2024 08 22 08 16 13

Getting a periodic snapshot of the year is helpful for those of us who track the commercial aviation industry closely. If you read the PR, everything is great and bound to improve. That’s when a look at the data becomes necessary and, often, revealing.

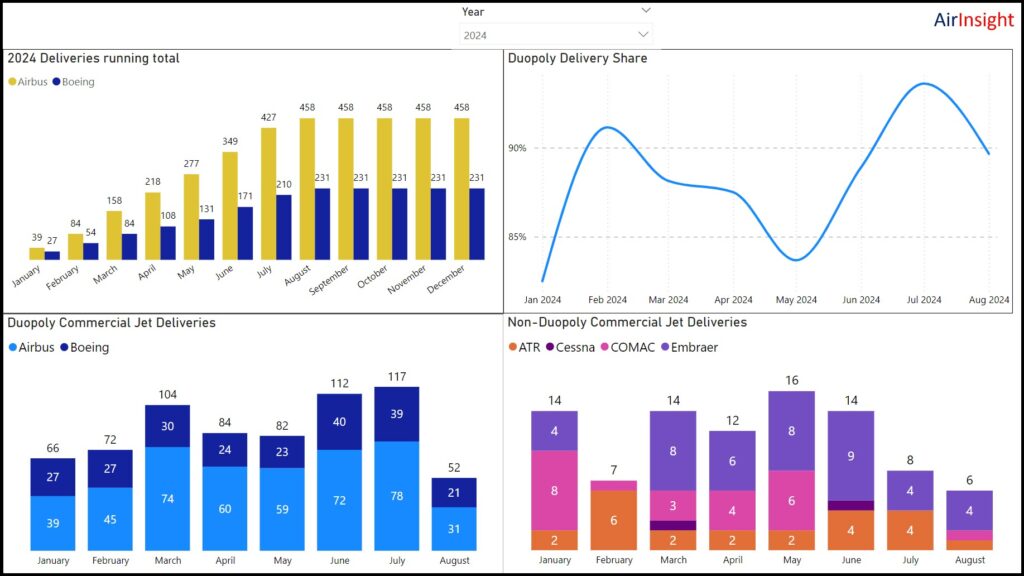

If the chart looks small on your monitor, please click it for a larger version.

Notes:

- Airbus, despite complaints about the supply chain, is doing relatively well. They look at being on track for ~700 deliveries. Airbus backloads deliveries.

- Boeing is having another rough year. Interestingly, the past two weeks have seen a surge in MAX deliveries, which is encouraging. Most of these are from the parked fleet rather than new builds. That is noteworthy, and the critical issue is getting aircraft to operators ASAP. Fortunately, they have inventory to work with.

- As noted in other posts, Embraer is having a good year. The OEM needs orders for its E2 to bolster the backlog. Its primary competitor is the A220, which has a more extensive backlog but struggles with delivery rates. This is Embraer’s moment to lose.

- COMAC looks like having a good year as well. However, its delivery rate is slow and bumpy. Production must speed up considerably to win deals outside the very patient Chinese market. Then again, COMAC suffers from the same Western supply chain bottlenecks and does not wield the clout the duopoly does. Interestingly, COMAC just made a smart move to build its talent pool.

- The upper right chart clarifies the duopoly’s industry dominance. Airbus is increasingly driving that dominance.

Overall, 2024 is a challenging year as the supply chain remains wobbly. OliverWyman has a good analysis of the implications for the MRO industry. Probably the most significant cause of the wobbly supply chain is skilled labor.

Boeing forecasts a need for 2.4 million industry professionals, which should be good news for young people looking for a career. Before anyone jumps in, it is essential to know all about this industry’s boom-and-bust nature from an employee’s point of view.

Views: 8