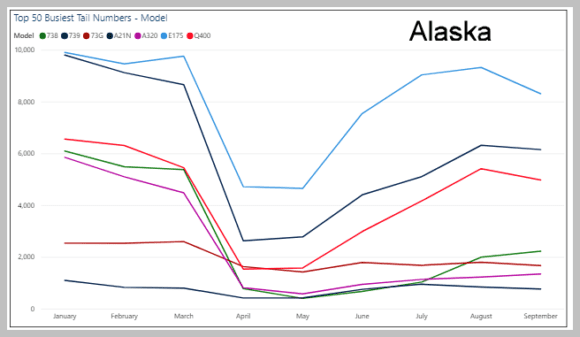

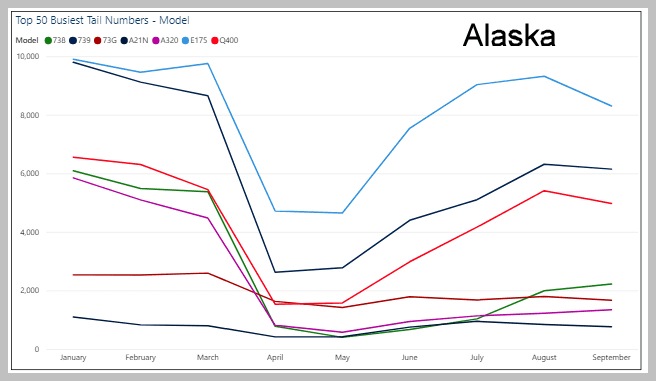

At Alaska, the E-175 recovered fastest and does most flights for the airline. This is followed by the 737-900ERs and Dash8s.

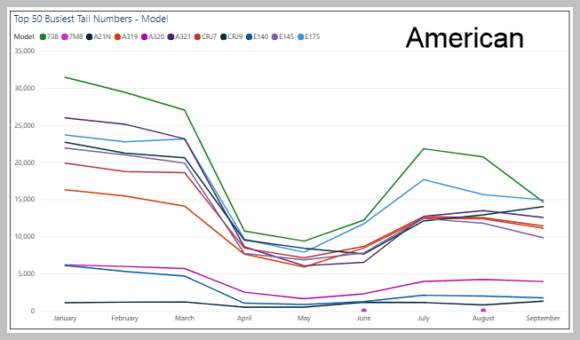

American has a complex fleet but we can see the 737-800 and E-175 doing most of the flights. Notice the A321neo pops into third place in September. The A321neo is the only model that shows consistent growth since April.

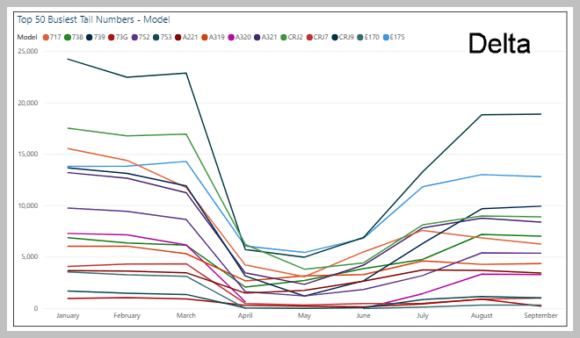

Delta is another airline with a complex fleet, essentially it looks like too much of everything. Here we see the CRJ900 being the busiest, followed by the E-175s and A321s. Similar to American, the A321s have seen increased use since April.

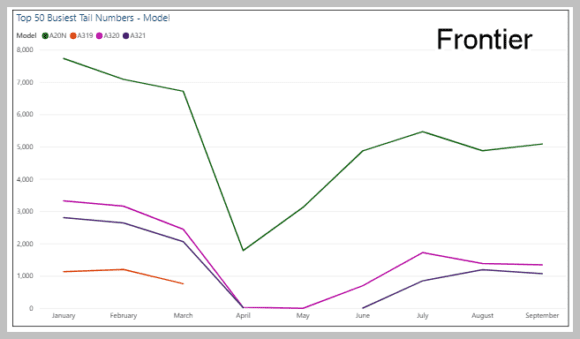

Frontier is an “All Airbus” operation. The airline has focused on its A320neo fleet. It’s older A319s appear parked.

Jetblue mostly uses its A320s, but once again we see the A321 making headway. The E-190s are busier than the A320neos.

Southwest is the largest domestic traffic mover and an “All Boeing” operation. The 737-700s saw the largest dip and then recovery. The 737-800s seem to be the more stable fleet segment, probably because they are newer.

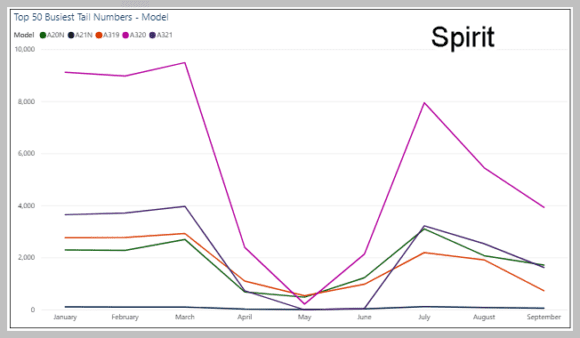

Spirit is another “All Airbus” operation. Operations have been primarily focused on A320ceos. Unlike other A321 operators, we don’t see increased use.

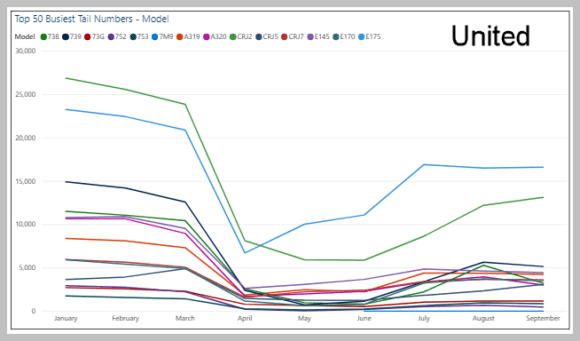

At United, we see another complicated fleet. Once again we see the E-175 leading operations. Interestingly we see the CRJ200 at the #2 slot and the 737-900ER at #3.

Summary:

- Regional jets are doing a lot of work. The E-175 is doing especially well, and the CRJ900 gets a shout out at Delta. These aircraft have the optimal capacity and adequate range to serve most flights under the current market conditions. Scope limits probably hold back these aircraft from even greater use. Another shout out goes to the Dash8 at Alaska, showing surprising activity.

- The A321 also seems to be doing rather better than expected – though Spirit is the exception here. The A321 offers operators the chance to offer one aircraft in markets that warrant it, rather than fly two smaller aircraft. In a time of reduced schedules that can be expected. We see similar activities for the 737-900 at Alaska and United.

- Looking specifically at Southwest, we can see why that airline remains keen on the MAX. The increased efficiencies of the MAX would help lower costs compared to the 737-700, even if it is much larger. We remain skeptical of the airline’s interest in the MAX7. We expect to see a focus on the MAX8 as it offers better tradeoffs among the MAX family. Southwest, as the largest domestic US carrier, would want to have the MAX8 capacity, range, and economics to seek the lowest operating costs and be able to set market pricing. For Southwest we see the MAX8 being the ubiquitous solution.

Views: 1