First Airspace A321LR to Jetblue

JetBlue inaugurated its international service to London using the A321LR and has plans for additional routes with new aircraft still on order. The reason is quite simple – the A321neo family offers excellent economics for the North Atlantic. Here is how the A321 is changing trans-Atlantic economics.

The wide-body versus narrow-body argument has been ongoing since the inception of the wide-body era with the Boeing 747. Conventional wisdom in the industry held that bigger was better if you could fill the aircraft. But today, the conventional wisdom is changing, as the combination of capital costs and operating costs makes the A321neo family a better choice for markets within a 4,000nm range.

From a revenue perspective, premium class service in a narrow body typically entails a 1-by-1 seating arrangement and the conventional 3-by-3 in economy. As a result, the premium seating options take up a higher percentage of the cabin, increasing average yields and RASM.

At the same time, the lower capital cost of a narrow-body aircraft, combined with its low operating costs, provides a distinct cost advantage. With the lower capital costs, one could acquire three narrow bodies for the price of 2 wide bodies, providing a potential advantage in frequencies if enough gates and slots are available. And since a narrow body can be accommodated in nearly all gate classes, gates are easier to find.

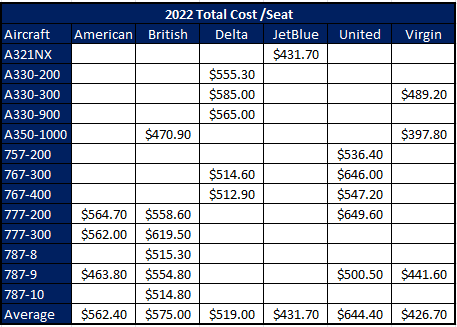

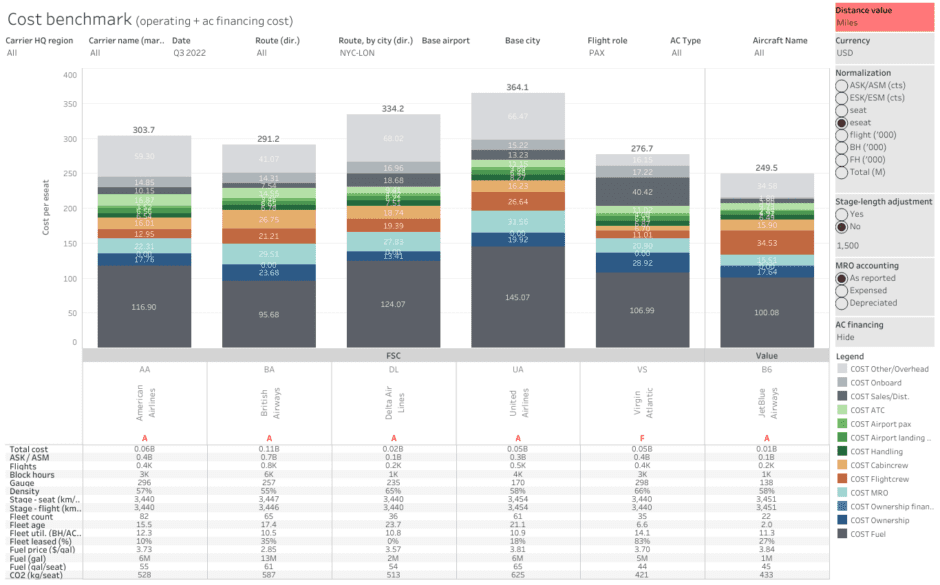

What does that advantage mean in terms of numbers? We examined operating cost data on the New York JFK to London route, which includes JetBlue operations, and several competing carriers, including American, Delta, and United (from EWR), using 767-300, 787-9, and A330-300 wide-body aircraft.

The data source for this analysis is Munich-based Skailark, which has unique intelligence and data on airline costs, aviation emissions, and airline market intelligence. The following table compares costs per seat for carriers on the New York to London route.

On a cost basis, the JetBlue A321neo has competitive costs in this market. Virgin Atlantic’s numbers are 3.5% lower than JetBlue’s, largely because of flight crew costs. JetBlue also has higher overhead costs than Virgin Atlantic because of its relatively small operation in the UK.

