2019 11 27 9 38 07

As we head into the first of the year-end holidays in the US, and airports grow even more crowded, here’s something to consider if you’re going to brave the annual migration. Flying an LCC means paying fees.

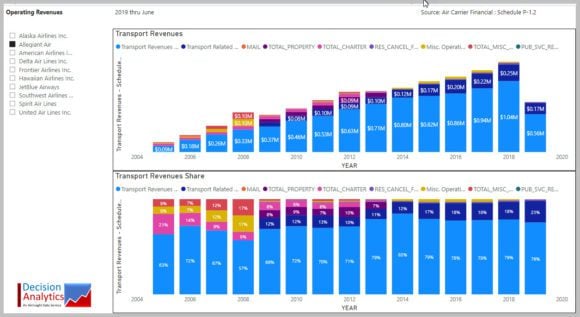

We took a look at three LCCs to make the point. In the charts that follow, focus on the lower chart in each series. Notice the percent of revenue that comes from Transport Revenues (the bottom section of each column).

The first chart shows Allegiant. We see that the airline’s share of revenues from fares is slowly declining as other sources of revenue climb.

Next, we look at Frontier. Notice here that the share of revenues coming from fares is down to about two-thirds. Fees make up the rest.

Next, we look at Spirit. Fares are at a steady 70% with fees making up the rest.

For perspective here is a chart that combines American, Delta and United. Surprisingly, the fare ratio is not that different from the LCCs.

If we look at 2018 data and compare the average fare reported and see what the typical passenger paid in fees, we get this.

Lower fares come with higher fees. Even then, the overall cost to go from Point A to Point B is cheaper on an LCC. Southwest, though, seems to offer a compelling combination. This won’t make your US domestic trip easier this week but there you are.

Views: 6