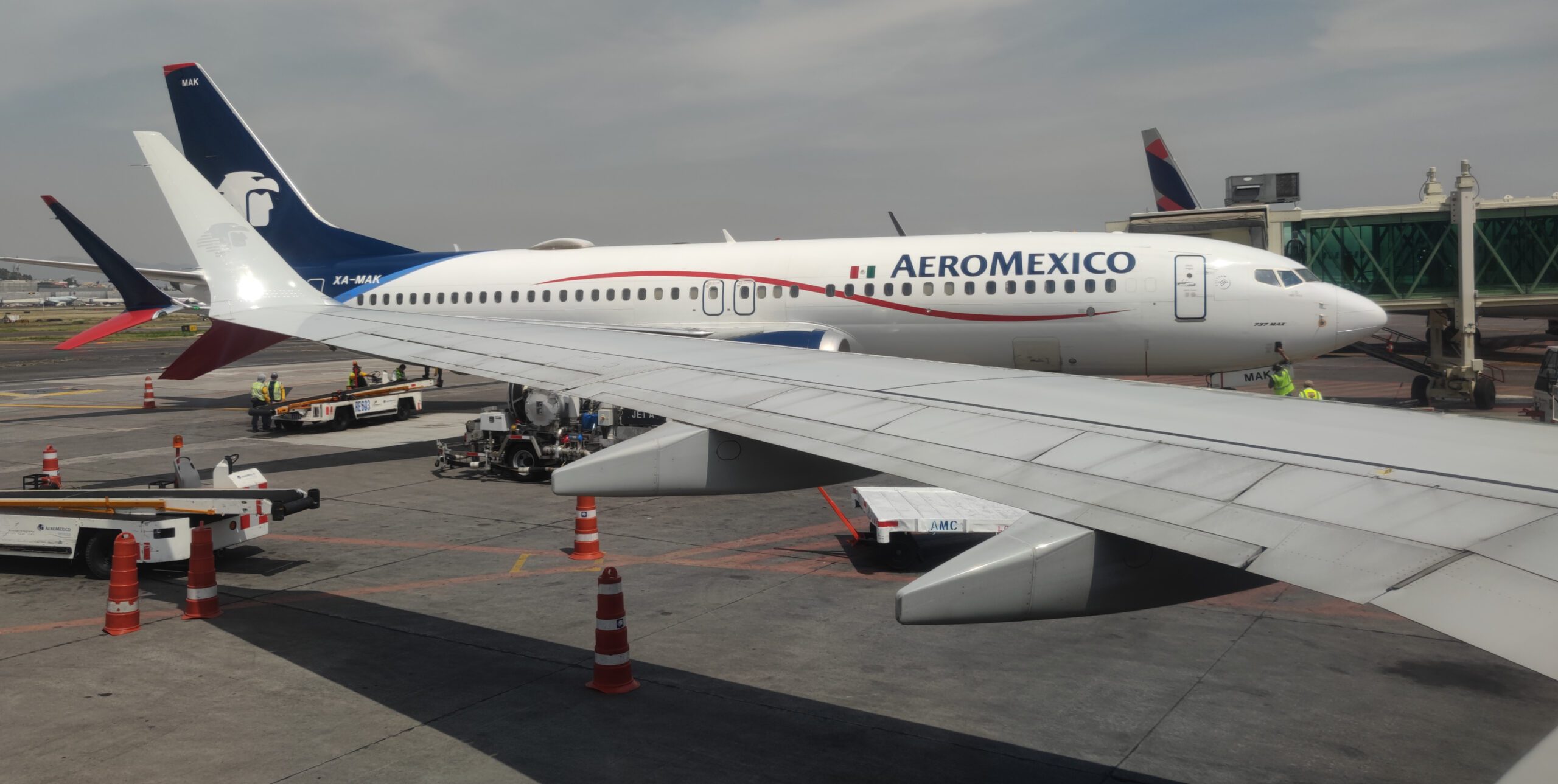

Aeromexico MEX LIM 17 scaled

Last week, there was plenty of news regarding the Mexican aviation industry. First of all, the three main domestic carriers, Aeromexico, Volaris, and Viva Aerobus, all published their financial results with combined net revenue of US$2.23 billion and net profits for the three operators, despite the complex macroeconomic environment. There was also news of a possible opening of Mexican domestic skies for international carriers, which has sparked controversy, and an update regarding the country’s Category 1 recertification process with the Federal Aviation Administration (FAA). Let’s do a recap of Mexico’s aviation industry in 2022.