JetBlue’s good numbers are expected, as narrow-body aircraft are more efficient than widebodies. The higher capacity of the competing wide bodies doesn’t offset the inherent cost advantage associated with the A321, even when we project an all-economy configuration at maximum seating.

As the following chart demonstrates, JetBlue has market-leading costs. Indeed, JetBlue would have an advantage over Virgin Atlantic of ~10%.

In this case, on the NYC-LON route, the various aircraft rank as follows:

As the table highlights, Virgin Atlantic’s A350-1000 is the driver in reducing its costs in this market. The A350-1000 at Virgin Atlantic generates an 8.5% lower seat cost than the A321NX at JetBlue. But the per-seat ownership cost of an A321 is $11.17 compared to $35.18 for Virgin Atlantic’s A350-1000. As JetBlue grows its fleet and market presence, its cost advantage will grow because Virgin Atlantic won’t add A350-1000s as quickly.

Also, note how good the A330-300 is compared to the A330-900 – the newer model is only 3% better. Since we can compare the data within an airline, we are confident in the numbers. Another data item worth noting – Delta and United report very different numbers on the 767-300ERs. Delta is moving to A330-900s, while United is moving the 787. Based on the current data, United will see a significant improvement and a near 12% advantage over Delta. Meanwhile, Virgin Atlantic and American report good numbers on the 787s.

Interestingly, JetBlue and Virgin Atlantic are largely O&D carriers in this market. JetBlue has feed potential behind New York, whereas Virgin Atlantic depends on its partner Delta.

Implications

The implications of these findings are significant. Airlines deploying less expensive equipment to serve a route at a lower cost have an inherent competitive advantage.

Airbus reported 4,603 orders for the A321 family at the end of November 2022. The A321XLR version will provide the capability to serve transatlantic flights into central Europe from New York. It can also accomplish long hauls from the US to Latin America. With its economic advantage, the sizable order book for the aircraft is understandable.

Unfortunately, Boeing has no offering that competes with the A321neo for long-range narrow-body operations. The table above shows that United’s 757-200s cost over 24% more than JetBlue’s A321NX. The 737 MAX family lacks the range for most transatlantic operations and lacks the A321 payload.

This is ironic because Boeing had a best-selling aircraft with this capability, the 757-200. United’s numbers above show that aging 757s are no longer as effective as they were. The gap in Boeing’s product line makes Airbus the market leader in long-range narrow-body aircraft. Airbus is your only choice if you want the most-efficient aircraft for a 4,000nm mission.

Skailark is offering AirInsight readers a 20% discount on its data services. You can contact Skailark here with the offer code AirInsight 2023.

Views: 99

Interesting to see how this will play out, specially on the Atlantic. Looking at order books there will be a lot of A321s above the Atlantic in a few years. Modern widebodies have other advantages; they have many seat classes, beds, huge cargo capability and can fly to Shanghai tomorrow. Most airlines will have both long haul NB and WB’s.. I think there is a place for a slightly wider, real efficient 250-280 seat single aisle, 4500NM. Why Boeing kept pushing a flat 7 abreast fuselage, while everyone told them Too Heavy, remains puzzling.. avoiding inve$tment for short term gain$?

The interesting factor may be route dispersion, where smaller city to smaller city traffic is facilitated without the need for transiting hubs on either end. Routes like Dusseldorf-Baltimore may become economically feasible with a narrow-body, rather than the current transits of Frankfurt and JFK or Newark. That brings interesting possibilities for new services, as long as the O&D traffic is there. In Europe, this might eliminate a train ride to a major hub airport, and in the states it might replace a feeder flight in a typical itinerary today. Our view is that there are likely 30-50 city pairs that could quickly support service using an A321XLR that would result in hub-bypass and faster origin to destination times for passengers. After all, saving time is the reason we fly.

Thank you Ernest for the reply. I think traditionally hub operations offered travelers the advantage of frequencies, flexibility in planning. And for most travelers, at least either the departure or destination is a major hub. I think the large network carriers will use xlr’s to fly into each other hubs to secure their premium customers and open up new routes. Airlines like Jetblue, Frontier will be more opportunistic, maybe even creating new customers like the LCC’s did in the past.