3 18 2022 11 34 27 AM

The Western Cape (where Cape Town is located) declared an inter-governmental dispute over the South African Department of Transport’s silence on Delta Air Lines’ request to fly a triangular route from Atlanta to Johannesburg and Cape Town.

Western Cape MEC for Finance and Economic Opportunities, David Maynier filed the dispute. “As far back as May 2021, I wrote to the Minister, to request that Delta Air Lines’ application to operate a triangular route between Atlanta – Johannesburg – Cape Town, be processed urgently precisely because tourism is a significant contributor to job creation and economic growth in the Western Cape,” Maynier said in a statement. Over a period of six months, seven letters were sent to South Africa’s Transport Minister Fikile Mbalula over the matter, with “no substantive response” received, adds Maynier. An inter-governmental dispute was declared on November 25, 2021, to which the Mbalula replied on February 21, 2022, asking for more time.

Meanwhile, United Airlines and Delta are competing for the remaining slots available to US airlines under the US-South Africa bilateral. Delta applied to launch a non-stop Atlanta-Cape Town service and United (currently flying between Newark and Cape Town) applied to launch a new Washington DC-Cape Town service. There are no flights by South African airlines to the US at present. The re-constituted SAA has no announced plans to fly to the US.

Wesgro, the Western Cape government’s marketing organization, estimates economic losses of the decision to disallow Delta a triangular route could total R420 million (~$28m). Of this two-thirds is in tourism spending and 30% in cargo exports. Moreover, the US was the Western Cape’s largest export market in 2021, with an export value of around R17bn which was up 57.5% over the previous year. The US has become the province’s largest source of inbound tourism. For the past decade, the US was the largest investor in the Western Cape in CAPEX terms, accounting for R2.9 billion and R4.4 billion in 2020 and 2021, respectively. This resulted in the creation of thousands of job, training, and skills development opportunities, plus support for surrounding communities through outreach and humanitarian programs in the province, says Wesgro.

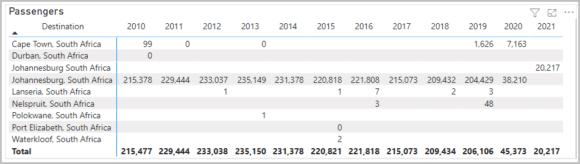

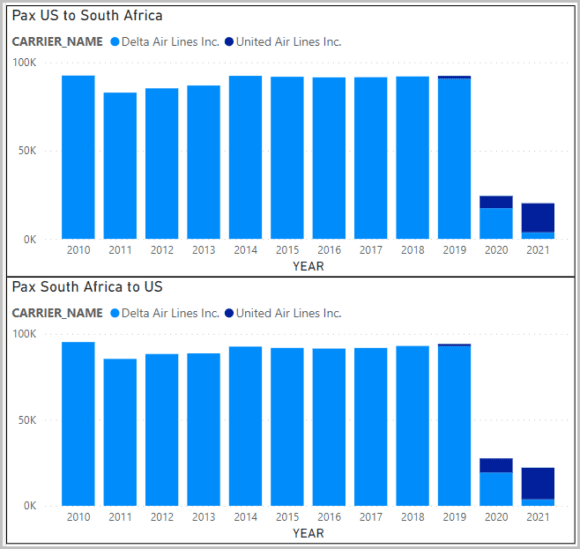

What about the view from the US? We took a look at the US DoT data to get a handle on the market. The US data is current through September 2021. Traffic levels are low compared to other markets – South Africa ranks rather low on US travel flows. The 2019 volume ranked South Africa at #62, between Finland and Ethiopia.

When we breakdown the numbers among airlines delivering travelers from the US to South Africa we note that SAA was the market leader, and the gap left by its absence are what Delta and United are chasing.

