K66651 04 scaled

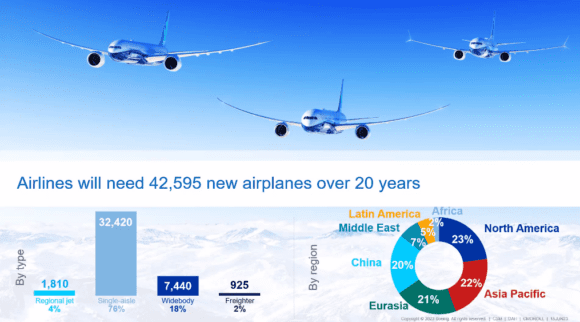

Boeing is predicting the airline industry will need 42.595 new aircraft over the next twenty years through 2042, the airframer says in the latest Commercial Market Outlook (CMO) that has been released today. That is up from 41.170 aircraft in last year’s forecast and compares to 40.850 predicted by Airbus. Although Vice President of Commercial Marketing, Darren Hulst, said there aren’t that many differences between this and last year’s predictions, the latest CMO identifies some trends. Boeing forecasts demand for 42.595 new aircraft in the next 20 years.

“The surprise is that there aren’t any surprises, maybe in terms of where we see demand in the market. I think that the end of the recovery has played out largely as we’ve expected, with a few different nuances and dynamics,” Hulst said during an online pre-Paris Airshow presentation.

“What we’ve seen is the resilience of demand for travel. I think we’ve seen how airlines continue to find ways to use airplanes in innovative ways. And I think the resilience that we’ve seen in the short term, whether we talk about last year, this year, or in the next twelve to eighteen months, is just proving out how valuable air travel is to the global economy.”

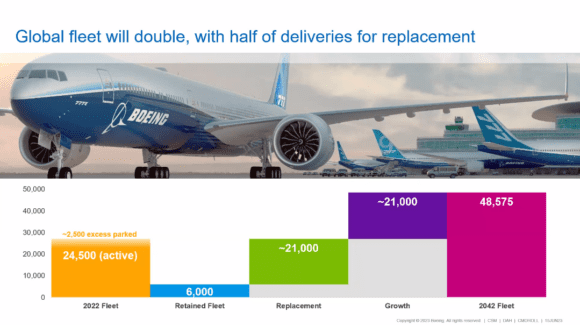

Looking at the numbers, Boeing says there are currently 24.500 active aircraft and some 2.500 in storage. By 2042, some 6.000 (Hulst later specified this as 5.900) will be retained. The airframer identifies roughly 21.000 for replacement and 21.000 for growth, bringing the total fleet to 48.575 aircraft. This is some 2.000 more than Airbus said this week in its 2023-2042 Global Market Forecast. With only 21 percent of the single-aisle fleet consisting of new-technology aircraft, there is plenty of opportunity for fleet renewal.

The 42.595 new aircraft required in the next two decades consist of 32.420 narrowbodies compared to 30.880 in last year’s CMO. This segment has fully recovered in all regions. These are MAX and A320neo family aircraft, as Boeing – in contrast to Airbus – has a separate number for regional aircraft: 1.810 versus 2.120 last year. Hulst says, in line with the global trend seen since 1994, capacity growth in available seat miles (ASM) on routes below 500 miles will hardly grow. It is long-haul where capacity growth continues, at 5.1 percent annual growth.

Hulst noted that regional aircraft are having a hard time, with just over 90 aircraft deliveries per year in this segment predicted for the next twenty years. “There are not a lot of suppliers. In this market, the cost of pilots is increasing. That reduces the relative effective efficiency or the ability of the business case to close for regional jets. And we have seen airlines move capacity into higher density, more efficient single-aisle jets over time. Partially because of human resource challenges, pilot constraints, and partially because of economics. Long term, we would view pilot availability as being something the industry console and we don’t see that as a major constraint.”

Another observation from Boeing is that low-cost carriers are leading the growth of single-aisle aircraft. Their share already increased six times since 2002 but will grow again to some forty percent of the world’s fleet in 2042.

Ultra-long-haul single-aisle is a niche market

With the A321XLR, Airbus has captured a significant slice of the long-haul market for single-aisle aircraft. Call it ultra-long-haul, where Boeing has nothing to offer. Darren Hulst said that this is a niche segment, comprising only 10 percent of all single-aisle jets.

