AFKL 777s nosetonose

Air France-KLM is slowly returning to profitability. Higher bookings and lasting effects of the restructuring and recapitalization initiatives have produced better results in the second quarter and first six months. More improvements are on their way, but the airline group is reluctant to look further ahead than the current third quarter.

The French-Dutch airline group reported a combined Q2 loss of €1.492 compared to €-2.614 billion last year. New CFO Steven Zaat stressed this has been caused mainly by a one-off accounting effect of €849 million coming from the derecognition of the KLM ground staff pension fund. “This is very good news as it will decrease our risk on the balance sheet by billions.”

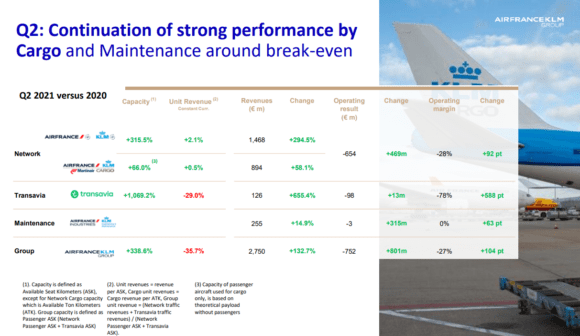

Higher fuel costs also negatively impacted the Q2 result. The Q2 operating loss was €1.612 billion versus €2.337 billion. Revenues were up 132.5 percent to €2.750 billion.

Over the first six months, the Group reported a €2.973 billion net loss compared to €-4.417 billion last year. The operating loss was €2.798 billion (€-3.198 billion), with revenues down by 20.8 percent to €4.910 billion.

By airline, Air France produced a €566 million net loss in Q2 compared to €-1.058 billion in the same period last year, while the HY1 loss was €1.408 billion versus €-1.596 billion. KLM’s Q2 loss was €185 million compared to €-493 million, or for HY1 €-522 million (€-768 million).

Q2 revenues grew by 195 percent at AF to €1.646 billion compared to +72 percent at KLM to €1.207 billion. Steven Zaat remarked that this is because KLM reduced less capacity in Q2 2020 than Air France.

A slide showing Air France-KLM Group Q2 results by segment. (Air France-KLM)

Another reason why losses are lower at KLM is that the Dutch carrier has implemented its labor restructuring plan more quickly than Air France. Actually, KLM has completed the plan and reduced staff by 5.700 FTE, 200 more than initially planned. This will save the airline €800 million by the end of this year. Furlough benefit schemes will end in late September.

So far, Air France has reduced its workforce by 5.300 FTE and expects to lay off another 900 in the coming months, including Air France HOP!. But it still has some way to go until the targeted reduction of 8.500 FTE is met. The French furlough scheme continues until the end of 2022.

Both network airlines are cash flow positive again

There is another indicator for Air France-KLM’s return to profitability. Despite continued losses, Zaat is most happy that both carriers have produced a positive free cash flow of a combined €210 million (€1.501 billion last year), the first time this has happened since the start of the pandemic. This can be contributed by 70 percent to advanced ticket sales but also to a continued and very strict investment policy and CAPEX of €2.0 billion that will focus for fifty percent on fleet renewal initiatives as more Airbus A350s, Embraers E2s, Boeing 787s, and soon Airbus A220s will join the fleet.

Also positive is that booking load factors have gone up from 40 percent in May to 67 percent in July. The network airlines operated at on average 48 percent capacity in Q2, but this is expected to reach 60-70 percent in Q3, with KLM seeing slightly higher levels than Air France. Long-haul capacity has increased to over 60 percent and saw higher load factors, especially since the EU opened up for fully vaccinated passengers from the US. Like all airlines, Air France-KLM is eagerly awaiting the full reopening of transatlantic travel. If the US reopens in Q3/Q4, Booking Load Factors could jump to 79 percent again, said CEO Ben Smith. Medium haul capacity is already close to 80 percent now.

Cargo onboard a KLM Boeing 777. Cargo capacity increased by 66 percent in Q2. (Air France-KLM)

Cargo has also played an important role in the Group’s fortunes. Capacity was up by 66 percent compared to Q2 last year, with the full-freighter fleet working around the clock every day. Q2 revenues were up 63 percent to €894 million or by 74 percent to €1.733 billion in HY1. Maintenance produced a €10 million HY1 loss compared to a €321 million profit last year, due to one-off effects.

Low-cost subsidiaries Transavia and Transavia France produced a €98 million Q2 loss (€-111 million last year) or €-218 million in HY1 (-233 million). Continued travel restrictions in Europe and North Africa are to blame, resulting in a drop of 37.4 percent in passengers to just over 1.5 million for the first six months. Steven Zaat hoped for a few more rainy summer days in The Netherlands and France to boost bookings for sunny summer destinations.

Debt reduction and new equity are top priorities

In the coming months, a lot of effort will go into further reducing net debt and raising new equity. In 2020, Air France was saved by a €7.0 billion aid package from the French government, while KLM received €3.4 billion in loans and loan guarantees from the Dutch government. This spring, the French state, and China Eastern Airlines participated in a €4.024 billion share capital increase. Thanks to this, the Group has been able to reduce net debt by €2.7 billion to €8.344 by the end of June. The liquidity stood at €9.4 billion then but since then has increased to €10.2 billion on July 1.

Air France is now in negotiations with the government and banks to reimburse the outstanding 2020 state-guaranteed loan of €3.5 billion, which matures in 2023. It wants to repay the loan in three tranches, with the last in 2025. Earlier in July, the Group issued a Euro Medium Term Notes program for €4.5 billion that will give its easier access to the debt market to support its financing strategy and repay all state aid. The plan is to get debt levels back to pre-pandemic levels in 2023. Air France-KLM also wants a so-called ESG rating to be able to attract money from ‘green’ funds.

The situation on further recapitalization measures at KLM depends on negotiations between the (new) Dutch government and the European Commission.

While Air France-KLM is slowly returning to profitability, the carrier limits its outlook to no further than Q3. The uncertainty of the reopening of North America and continued travel restrictions elsewhere make it difficult to be more specific. Capacity will not return to 2019 levels until 2024, which includes a seven percent reduction for next year. When it emerges from the crisis, the Group plans to have 8-10 percent lower unit costs, lower debt, and operating margins of 7-8 percent.

Views: 11