All of the major OEMs, Airbus, Boeing and Embraer, typically release their market forecasts just before or at the Paris Air Show. All three forecasts have been released, with some changes to the normal patterns of constant growth we’ve seen over the last two decades, as forecasts are level or close to last year’s estimates. We highlighted Embraer’s forecast last week, and highlight the duopoly in this post.

Airbus

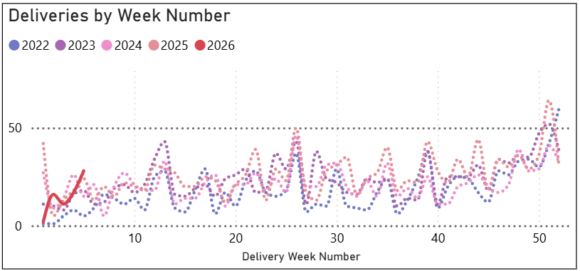

Airbus released its Global Market Forecast, which calls for global demand for 43,420 new passenger and freighter aircraft from 2025-2044. This is slightly higher than last year’s forecast of 42,430 new aircraft from 2024-2043 . That means the existing fleet will nearly double over the next 20 years.

Of the 43,420 new aircraft, 18,930 will be for replacement and 24,480 will be for growth, joining 5,800 aircraft that will remain in service in 2044. Of the 42,450 new passenger aircraft, the demand by region shows Asia-Pacific as the highest, with 10,050 new deliveries, followed by the PRC, with 9,570 deliveries, Europe and CIS with 8,070 and North America with aircraft.

Airbus projects that single aisle aircraft will take 34,250 of the new deliveries, for which 14,190 are in current backlogs and 20,050 open to be ordered. Airbus also projects 8,200 wide-body deliveries, with 2,560 on order and 5,630 in open demand.

Boeing

Boeing released its Commercial Market Outlook, which calls for global demand for 43,600 new passenger and freighter aircraft from 2025-2044. This is 180 aircraft higher than Airbus forecast, or less than 1 aircraft per month different from Airbus forecast. While Boeing defines its regional outlook slightly differently than Airbus, the largest regions are China at 21%, North America at 20%, Eurasia at 20%, and South and Southeast Asia at 19%.

Boeing projects that single aisle aircraft will account for 33,285 aircraft, slightly lower than Airbus, and 7,815 wide-body aircraft, slightly lower than the 8,200 Airbus projects. Boeing also projects 1,545 regional jets, and 855 freighters.

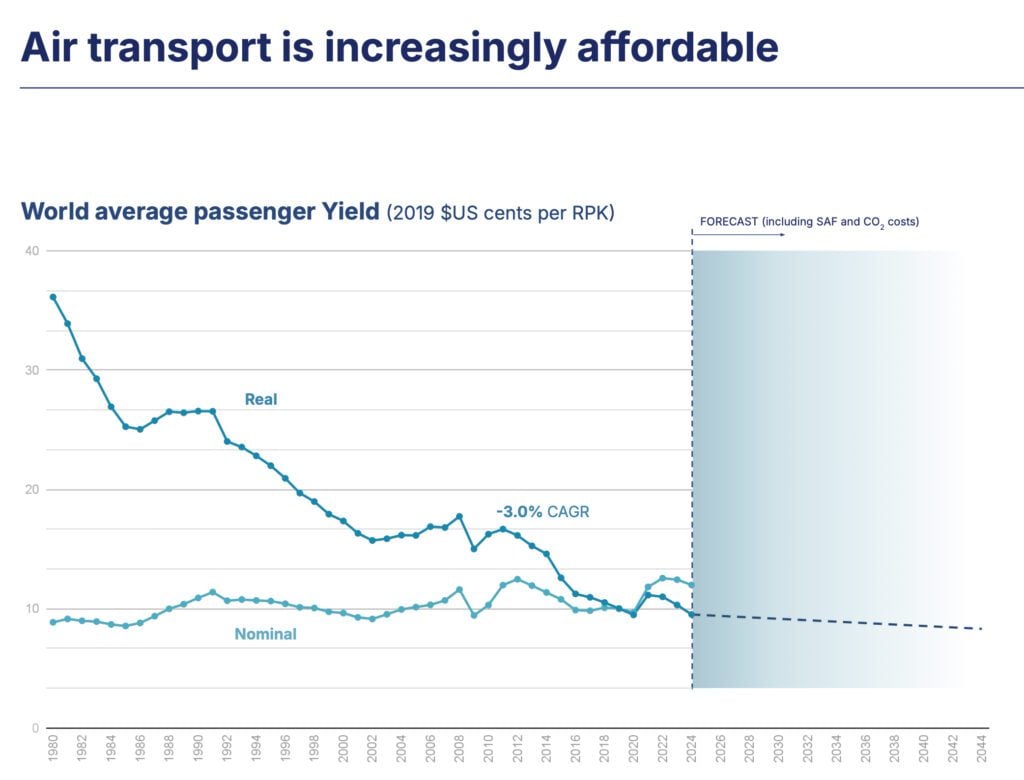

With airline productivity moderating, accommodating traffic growth cannot be done through load factors, which are very high, nor utilization, which has also been increasing. The trend to higher seating will continue, but larger narrow-bodies like A321 and MAX10 are already gaining in market share. That leaves additional aircraft to accommodate traffic. Boeing estimates 21,100 aircraft for replacement and 22,500 for growth over the next 20 years, with the fleet growing from 27,150 today to 49,640 in 2044.

The Bottom Line

Both forecasts make for an interesting read, and reflect the deep analysis of the market by the two major OEMs. Each has slightly different take on some issues, and on occasion a bit of bias can be seen. But overall, both forecasts provide a strong representation of where they believe the industry is headed.

We are expecting some clouding of the market via technology with the introduction of blended-wing-body aircraft from new entrant players, which differ from traditional classification. As technology and aerodynamics change, will new categories emerge? By 2044, we will know one way or the other.

Views: 818