A brief look at the financial performance of Mexican airlines

In the third quarter of 2022, the three main Mexican airlines had combined net revenue of US$2.23 billion and net profits of about US$58 million.

Juan Carlos Zuazua, Viva Aerobus’ Chief Executive Officer, said,

“In the third quarter of 2022, market demand continued to be favorable with a healthy pricing environment across our markets. As a result, we were able to grow our business and unit revenues. However, the continuous effects of disruptions in the global supply chain, surging inflation, and high jet fuel prices have brought a unique challenge for the airline industry.”

Enrique Beltranena, Volaris‘ Chief Executive Officer, said,

“We have consistently anticipated strong demand in our visiting friends-and-relatives and leisure markets – markets which shows no signs of a slowdown. Forward bookings are solid, and we expect to maintain a strong load factor for the remainder of the year, while CASM ex-fuel for the third quarter was under control despite inflationary pressures.”

Aeromexico explained,

“Sequential recovery in the domestic and international markets continued during the third quarter. In addition, revenue initiatives achieved positive results, allowing to mitigate the impact of higher fuel prices.”

Fuel prices remain a top area of concern. For Aeromexico, fuel expenses amounted to $7.9 billion pesos, an increase of 123.3% compared to the third quarter of 2021. This increase was primarily driven by the rise in fuel price, which was 76% higher than last year. Volaris and Viva Aerobus suffered fuel increases in the same range.

Is Mexico opening up the domestic market for international travelers?

Last week, the Mexican president said he thought international airlines should enter the domestic market and operate domestic flights. He said this would allow for a decrease in fares and increase connectivity in unserved markets. We could argue against both ideas because, first, the domestic fares are already very cheap, and most of the ticket costs are related to local taxes. Second, international airlines would not be particularly interested in operating these unserved routes that Mexican airlines are also not seeing as interesting.

While allowing international carriers into the Mexican domestic market is something far from approved, it will be fascinating to see what happens in this regard. In the meantime, Sarah Hanan, Commercial Director from travel tech provider Dohop, commented,

“The last week of September saw 1.4m weekly air seats scheduled in the domestic market as per OAG schedules, and 97% of that was in the hands of three carriers – with Mexico City featuring in 13 of the top 20 routes.

So overall, we welcome news of opening up to the competition as positive for both consumers and the industry. Competition lowers prices, shakes up monopoly or duopoly on routes, and generally improves service levels and punctuality.

We would expect the likes of Spirit, JetBlue, and Southwest to further develop their footprint in Mexico and that this extra capacity would create more connectivity opportunities to/from Mexico by connecting secondary cities in Mexico to the rest of the world – again good news for Mexican travelers, those wishing to visit Mexico, and indeed Mexico’s quite mature tourism economy.”

Category 2 well into next year

Last week, members of the Mexican and US governments met in Washington to discuss the recertification process to regain Category 1 status with the Federal Aviation Administration. As we know, Mexico has been downgraded to Category 2 status since May 2021, following an IASA audit which found out the country does not compel with ICAO’s minimum safety standards.

The results of this meeting were not the ones expected by the Mexican airline industry. Both parties agreed to conclude a Corrective Action Plan for Mexican civil aviation no later than December, which would allow for the FAA to travel to Mexico in January 2023 to present the conclusions of the corrective action plan and define a date to do the final audit, which would allow Mexico to regain Category 1 status. According to the Mexican government, all this should happen before next summer.

In the meantime, Mexico will remain downgraded to Category 2 status. The Mexican airlines are already losing ground in the market share against their US counterparts. Moreover, key growth plans such as the Allegiant-Viva Aerobus partnership are not allowed to happen until Mexico regains its Category 1 status.

Since being downgraded to Category 2 status, the Mexican airlines have kept adding new aircraft. These next-generation, brand-new planes are not allowed to operate commercial flights to the United States. Instead, the local airlines have to find ways to redeploy these jetliners to other destinations and routes, which may be suboptimal.

Views: 8