2024 09 10 08 17 28

Reuters broke this story early this morning. Sources told Reuters that the latest 737 supplier master schedule communicated to the industry calls for MAX output to reach 42 a month in March 2025, compared with a previous target of September 2024.

The news is not too surprising. Our model tracking MAX production shows the struggle has been going on for some time.

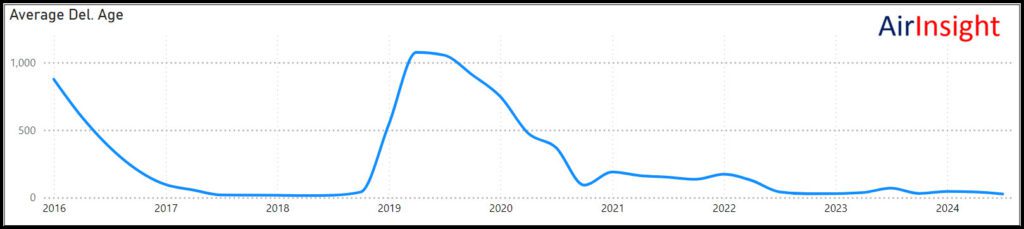

The MAX program has experienced several disruptions, and their impact is clearly shown in the chart. These disruptions have caused all kinds of network planning havoc among customers, and Ryanair and United have been among the most vocal.

As frustrated as both Boeing and its customers must be, the production of a commercial airplane has a long-tail supply chain. Sourcing materials and then manufacturing them starts a long time before delivery. Even once the aircraft is produced, we have seen some aircraft go through several test flights before customer acceptance. It just takes a long time to get the final product right. Given program disruptions, Boeing has to be extra diligent.

The following chart illustrates how Boeing has worked its way through the disruptions.

The current average delivery delay is ~26 days, which is the period between the first flight and customer delivery. The chart shows how Boeing has worked through the peaks since 2019. It has been bumpy, but Boeing has persevered.

Here is our tracking estimate for the MAX program through yesterday.

While Boeing has been working through these disruptions, that longtail issue remains a problem.

Because of these disruptions, the MAX program has burned supply chain firms. Arguably, Spirit Aerosystems has suffered the biggest damages, so it is going back inside Boeing. Both Spirit and Boeing need this as a solution.

But what about the other, smaller firms? They now have to eat the cost of work in progress while waiting six months. How many will wean themselves from Boeing and find a way into Airbus and Embraer? They are also rational players and need to de-risk.

Views: 58