At the end of 2024, it is estimated that Boeing had 55 MAXs in inventory, of which 25 were...

Boeing

The initial report into the crash of Air India flight between Ahmedabad and Gatwick on June 12 states that...

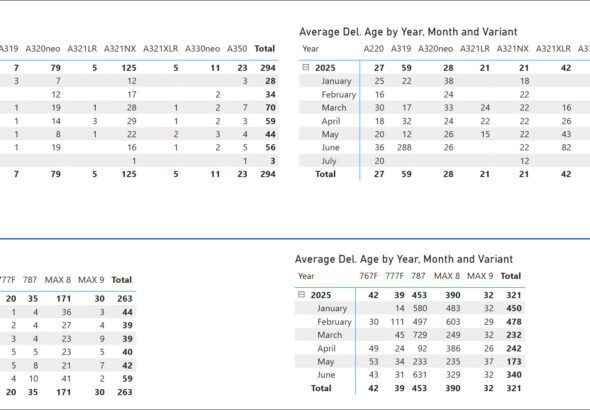

Yesterday, we updated our models to reflect the June numbers from Airbus and Boeing. It was quite a month!...

Here’s the updated model. Subscribe

The first civil trial against Boeing, stemming from the 737 MAX crash in Ethiopia, will begin on Monday, July...

The numbers through June are now settled, and here’s our estimate of the score. As you will see in...