2020 05 04 8 44 15

The past weeks have been a one-way roller coaster for everyone in Commercial Aviation, and we’ve been on the craziest ride down ever. But the Boeing story is of special interest.

For some background please see this story from Bloomberg. “Less than two months ago Boeing Co. went to Washington, hat in hand, asking for a $60 billion bailout for itself and its suppliers. The company, which had spent heavily on stock buybacks and was still reeling from the 737 Max disaster, was an unlikely candidate for government support.” Yet last week: “Ultimately, it allowed Boeing to raise $25 billion from private investors and withdraw its request for a government rescue, avoiding the restrictions that would have certainly been imposed.”

Another view on this story you want to see comes from Reuters: “In just six weeks, Boeing Co went from seeking government aid to announcing it no longer needed it.” Followed by: “Then Boeing had a breakthrough. Its plan was to gauge investor interest for a bond issue of between $10 billion and $15 billion, according to people familiar with the deliberations. Yet demand for the bonds on Thursday peaked at more than $70 billion from over 600 investor accounts, according to the sources.”

The role of the financial community with respect to Boeing deserves attention. What are these people thinking? We aren’t alone with this question.

An articulate view on questioning the rationality of funding Boeing is to be found here. “Boeing has launched an extremely successful multi-tranche $25 billion bond deal. The issue solves all its immediate funding needs. It enables the company to walk away from difficult bailout discussions. It claims its access to market capital demonstrates it’s soundness – which is utter bollchocks – and that it doesn’t need a government rescue. The issue of moral hazard for government is avoided. Boeing will survive – for time being – as is.

It’s a crock of s**t.

The bond deal was snapped up by investors. It does offer a small increase in yield if it’s downgraded to junk and a 5.15% yield on the 10-year tranche. Buyers are unconcerned the company is hemorrhaging money, has been downgraded to the cusp of junk, faces massive lawsuits over the B-737 Max, has comprised on quality and safety, is laying staff off in droves, and is seeing orders cancelled around the globe.” Put in a nutshell: “No one cares about the economic reality facing the company.”

All through 2019, many in the financial services industry was saying that even at over $400, Boeing was a “buy”. On March 12, 2019, Business Insider had a story pointing out interesting items. Boeing’s market value had plunged 40% from the 2019 peak after the second MAX crash. The stock topped out at $446.39 on March 1, 2020. “But the recent selling has been unable to sway Wall Street analysts, who remain largely bullish on Boeing shares. Among the analysts surveyed by Bloomberg, 21 had a “buy” rating while only 2 had “sell.” The report notes that on February 27, Morgan Stanley raised its price target to $500, representing an increase of 17% at the time.

As of this writing, the stock price is quite a lot lower. Here is how analysts rate the stock is now. On January 31, 2020, we questioned the Boeing market valuation.

On March 19, 2020, Boeing asked the US government for $60bn in assistance for aerospace manufacturers, a liquidity injection to bolster the group, and its supply chain if airlines deferred deliveries. Then on April 30, 2020, Boeing made a bond offering of $25bn, bringing its total debt to $64bn. As pointed out by Bank of America, this is the equivalent of five times Iceland’s sovereign debt and $7Bn more than what is owed by New Zealand. What is going on here? First, they needed $60Bn then they only needed $25Bn? In two weeks the requirement went down 58%.

We are not in the financial services business and we do not offer financial investment advice. But staying in our lane does not mean we cannot ask questions.

It appears to us there might be a rationale for this Boeing financing process. This does require a level of cynicism to follow.

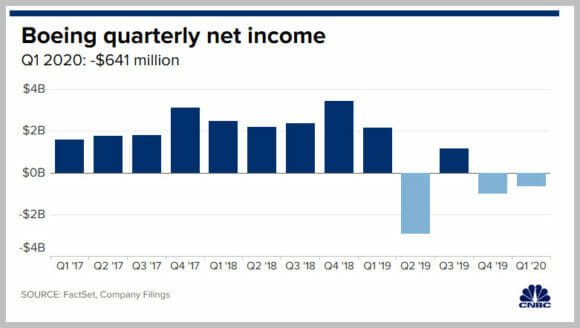

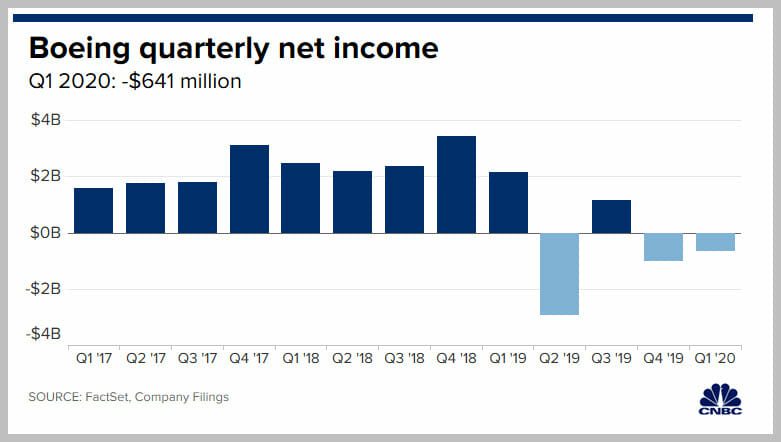

In 2019 Boeing reported an annual loss of $636m, with a 1.01bn loss in the fourth quarter. The two MAX crashes have cost Boeing $19Bn. In 1Q20 there was another $641m loss. It is reasonable to expect more billions are going to be lost as the MAX crisis rolls on. Even if there were no longer a MAX crisis and the aircraft were ready for delivery, pent up demand for the aircraft has dissipated.

All of which points us to the following conclusions:

- Boeing does not want to see its management control interfered with by Washington DC

- Such interference could lead to Chapter 11 and the requirement to keep staffing levels intact

- But Chapter 11 would wipe out the stockholders – and crucially, the stock options held by management

- Such a loss for management and financial markets would be really hard to stomach, so it has to be avoided at all costs

- So, pour more money into Boeing, with a hope and a prayer that time fixes this – kick the proverbial can down the road. Hope nobody notices or forgets a few years from now. Covid-19 didn’t create this fiasco, it merely magnified Boeing’s weaknesses

- In a world where risk capital no longer carries risk, it will be taxpayers to end up paying. Just like the last banking crisis

In the end, we are led to believe that “Buy Boeing” is the right strategy. Boeing is too big to fail. This is Fool’s Gold. The part too big to fail and is crucial to the United States is the 16,000 talented workers (with perhaps more to come) that are losing their high-skill jobs.

How about Boeing management? The people that brought us the MAX debacle, KC-46 fumbles, 787 production problems, Starliner failures, and 777X delays. And billions in losses. Give them another $25Bn? It’s like giving drugs to a junkie. If this team deploys the funds for new programs, rehires people and invests in products then, perhaps, “Buy Boeing”. But any continued focus on stock buybacks leads us to conclude “Bye Boeing”.

Views: 0