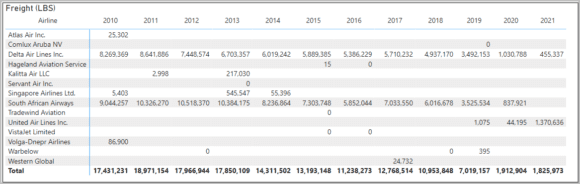

Note the 2021 volume increase for United, driven in part by adding Cape Town and the slow return by Delta. Is freight a key consideration for US DoT in deciding on the competing requests by Delta and United? Delta uses the A350-900 to Johannesburg and proposes this aircraft for Atlanta-Cape Town as well, while United deploys the 787-9 to South Africa. Delta’s ATL-JNB flight used the 777LR and this remains Delta’s longest route. The 777LR had a useful cargo capacity that Delta exploited.

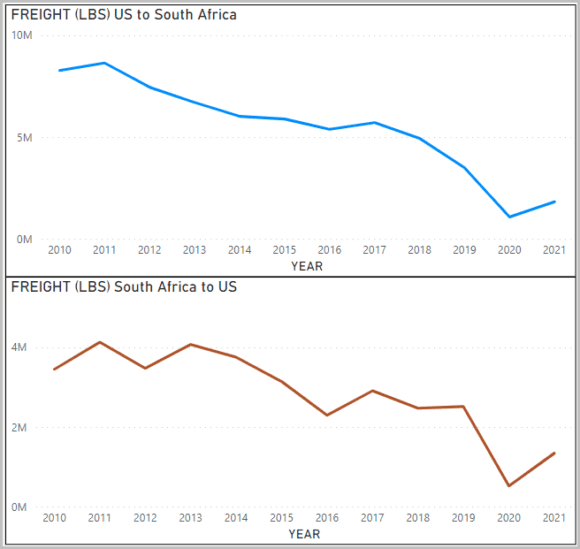

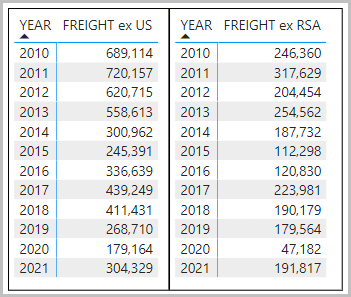

DoT data shows that in 2021 Delta’s A350-900s averaged about 400,000 pounds in freight while United’s 787-9s averaged 357,000 pounds. Is the 11% difference between the two is small enough to call it a draw? You know how this difference will show up at any route hearing. How big is the market? The data shows a depressing history. The curves go the wrong way, even if there’s a blip through 3Q21. Note the market is mostly US exports to South Africa.

If we breakdown the numbers into averages, for a per flight volume, we get the following. Essentially, either airline could handle the available freight.

A challenge is that Cape Town is swamped by Johannesburg. Johannesburg is the country’s main business center. Cape Town has not been allowed to develop its own direct air service. This is an important issue because Cape Town is routinely ranked among the world’s best destinations. Here’s another source, and also Travel&Leisure. It is a special place (disclosure: your correspondent lived there for much of my youth).

Traffic between the US and South Africa declined with the pandemic. But even before that, traffic was not growing.

Looking at the two US airlines in this market: United moved ahead, overtaking incumbent Delta. Even though SAA isn’t in the market, as a Star Alliance member it can codeshare United’s flights. Which means it can also start feeding these flights.

Delta faces an uphill battle here. The SA government does not seem interested in helping the Cape Town economy by allowing a Delta triangle flight. Hence Delta’s decision to serve Cape Town directly. The traffic volume is tough – is there enough for both airlines to make it work? It sure does not look that way.

Based on 3Q21 DoT data, United’s 787-9 costs $26.48 per seat/hour compared to Delta’s A350-900 at $23.33 per seat/hour. The IAD-CPT route is 7,927 while ATL-CPT is 8,129 miles. United’s route should take 14.4 hours and Delta’s route should take 14.8 hours. We estimate Delta having a one-way $37/seat cost advantage, so there’s little margin here.

The market is small, with questionable growth prospects. Even though Cape Town is a spectacular tourist destination, the competition for the market is surprising.

Views: 1