2024 10 23 152545

Boeing CEO Kelly Ortberg outlined his strategy in advance of the company’s third-quarter earnings call, and most analysts felt that he did not underestimate the tasks ahead and recognized the turnaround will require a long-term strategy and cultural change. This was the first major public opportunity for the new CEO, who outlined his focus on cultural change and returning to the traits that initially built the company’s reputation for quality airplanes.

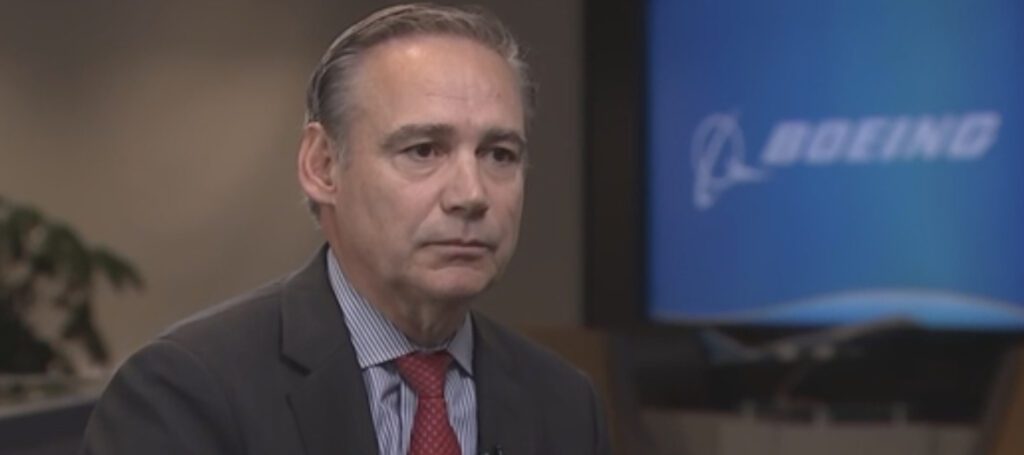

In an interview on CNBC before the conference call, he indicated that he clearly understood the challenges Boeing was facing when he accepted the job and that he plans to return the company to a culture focused on quality, safety, and trust.

Kelly Ortberg’s Remarks

His prepared remarks focused on culture. “It will take time to return Boeing to its former legacy, but with the right focus and culture, we can be an iconic company and aerospace leader once again. We will be focused on fundamentally changing the culture, stabilizing the business, and improving program execution while setting the foundation for the future at Boeing.”

He didn’t duck the seriousness of the moment. “Clearly, we are at a crossroads. The trust in our company has eroded. We’re saddled with too much debt. We’ve had serious lapses in our performance.” Then he spoke about the “great opportunities” ahead, citing the half-billion dollar backlog in the business and a customer base that wants Boeing to succeed and deliver products on time.

He indicated that “employees who are thirsty to get back to the iconic company they know” and that the 10% job cuts, which don’t impact the IAM, are not due to the strike. “We’re overstaffed for the forecast of our business,” and said the company needed the right size.

He concluded, “When it comes to our future, the only way to be successful is by working together. This is a big ship that will take some time to turn, but when it does, it has the capacity to be great again.” Time will tell.

Regarding the strike, he hoped that the rank and file would vote for acceptance in their voting, which is also taking place today.

Third Quarter Financial Results

As previously announced, Boeing’s third-quarter results were disastrous, even without the impact of the IAM strike that began in mid-September and is factored into results. The company lost $6.174 billion in the third quarter, compared to $1.638 billion in the same quarter last year.

Revenues were down yearly, with $17.8 billion compared to $18.1 billion. Operating margins, which were negative 4.5% in 2023, ballooned to 32.6% in 2024. The core loss per share tripled from a loss of $3.26 per share last year to a loss of $10.44 per share this year. As might be expected, free cash flow went from a negative $0.3 billion to a negative $2.0 billion in 2024. These results were generally in line with the pre-guidance released last week.

The results hurt the balance sheet. Cash and marketable securities dropped year-over-year from $12.6 billion to $10.5 billion at the end of the third quarter. Consolidated debt reflected a payback of $10 billion and new loans of $10 billion, leaving total debt nearly flat, going from $57.9 billion in 2023 to $57.7 in 2024. The company is focused on maintaining its investment-grade credit rating, which is currently only one step above junk status. A downgrade would materially increase Boeing’s interest rates.

Only the latter of the three major business units—commercial Aircraft, Defense, Space and Security, and Global Services—remained profitable.

Commercial Airplanes

BCA revenues fell yearly from $7.9 to $7.4 billion, primarily on fewer aircraft deliveries. Operating margins for the business unit tumbled from an 8.6% deficit last year to a 54.0% deficit in 2024. The company delivered 116 airplanes during the quarter, with production of the 787 planning to return to 5 aircraft per month rather than the current 4 per month. The company has a backlog of $428 billion, representing more than 5,400 aircraft.

Defense, Space and Security

Defense, Space, and Security revenues were flat in the quarter, but the company is losing money on several fixed-cost programs. The Starliner is most visible, with its astronauts stranded on the International Space Station, which SpaceX, another public embarrassment for the company, will rescue. This division has a backlog of $62 billion, representing more than 10 quarters of current sales levels.

Operating margin fell from a negative 16.9% last year to a negative 43.1% in the third quarter this year. In comments to CNBC this morning, Ortberg indicated no plans to divest the defense and space businesses.

Global Services

Global Services is Boeing’s most profitable unit. Revenues grew slightly from $4.8 billion last year to $4.9 billion in the third quarter of 2024. Operating margins grew from 16.3% to 17.0%. This division has a current backlog of $20 billion and should be able to maintain its momentum with increasing MRO on older aircraft as new deliveries are delayed.

The Bottom Line

Kelly Ortberg outlined his strategy in his first major public appearance since taking the reins at Boeing. His remarks appear to have been well received by those in the industry, and while his strategy was outlined in broad strokes, it was generally well received. He clearly understands the depth of the company’s problems and the need for cultural change.

He has outlined a series of steps to stop Boeing’s financial bleeding while moving forward with a focus on quality and safety. He also realistically understands that this will take time and that losses like this $6 billion quarterly loss are unsustainable.

While his strategy lacked specifics, the objectives identified were well received by analysts after the conference call. The question now is whether that strategy can be successfully executed. We wish him well in those efforts, as the industry needs a healthy Boeing.

Views: 51