9CFE90FE 6379 489B BB59 56B03ED4DA9A scaled

Next week the UK is expecting a heatwave. That’s despite the airshow. After so many canceled shows this is going to be something the industry is looking forward to – heatwave or not. While we expect the usual show orders (calling Mr. Akbar), it is perhaps useful to get a half-year score. Here’s an Airbus vs Boeing June 2022 YTD.

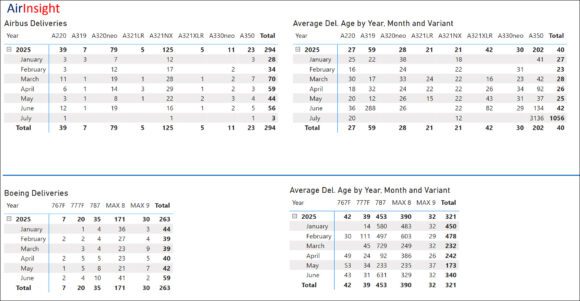

- Here’s our scorecard for the bigger deals YTD. YTD the order score is 44% Boeing, and 56% Airbus, YTD deliveries score is 42% Boeing and 58% Airbus.

- Looking at MAX vs NEO orders we note the following. The return of the MAX is helped by a pent-up demand – but Boeing is well behind.

- These charts help explain why – the MAX8 works as well as the A320neo. But when it comes to the A321neo Boeing is way behind and may never catch up.

- Looking at single-aisle MoM, we estimate Airbus is over 1,700 deliveries ahead. And, crucially, this segment is growing.

Summary

The return of the MAX is important to Boeing, but the amount of lost business hurt them. However, a bigger issue is that the MAX family is weakest where the Airbus NEO family is strongest. It does not appear the MAX9 and MAX10 will close the market gap with the A321 family anytime soon.

Anecdotally we hear that A321XLR pricing now is close to that of the A330-800. That is remarkable and does not reflect on the twin aisle. Rather it shows Airbus is able to charge a premium on the XLR because it has no competitor and demand is strong. Transfer pricing allows Airbus to use super profits on XLR deals to support deals where it faces competition with a MAX. For Airbus, this is a virtuous cycle. But even as Airbus is in a relatively strong situation in this segment, the duopoly is unstable, and that is a concern for the entire industry.

Farnborough is where we will see if Boeing announces a lot of MAX9 and 10 orders. These are more important than ever to allow Boeing to try to restore the stability the duopoly/market needs. If they announce a deal with Delta for over 100 MAX10s that will be an important positive signal. Of course, Delta will manage its risk, because almost certainly there are deal clauses covering the certification issue and delivery dates. It will also be helpful for all if Qatar would be more transparent about its MAX deal status.

We expect Boeing announcements to be eagerly attended and much analyzed. This looks like a big show for Boeing.

Views: 4