“While we’ve seen airlines here and there add new services, it hasn’t dramatically changed the proportion or even the amount of long-haul services by single-aisle jets. The challenge in flying ultra-long-haul, single-aisle services is you run out of capacity for bags, and you run out of ability to provide a premium product. And the cargo element that is such a huge part of medium and long-haul transportation is not an option when you’re talking about a single-aisle. When you run out of range and you run out of some capabilities, that becomes an issue.”

Widebodies

While long-haul routes and thus widebodies were hit hard during the pandemic, they have witnessed a very strong recovery and are at 85 percent of pre-Covid levels. There are now 628 airports served by widebodies compared to 544 ten years ago. Most twin aisles operate on routes between 1.000 and 9.000 miles but also over 10.000 miles.

The CMO predicts demand for 7.440 widebodies compared to 7.230 last year. Demand for freighters is 925, slightly down on the 940 in the previous forecast. Asked if he could specify the numbers for medium-sized widebodies like the 787 and the larger 777X, Hulst said:

“From a public perspective, we don’t lay out the different sizes of widebody passenger aircraft. From a freighter standpoint, medium and large-size freighters are at 80 tons of capability. So for example, 767 freighters with about 55 to 60 tons of capability or medium-sized and 777s with over 100 tons of capability are large graders. Informally I would say the 787-9 is a medium-sized wide body and anything above that is probably a medium or medium to large size widebody.”

North America is still dominant

By region, there are not many differences where the 42.595 aircraft in this year’s CMO or the 41.170 in last year’s edition will go. North America continues to lead with a 23 percent share, but Asia/Pacific grows to 23 percent from 22 percent last year. Eurasia (last year referred to as only Europe) is static at 21 percent, China goes from 21 to 20 percent. Unchanged are the Middle East (7 percent), Latin America (5 percent), and Africa (2 percent).

Whereas Airbus is predicting significant growth in China, Boeing is seeing a one-percentage-point reduction in demand. Yet, the country remains of great importance, said Darren Hulst: “Demand is largely flat. In fact, that increased slightly compared to last year, but we didn’t see a dynamic that would dramatically change our outlook from last year to this year. The fundamentals that have driven China haven’t changed. In terms of economic activity in terms of growth, I can’t speak for what Airbus did in terms of their shift between replacement and growth, but I don’t think our outlook has changed measurably. And I think it’s still very bullish on that overall market.”

Freighters

The freighter fleet is set to grow to 3.745 aircraft in 2042, up from 3.610 predicted last year through 2041. This includes aircraft that will be retained and 2.825 new deliveries and passenger-to-freighter conversions, up from 2.795 last year.

Of these, 1.290 will be standard-body aircraft, 885 medium-sized freighters, and 650 large widebody freighters. As Boeing changed the split between the different models and no longer specifies conversions and new deliveries, the numbers are less detailed compared to the previous CMO.

Boeing says that at 3.0 percent, global trade will grow more than the 2.6 percent increase in annual Gross Domestic Product (GDP). This is reflected by the long-term growth of air cargo, which has been 3.5 percent annually over the past five years despite the pandemic.

“We are seeing those fundamentals for demand for air cargo continue. We’ve seen a significant amount of new deliveries both from production and converted freighter perspectives over the last few years. And those new aircraft will continue to provide value for the market. And so that’s why we’ve really moderated our forecast. It’s not a significant change from last year, but we see demand for about 2.825 new freighters, whether they’re new-production or converted standard body freighters, over the next 20 years.”

Airlines are more productive

Another observation from Boeing is that airlines have become more productive with their aircraft. “It is incredible to see how much productivity airlines were able to gain from higher utilization, higher load factors, and an increase in seat densification. Over the next 20 years, we’re projecting that airlines are going to be able to squeeze about 20 percent more productivity out of the fleet,” said Hulst.

“This means that if airlines would stay at the 2022 level of productivity from a load factor or a utilization standpoint, the industry would need 20 percent more jets than we’re projecting in this year’s commercial market outlook. We’re seeing small increases in average seat sizes across the single-aisle and wide-body spaces, but in many ways, it’s split quite evenly between the size of aircraft up gauging between densification on existing aircraft, which means more seats per airplane.”

Boeing also sees that the pandemic has led to airlines simplifying their fleets by reducing the number of different aircraft types. The airframer counts 75 airlines that have phased out at least one aircraft family from the fleet.

Views: 131

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →