AlaskaAirlines Boeing737800

Alaska’s results were good – with a strong quarter beat and an upbeat 2025 outlook. Revenue and non-fuel costs were better than expected. You can see their slide deck here.

Alaska reported adjusted EPS of $0.97, beating the consensus estimate of $0.47 and guidance. Revenue of $3.53bn also beat the consensus estimate of $3.49bn. Despite the January 2024 door blowout and Hawaiin acquisition, Alaks had a great year.

The airline notes:

- Fourth quarter revenue was stronger than expected across both Alaska and Hawaiian, building on the strength seen in the fall, and exiting the year with momentum driven by sustained leisure demand and an uptick in corporate travel which improved close in demand.

- Mild winter weather to end the year enabled reliable operational performance through the holiday travel period, with higher-than-expected completion rate and load factor.

Within the group, Hawaiian took delivery of two A330 freighters to fly for Amazon. Its 787s will serve JFK. At Alaska, several MAX9s were delivered during the year.

New Group Outlook

The interesting story now is how the larger group might perform— here, we use the US DoT data through September 2024 as guidance.

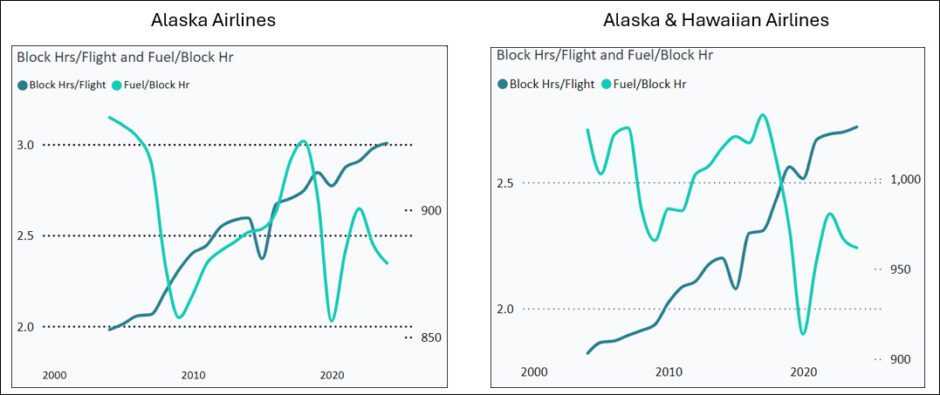

In terms of block hours and fuel burn, we see this. Because of Hawaiian’s extensive inter-island flights, group block hours/flight dropoff. Fuel per block hour rises accordingly.

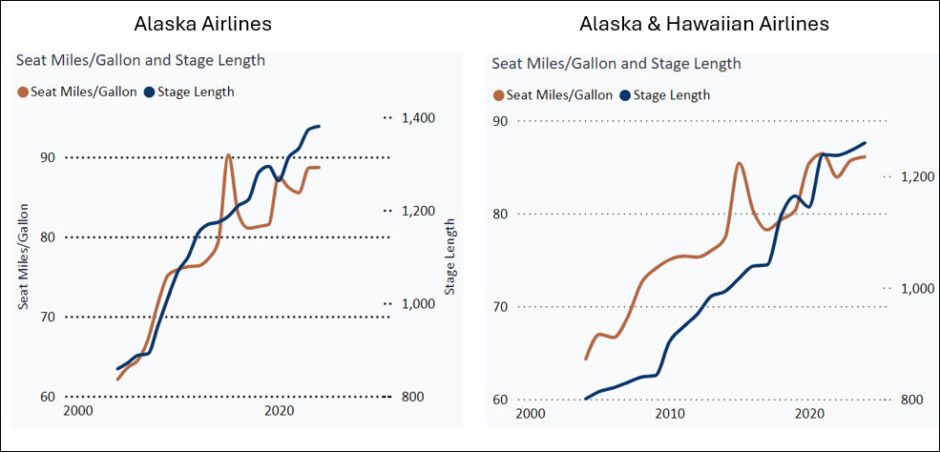

We get this in terms of average stage length and fuel burn. Stage length is impacted as described above in block hours, and fuel burn is equally affected. This is important because this input is typically the most significant operational cost.

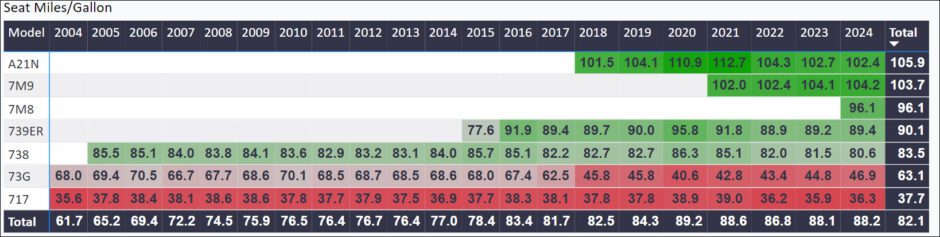

To underscore the importance of fuel costs, here is a history of the combined single-aisle fleet.

It’s clear the 717 is a gas guzzler, but what are the options for inter-island flights? The 737-700 is aging out, but absent the MAX 7, they must soldier on. On the other hand, the A321neo (Hawaiian) and MAXs have excellent fuel burn.

With a new administration focused on the “liquid gold beneath our feet,” there is every expectation that airline fuel costs will drop. This is excellent news for the entire industry.

Moreover, the airline projects a strong 2025. In 2024, through September, the combined group averaged a load factor of over 80%. New flights to Japan from Tokyo using fuel-efficient 787s and using Seattle as a hub, with feed from the West Coast and further eat, are likely also to have good loads.

Alaska’s confidence seems well-placed.

Views: 59