Fuel burn is becoming a growing concern for airlines – fuel burn is the great exogenous factor. Fuel is the #1 input cost that the industry has zero control over. Some airlines hedge fuel, but that is not as popular as it was.

We see how aircraft and engine OEMs are struggling to deliver. Demand for new aircraft is strong because of concern over fuel burn. In addition to the cost issue, airlines seek to improve their “green” credentials. Lower fuel burn accomplishes lower costs and better credentials.

Let’s look at the US airline and how they are accomplishing the task of fleet renewal – seeking lower fuel burn and better green credentials. We divided the fleet into the current generation (MAX, NEO, etc.), and the rest are called the previous generation. The following table shows the big US airlines’ single-aisle fleet by generation.

Frontier’s fleet is 75% current, and Spirit is 40% current. Hawaiian is also relatively high at 31% current. The others? Not so much.

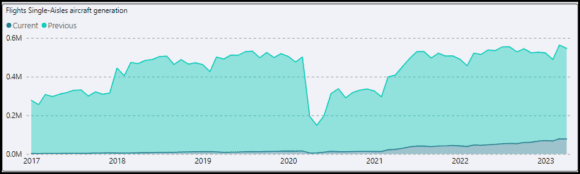

To get some scale and context, the following chart shows the number of flights in the US for single-aisles by aircraft generation. The amount of state-of-the-art aircraft deployed is tiny compared to the number of previous generation models. The impact is growing as newer aircraft are deployed, but the impact is small.

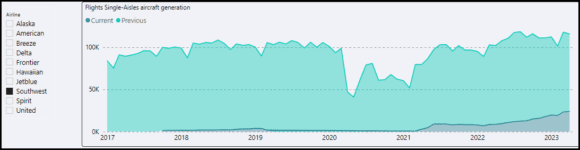

The chart becomes much more interesting when we look at airlines aggressively updating their fleets. Take a look at Southwest, for example. Taking a new MAX every three days will make an impact. But, overall, the MAX fleet is smaller than the previous generation deployed.

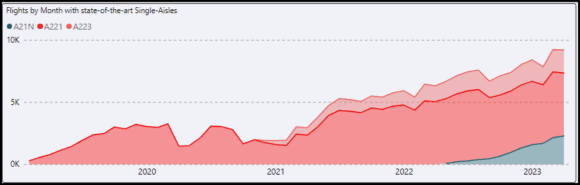

Looking at the fleet activity from the point of view of an airline, we also see interesting trends – like this one at American. Here we see how American is aggressively deploying its A321neo fleet.

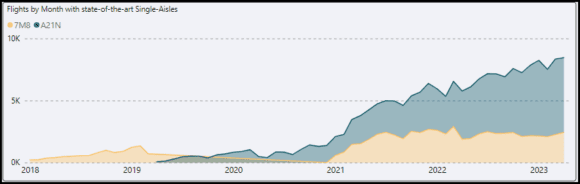

Here we have the same chart for Delta.

Considering the drive to save fuel and the environment, it is useful to understand how this process takes in the airline industry. Airline fleets are long-term assets that are worked for about 20 years, often longer. The industry can not switch faster and remain viable. That net zero target is far away because it has to be.

Views: 0