For those who have been watching carefully, our AirInsight US Airline Performance Index has been in the red – that is decreasing – over the last week. That trend has been driven by promising growth rates a couple of weeks ago coming to a halt over the last week. The spring break and Easter holiday increases in traffic have not held, despite the continued increase in vaccinations.

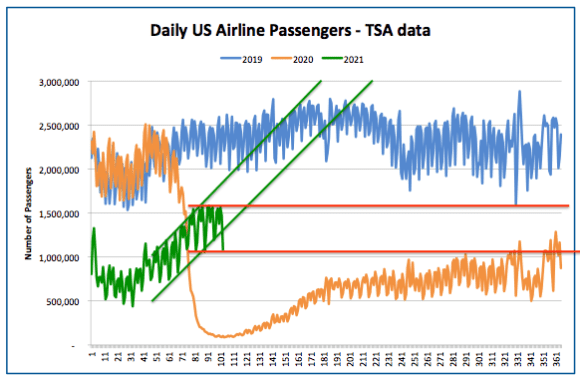

The chart below illustrates the trends in traffic – with the green line showing an extrapolation of the growth earlier in the month and the red line showing the plateau we’ve seen over the last week. It is now clear that a full recovery by the third quarter, which seemed a possibility if the growth rate in traffic continued after the CDC declared it was safe for vaccinated individuals to travel, no longer appears likely to happen.

Most industry analysts expect a slow return to normalcy, with periods of little or very slow growth followed by periods of rising traffic. From the 4th quarter to the end of the first quarter, average traffic growth was roughly 50%, from a million passengers per day to a million and a half. The question now is when or whether another “growth spurt” might occur, and the degree to which traffic can recover by year-end domestically. It is clear that resumption of international traffic will lag domestic traffic, given third waves in many countries that have resulted in additional flight cancellations (e.g. Brazil) and additional postponement of border openings (Canada).

Our projections continue to show a slow recovery with normal conditions domestically not occurring until mid to late 2022 and international recovery in 2023-2024. While we’re hoping that additional “growth spurts” can develop as herd immunity is gained through vaccination and natural antibodies, we can’t product when and if they will occur.

Views: 2