2025 03 11 08 30 39

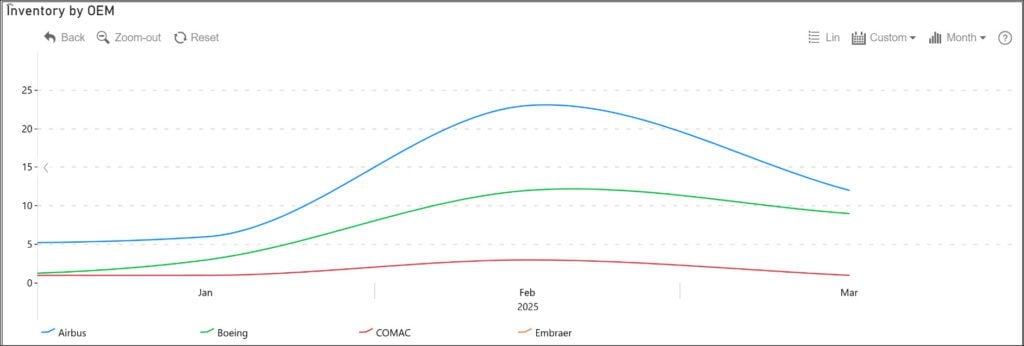

It appears that aircraft inventories are easing this year.

View our daily updated tracker here. Please note that the inventory tracker is on page two. This model is published outside our paywall.

This model has an active “X-axis.” When you click on a period, the axis expands. A year breaks out into months and a month into days.

When selecting 2025, we see the following for inventory: February saw a rise, which seems to have eased into March.

We should have data on Embraer, but it does not publish the first flight date (they tell us it is a secret). So, we focus on the duopoly since it accounts for ~95% of industry deliveries.

Inventory Breakdown

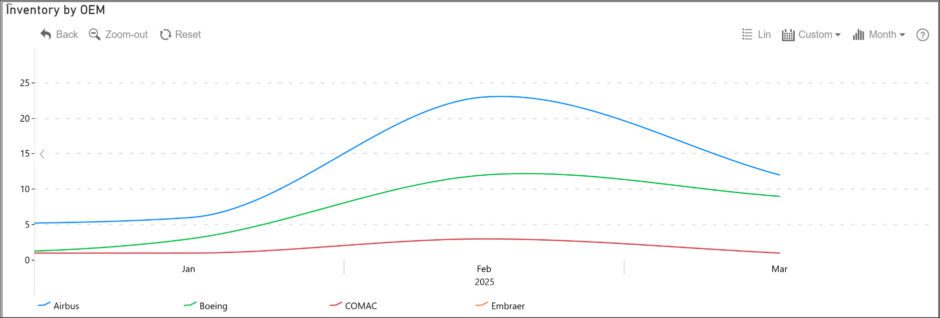

Here’s a breakdown of the industry’s most prolific segment: single-aisle inventory.

The number of 737 MAXs is unsurprising as it has been building for a long time. Boeing has been driving down that inventory at remarkable speed, though. With 76 MAX deliveries to date, the following chart demonstrates Boeing’s success.

The Airbus inventory is heavily tied up in A321 variants. We will analyze this along with engine selections later today, but it will be behind the paywall. Despite the media coverage the XLR is getting, we can see it is still a small part of production. We increasingly believe that the LR will meet almost every airline requirement. Will the XLR will outsell the 757?

COMAC remains an enigma. It is long on promise and short on action. If the duopoly struggles with the supply chain, the non-duopoly members are having it worse. COMAC has four deliveries YTD. Even if the details we’d like from Embraer are absent, the data shows this, with only five deliveries YTD.

