map 1500px 1

News has just emerged that Alaska Airlines group struck a deal with Hawaiian at $18/share, worth about $1.9Bn. This will push Alaska Airlines into the fifth largest airline in US service with 365 aircraft. You can read about the Alaska side of the deal here. The deal should take between 12 to 18 months to close.

Now comes the real challenge – the deal requires regulatory approval. Given the US DOJ’s views on JetBlue’s deal with American and the JetBlue/Spirit deal, you would be right to pause. This is likely not a shoo-in.

That Alaska needs to grow is clear – this is an economy-of-scale business. Both Hawaiian and Alaska benefit from the deal in that respect. Is this good for the consumer? Probably not – consolidation never is. Fewer choices are just that.

But the other side of this deal is industry-focused. From this point of view, the deal makes sense. And for the same reasons, JetBlue/Spirit does. Driving down seat costs is crucial to stay in business. Volume is your friend if you run an airline.

However, there are aspects of the deal that many will be thinking about:

- Alaska just sold off its last Airbus aircraft. Now, it is going to be adding a lot back again. What can we expect about this fleet complication? Does the argument for streamlining the fleet three months ago no longer apply?

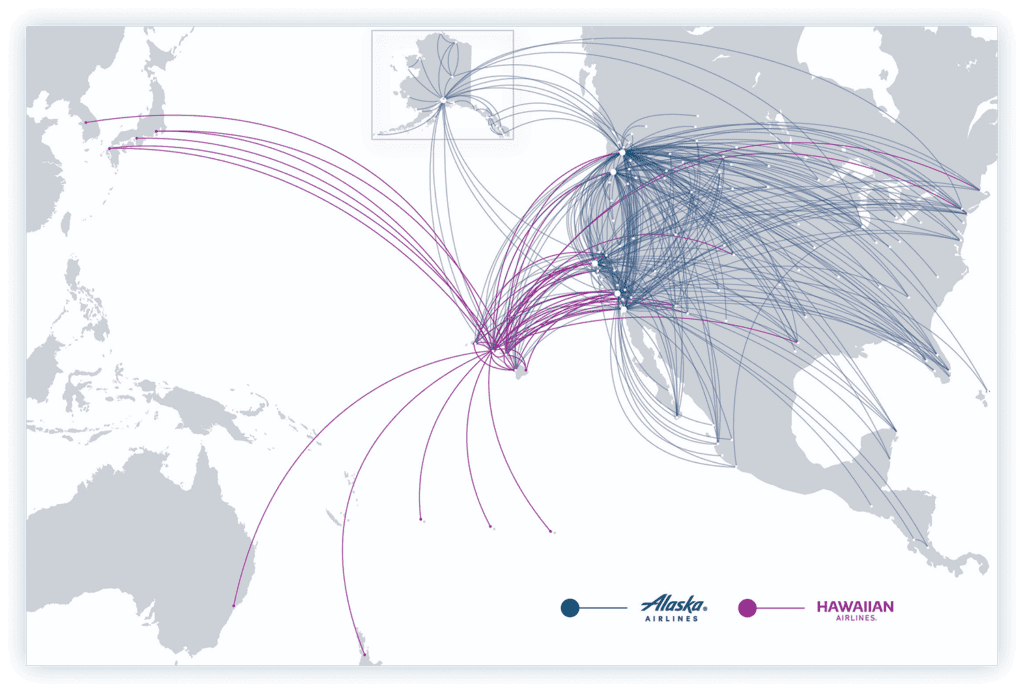

- Hawaii is literally “out there”. How will Alaska manage its operations from Seattle? There is talk of Honolulu becoming an Alaska hub. But it’s going to be more than that. Hawaiian will operate under its brand. It has a widebody fleet serving markets across the Pacific. This is not like any other of Alaska’s hubs. Look at this route map for a moment. This will be a lot more complicated than operating the individual airlines.

Source Airlines - Hawaiian recently started a new line of business with Amazon using A330 freighters. Where and how will that fit in?

- Fortunately, amid the pilot shortage, both airlines’ pilots are with the same union.

- Can the deal win federal approval if these few items are addressed to satisfy both company’s shareholders? The current situation facing airline deals has not been as sticky before.

Views: 1