2021 1 aercap acquires gecas

Dublin-based lessor AerCap is seeing the purchase of US-competitor GECAS as a golden opportunity to strengthen its long-term future to the benefit of both customers and investors. The two lessors’ portfolios of aircraft leasing, engine leasing, and helicopters complement each other really well and will deliver AerCap significant revenues, cash flow, and earnings growth, CEO Aengus Kelly said during an investor’s call on March 10. Both companies confirmed they have agreed on a deal after the media wrote on the deal last weekend.

General Electric (GE) has been looking for a buyer for GE Capital Aviation Services (GECAS) for a few years now, but the timing was never right until today. AerCap will acquire 100 percent of GECAS in a deal that includes $24 billion in cash, $1 billion of AerCap notes or cash, while GE will receive 111.5 million of AerCap shares that gives GE a 46 percent share in the combined company as well as two board directors and certain voting rights.

At today’s share price of around $53, that translates to $5.9 billion, bringing the total value of the deal to some $31 billion. Kelly and CFO Peter Juhas confirmed they have got a discount, as the net offset value of GECAS is between $34 and 35 billion. GE itself valued the assets of GECAS at $35.9 billion in today’s 2020 results presentation. Citi and Goldman Sachs have provided $24 billion for the financing of the transaction. When the closing nears, AerCap will take out financing by issuing unsecured bonds and secured or unsecured hybrid bonds.

AerCap’s aircraft portfolio includes 1.044 owned and managed aircraft, including Airbus A320ceo/neo-family, A330s, A350s, Boeing 737NG/MAX, 757s, 767s, 777s, 787s, and Embraer E1s and E2s. They are leased to some 200 customers. It has 286 aircraft on order. GECAS has about the same number of customers, with 984 aircraft as owned and managed. They include A320ceo/neo-family aircraft, A330s, A350s, Boeing 737NGs, and MAX, 747s, 757s, 767, 777s, and 787s. GECAS has 255 on order. The US lessor also has some 900 managed engines through General Electric and CFM, plus 300 helicopters. While the rotor wings are new to AerCap, Kelly is seeing them as a nice addition as the fleet is young and the market is in positive shape. Yet, 91 percent of the combined portfolio will consist of the airliner leasing business.

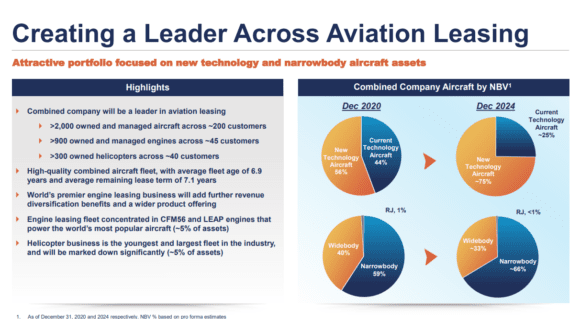

Fleet and customer base complementary

“Our fleet and customer bases are highly complementary”, Kelly said. “Adding GECAS’s predominantly narrow-body fleet and order book to our own creates a strong strategic fist. Together, we will have a 56 percent new-technology aircraft, and this is expected to grow to 75 percent in 2024. This is not about scale, this has to make sense financially. This agreement will deliver AerCap significant revenues, cash flow, and earnings growth.” CFO Juhas quantified additional revenues coming from this transaction at some $7 billion and cash flow at $5 billion. The share of narrow-bodies will increase from 59 percent now to 66 percent by December 2024, with combined capital expenditures of $4-5 billion per year from 2022.

It’s not the first deal AerCap, which reported a $299 million loss for 2020, has done to grow in size. In June 2005, it acquired Debis Air Finance for $2.8 billion. In September 2009, it added Genesis Lease for $1.3 billion, but its biggest coup was the purchase in December 2013 for $ 28 billion of ILFC which was a bigger deal to complete. “As I have told you many times before, the balance sheet comes first. A consistent focus on a strong balance sheet and a conservative capital structure for many years have put AerCap in a position to execute this deal”, Kelly said. What makes GECAS so attractive is its careful approach to business since it was established in 1967. “One of the reasons we found GECAS attractive is that it grew its portfolio organically over time and at scale, not at overprized mergers and acquisitions.” Kelly added: “ This is the right business at right time at the right price.”

Lease cycle set to change

Putting color to the “right time”, Kelly and Juhas said the leasing market has changed since the purchase of ILFC. The share of leased aircraft has increased from 44 to some 50 percent. As airlines hope to escape from the Covid-crisis and look for options to reduce costs, it is likely that they will turn to lease even more. “The market is much bigger now. We had 1.500 aircraft when we bought ILFC, there are fewer aircraft in the books now but we have a bigger balance sheet. In the last five years, AerCap has leased 1.000 airplanes. Looking at the capability of the platform, the size of the market has grown. We appear to be in the cycle, and very important too, the debt of the funding market coming out straight away in investment rating is looking to improve further, so we thought this is the right thing to do.”

“The combined aircraft trading platforms between AerCap and GECAS did over $20 billion in aircraft sales in the last four years. As we believe we can see the recovery of the aircraft cycle, this company is extremely well-positioned to take advantage of the cycle as it moves on.”

Juhas stressed that AerCap won’t take any unwanted risks. “We will keep a conservative capital structure with a large amount of liquidity. It will strengthen the underlying performance of the company far out into the future with long-term value for our investors, that’s what we are doing today.” Asked whether growing AerCap through a share buyback plan had been an option, Juhas said: “This opportunity presents a big generational chance to move the business forward and generate returns that would never, ever be possible by buying back stock.”

The capital markets have been positive on AerCap recently, so Juhas has no reason to be worried about securing the financing needed to complete the share deal. There will come some synergies out of integrating GECAS and AerCap, but synergies are not the main reason for this deal. “The benefit is that of combining the platforms and aircraft. There will be some benefits, but synergies are not really a focus in this transaction.”

The deal reduces debts at GE by $30 billion

Selling GECAS will allow General Electric to reduce its debt by $30 billion, bringing total debt down by $70 billion since 2018. GE will take a non-cash charge of some $3 billion on GECAS in Q1 and report it as a discontinued operation. “Today marks GE’s transformation to a more focused, simpler, and stronger industrial company”, CEO Lawrence Culp Jr. said: “Coupled with our continuing efforts to strengthen GE’s performance, operations, and culture, this deal brings GE closer to our future—delivering value for the long term and leading the energy transition, precision health, and the future of flight.” In 2020, GECAS reported a $-786 million net loss.

According to Culp, “AerCap is the right partner for our exceptional GECAS team. Bringing these complementary franchises together will deliver strategic and financial value for both companies and their stakeholders. We’re creating an industry-leading aviation lessor with expertise, scale, and reach to better serve customers around the world, while GE gains both cash and a meaningful stake in the stronger combined company, with the flexibility to monetize as the aviation industry recovers.”

The deal needs shareholder approval, which AerCap will ask during its shareholder meeting in May. In the final quarter, regulatory approval is expected from some twenty countries and agencies. After approval, it will take some nine to fifteen months until the share agreement will be completed. While completing the deal with ILFC took some three years, Juhas thinks this one will be easier as GECAS has an office in Ireland and most of its fleet is also domiciled there.

The combination of AerCap and GECAS will take it to an unchallenged top-spot in the lessor ranks. It will have some 2.600 aircraft, well ahead of Avolon’s 842 and Air Lease Corporation (ALC) 799.

Views: 4