IMG 9240 scaled

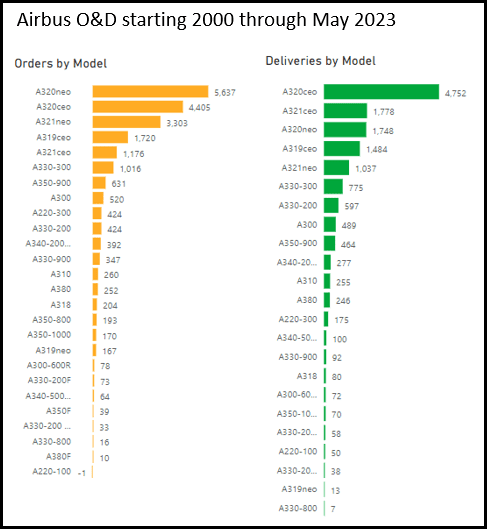

The recent numbers announcement warrants more attention. We think changes in Airbus’ order and delivery numbers reflect market views worthy of deeper analysis. Orders data is gross and is useful for guidance as these are modified before deliveries. Orders are plans; deliveries are facts. The orders and delivery numbers by model listed differ as customers make changes.

Starting with January 2000 and going through May 2023 provides a good idea of the history and a useful guide to where we are going.

Starting with January 2000 and going through May 2023 provides a good idea of the history and a useful guide to where we are going.

Starting with orders, the A320neo has outsold the A320ceo – which is remarkable in its own right. The A320neo has 1.3 orders for every A320ceo. The A321neo has 2.8 orders for every A321ceo ordered. You can see where we are going.

Among twin aisles, note that the A350-800 had 193 orders – about what the A318 attracted. The A350-800 is no longer a thing. Same with the A380F and a few others. The A380 won fewer orders than the A310.

In terms of deliveries, the A320neo is about to eclipse the A321ceo. The A320neo family has been a tremendous success. Way more successful than John Leahy thought at the program’s start in 2011.

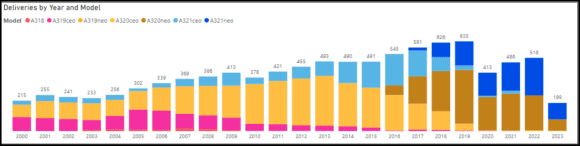

We will focus on the A320neo family because this is the source of a big market signal. Let’s start with a chart, as this helps to highlight what we are seeing.

The following chart lists Airbus single-aisle deliveries through the end of last month. Click on the chart to make it bigger and easier to read.

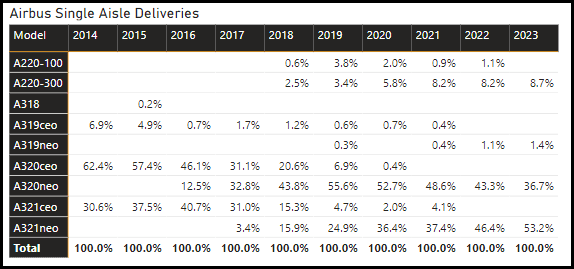

Takeaways:

- The swing from ceo to neo was quick. It took only four years from the first neo delivery to zero ceo deliveries.

- The neo single-aisle lineup now is essentially A320 and A321. The A319neo is a marginal product and likely eclipsed by the A220-300. Your correspondent impudently asked Mr. Leahy about this possibility in 2011 and received the full blast of his ire. Oh well, and here we are.

- Notice how from 2019, A321neo deliveries started to pop. The table below shows this in numbers. Whereas the A321ceo peaked at 41% of single-aisle deliveries, the A321neo is already comfortably over 50% this year. Last month A321neo saw 32 deliveries compared to 19 A320neo.

There has been a quick evolution, a sea change for the industry. Because of the MAX crisis, we cannot use Boeing data to show the same trend – though orders for the MAX10 support the thesis we are about to offer.

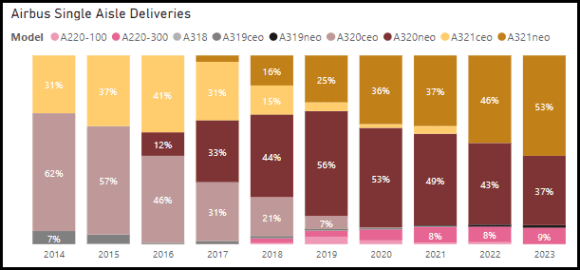

The data in the chart is identical to the table. It shows graphically how quickly the sea change is evolving. Here’s our basis and thesis.

- Airlines have bought into the upsizing argument.

- Airfares are declining in real terms; the growth among LCCs and ULCCs will maintain this.

- Airlines see the pilot shortage remaining even as traffic growth returns faster than expected. Airlines need bigger aircraft to move the volume with the pilot pool. (Disclosure: Boeing’s Darren Hurst disagreed with this idea when asked a week ago)

Thesis: The middle of the market has become the most important segment among single-aisles.

Views: 18

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →

Very infomative