Justin de Reuck

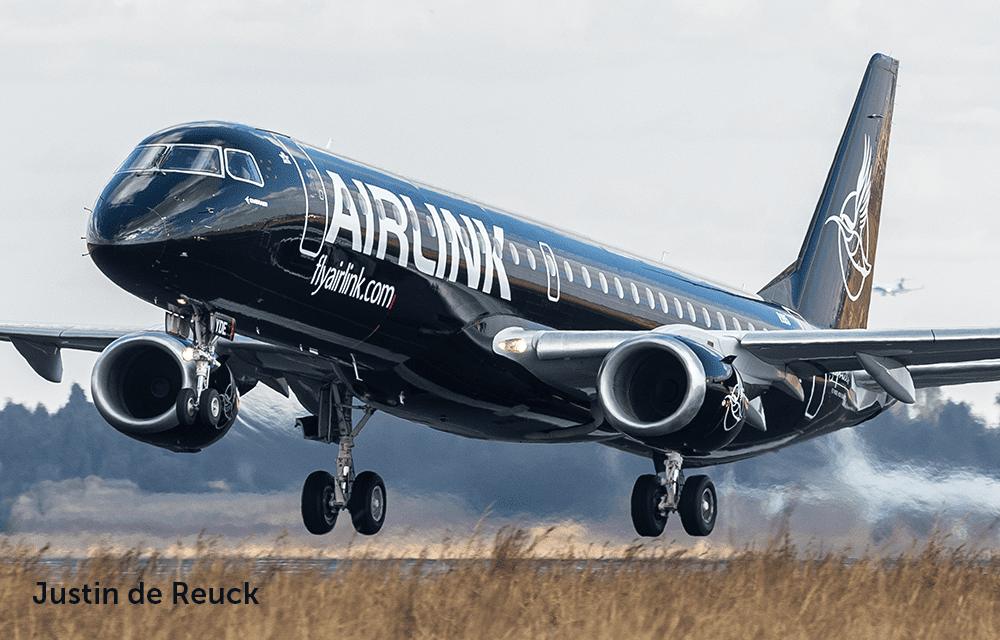

South Africa-based regional carrier Airlink says it will focus its energies on growing the business, in the aftermath of a court decision this week, which further dimmed prospects for recovery of R890 million ($50.5 million) in ticket revenues, owed by former franchise partner South African Airways (SAA).

In a decision announced on July 25, the Johannesburg High Court ruled that Airlink, should alongside other creditors owed money before SAA went into receivership, seek remedy from the receivers.

In a statement on July 26, Airlink said it acknowledged “the Johannesburg High Court’s decision” on its application “to recover approximately R890 million from its former franchise and commercial partner, South African Airways. Unfortunately, the High Court dismissed Airlink’s application.”

Airlink took South Africa’s revamped flag carrier to court in 2022, seeking to recover funds from tickets that SAA sold for flights on Airlink, before the former filed to go into voluntary administration in 2019. While SAA argued that Airlink should seek remedy from the receivers of the old entity where Airlink is listed as a concurrent creditor, the latter’s position was that it was not a creditor because the funds in dispute were derived from ticket sales for Airlink flights prior to SAA voluntarily placing itself in business rescue on December 5, 2019. The funds remained payable after that date according to Airlink.

Court takes a different view

However, the court differed, reasoning that according to the terms of SAA’s Business Rescue Plan, debts incurred by SAA prior to December 2019 would be settled under proceeds from the receivership. The receivers will determine how to allocate any funds among SAA’s creditors, from proceeds debts recovered on behalf of the defunct entity.

This adds a degree of uncertainty over whether Airlink and other creditors such as lessors, will be able to recover the money they are owed in full.

“Airlink respects the Court’s decision, it is after all the duty of the company’s leadership to explore every available avenue to recover the funds. Meanwhile, we will continue to focus on growing Airlink as an independent, financially robust, commercially vibrant, competitive and sustainable airline,” said Airlink CEO and Managing Director, Rodger Foster.

Foster was not available for comment but sources familiar with South African company law, said it places a fiduciary duty on the leadership of a company, to do all in their means, to recover any funds owed to the business. In the present circumstances, however, any further action has to be weighed against the potential costs. The High Court dismissed Airlink’s latest application with costs for two counsels in favor of SAA.

Views: 3