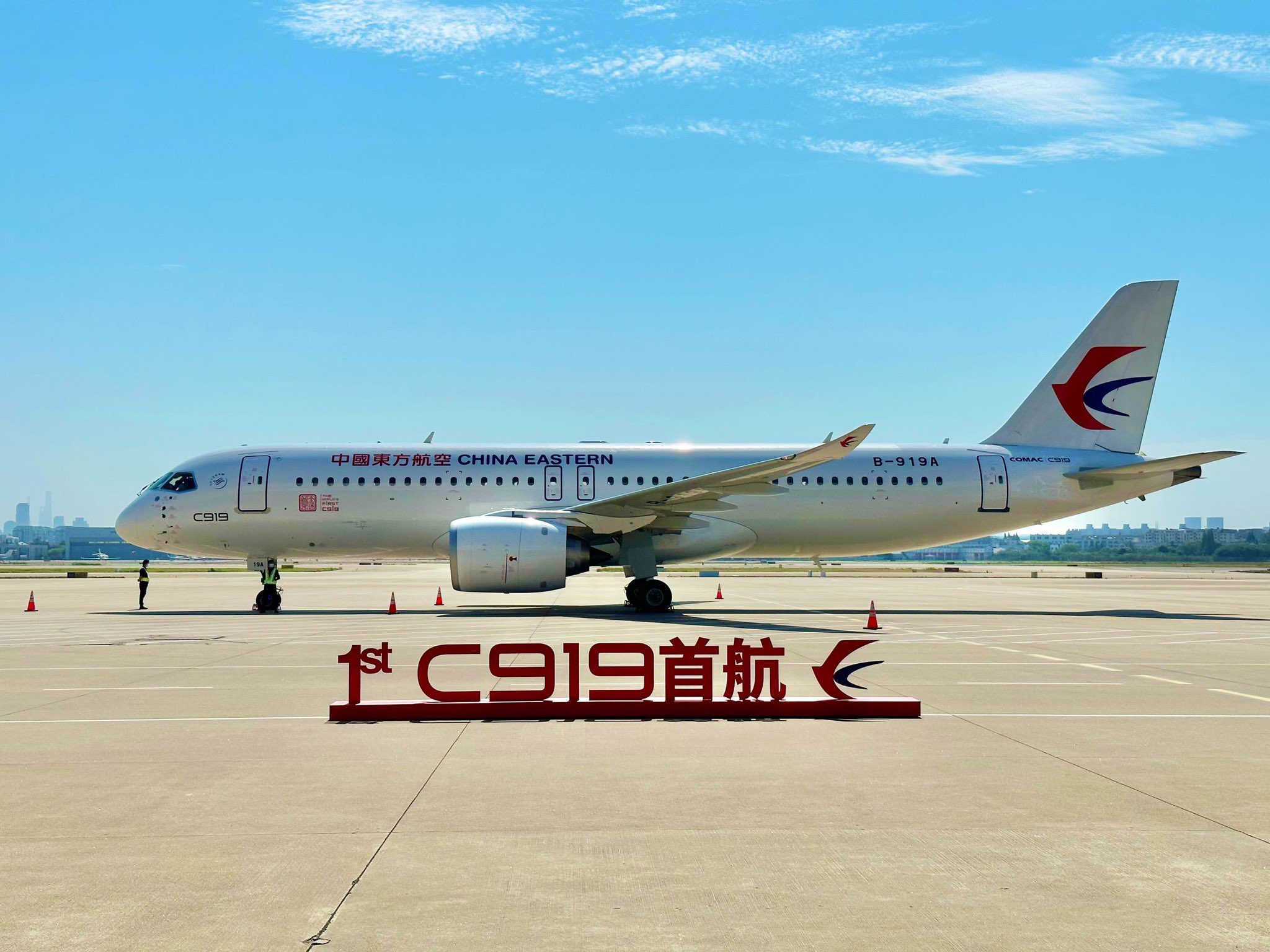

COMAC C919 China Eastern

News is emerging from Asia that Air China has ordered 100 C919s in a deal valued at $10.8 billion (based on list prices),

The initial media reaction reports this boosts the home team against Airbus and Boeing. Well, sort of.

Air China, one of China’s three biggest carriers, said in a filing that deliveries are planned for 2024 and 2031. It has previously ordered C919s.

The C919 competes with Boeing’s 737 MAX and the Airbus A320neo. Air China has a fleet of ~500 airplanes, including 212 A320s and 127 737s.

COMAC has been trying to disrupt the duopoly dominance but struggles to deliver fast enough. The order comes on the same day that privately owned Suparna Airlines announced it plans to replace its all-Boeing fleet with the C919.

While COMAC’s ambitions are well understood, some reality must be brought forward. The following tables lay that out.

- COMAC will win deals because it is a state-owned OEM, and these deals will be mostly with state-owned airlines

- Any observer would be rational to take the delivery schedule announced with a pinch of salt, ok, more than a pinch

- COMAC cannot match Western OEM delivery rates – thus ensuring business for Western OEMs in China

- To meet Air China’s delivery schedule, COMAC has to deliver an average of 14 aircraft per year for the next seven years.

- COMAC has not shown that level of productivity in its history

- The primary reason for the slower delivery rates is that the Western-dominated supply chain supports the largest OEMs first

- This is not by any state decree – it is simply how business works; you take care of your biggest customers first

In summary, it is an excellent order for COMAC. But let’s see how this plays out. The C919 backlog was over 1,000 before this order. If COMAC were a Western OEM, multiple FALs would be working on this backlog.

Views: 2