US airlines liked open skies, as long as they were going to benefit. Then came the Middle East Three and things changed. Subsidies and other types of state aid for state-owned airlines did not go down well in the US. Especially when these airlines were jumping into the A380 club.

But here we are, Air Italy is done. It was never the threat it was made out to be, and here’s the evidence. The US DoT T-100 shows just how stiff the competition has been.

First, seats in the US to Italy market. EU airlines have been winning share. But so have the Middle East carriers even though at a much lower level.

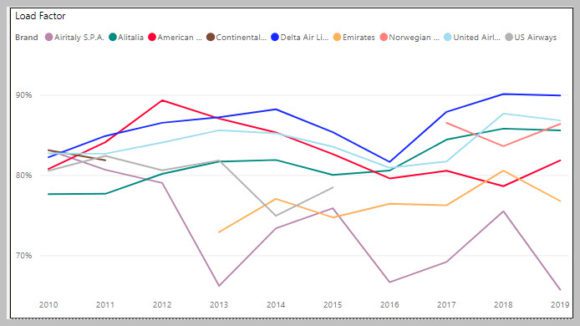

Next load factor. Air Italy was always the smallest player. Its load factor was too low to breakeven. Norwegian has been far stronger.

Indeed, the US carriers all have robust load factors. Delta’s latest numbers take them to 90% through October 2019. Even Alitalia looks like it is flying at 86% YTD. Fares may be soft, but the market is strong. Interestingly the carrier now looking the weakest is Emirates. But Emirates may be the carrier that picks up more than its “share” of the Air Italy traffic.

Indeed, the US carriers all have robust load factors. Delta’s latest numbers take them to 90% through October 2019. Even Alitalia looks like it is flying at 86% YTD. Fares may be soft, but the market is strong. Interestingly the carrier now looking the weakest is Emirates. But Emirates may be the carrier that picks up more than its “share” of the Air Italy traffic.

Views: 2