2019 10 10 11 40 21

This morning the US DoT published its latest T-2 data. This data source provides the first public view on the performance of Delta’s A330-900. The results are rather impressive. As always, let’s start with data.

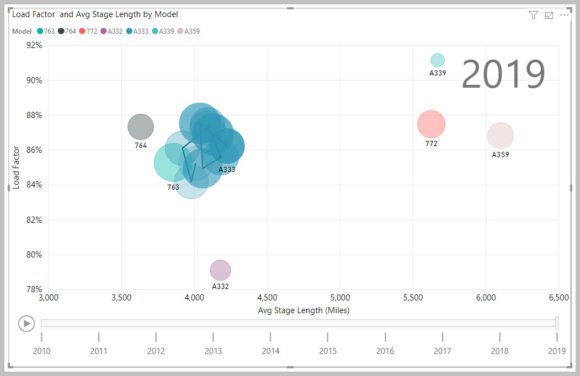

Using our data visual model, we clicked on the A330-300 to show that, over the period at Delta, that aircraft has been a consistent performer. Load factors have been between 80% to just under 90% with a stable stage length for several years. This aircraft is the right size and fits Delta’s needs well. Delta averages 292 seats on the A330-300 and 280 on the A330-900. The A330-900 is a replacement for the A330-300 in size terms.

But the A330-900 can do so much more. Evidence is the little green dot next to the year on the chart. Whereas the A330-300 averages a stage length of just over 4,000 miles, the A330-900 is already at about 5,700 miles. That’s nearly 43% more range! Happily, for Delta, its A330-900s have an average load factor of over 90%. Airbus scored with the A330neo concept from what it looks like here. Delta is surely happy with this. They placed their growing A330neo fleet in a sweet spot and its working.

Airlines have shown the A330 is a workhorse that can do regional and transoceanic routes. Airbus has explained to us time and again that the “natural” replacement of the A330 of today is the A330neo. Program boss Crawford Hamilton has given us several interviews where he repeated this message. Turns out he may be right on.

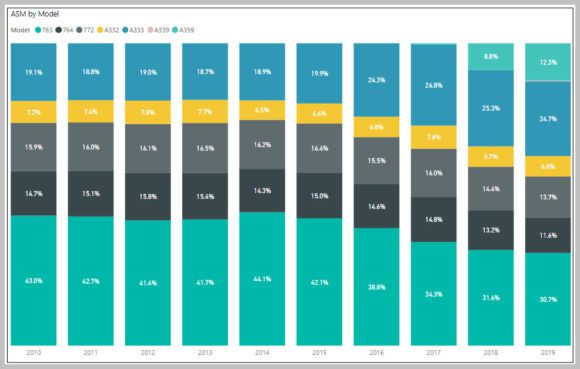

To get an idea of just how tiny the ASM impact of the A330-900 at Delta is through September, see the following chart. But this is bound to change.

We can see that Airbus is making inroads at Delta. The aging 767 needs to be replaced and it is Airbus with the most promising solution. Delta’s CEO comments on the NMA notwithstanding. The tiny slither between the 12.5% of the A350-900 and the 24.7% of the A330-300 is the A300-900 at 0.28% of the airline’s ASMs YTD. That number is only going to rise.

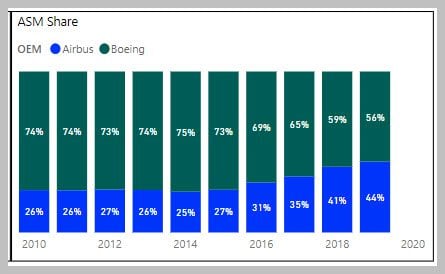

A further demonstration of Airbus’ rising fortunes at Delta is shown in the next chart which tracks ASMs for twin aisles.

We await the updated Form 41 to get a view of costs. Meanwhile, the T-2 gives us a glimpse of just how disruptive another Airbus neo program is.

Views: 4