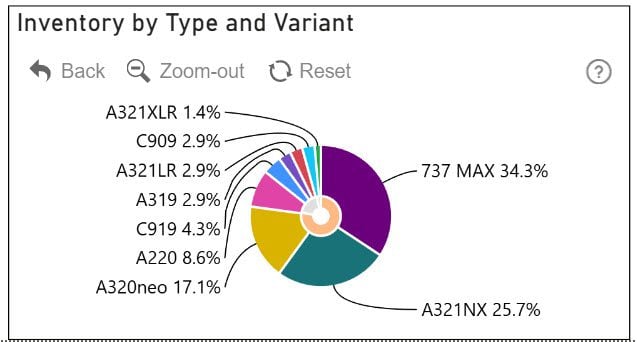

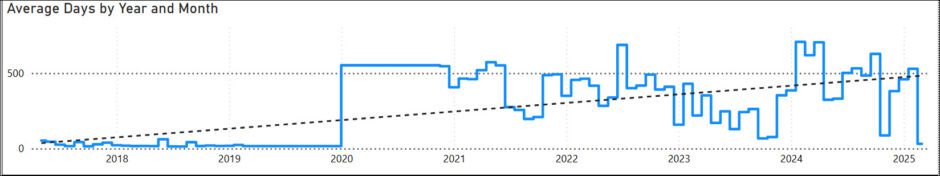

Inventory Ageing

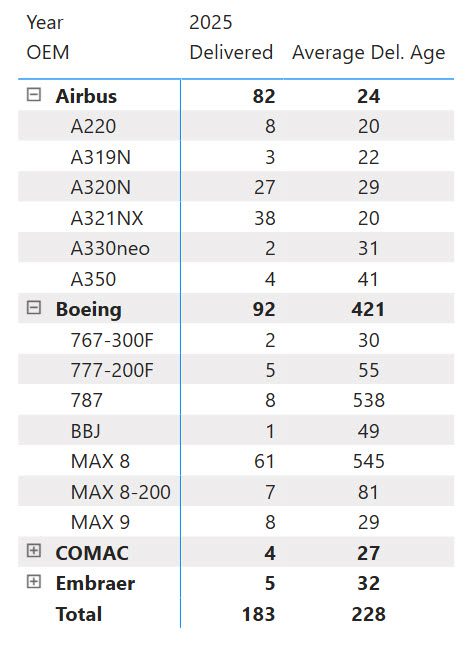

A key item to watch is inventory age—aging production costs dearly, as Boeing has shown. The numbers behind each aircraft model are the average days between the first flight and delivery.

The table below lists all commercial models we’ve been tracking.

The situation at Boeing is well known. Moreover, the problem is being tackled vigorously. Any slowing in deliveries is a concern at Airbus because this OEM has had the entire supply chain leaning in. While Boeing was fumbling through its issues, Airbus had the whole supply chain at its behest.

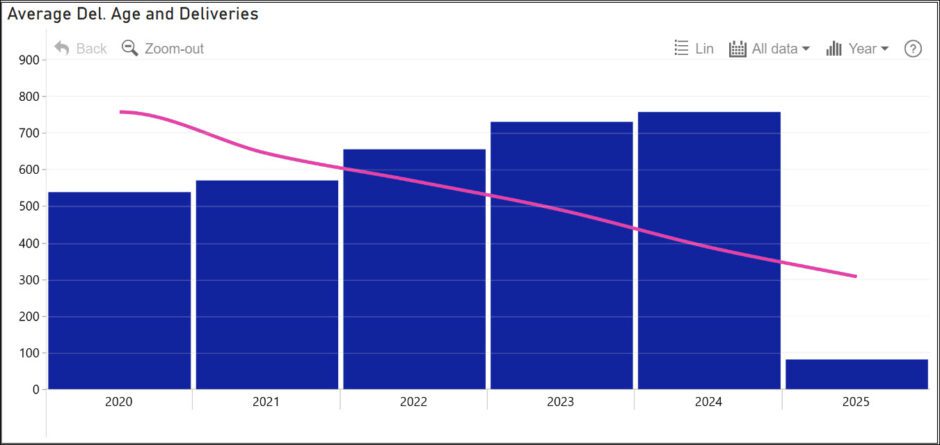

Here is how Airbus has fared over the past several years. It’s a great chart and shows continued success in getting deliveries to customers quicker every year. Impressive progress, right?

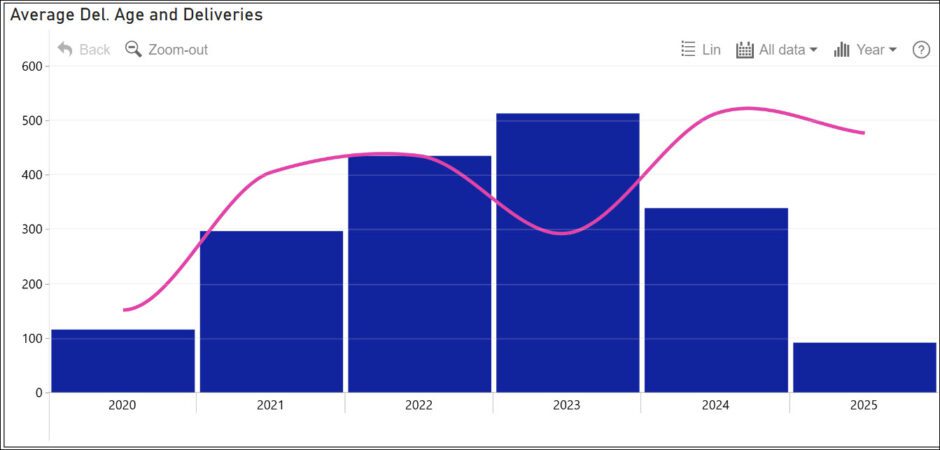

Now, here’s Boeing. It’s not so pretty, but things have changed now that Boeing is delivering MAXs at volume.

Boeing is slowly building new MAXs, and those deliveries (out-delivering Airbus YTD, by the way) mean its inventory is dropping. Even with slow production, Boeing is now drawing down its parts inventory and re-energizing its supply chain. That supply chain will no longer be leaning into Airbus as it was.

As much as airlines and lessors, the supply chain wants a vigorous duopoly. Helping Boeing regain its mojo is in the supply chain’s interest, and we can see it happening.

To answer the worry question: Yes, we should worry. Can the supply chain handle the pressure from a reset duopoly? It is not just a reset; Boeing can be expected to become ever more vigorous as the year progresses.

Views: 263