2020 02 10 11 05 57

Take a look at how oil prices are dropping. This should be great news for the airline industry. And with the Coronavirus keeping people off flights in the world’s fastest-growing travel market, fuel demand is going to remain below production. The longer this virus contagion goes on, fuel prices will stay soft.

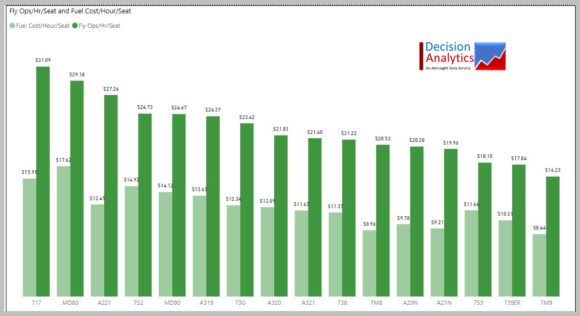

Now take a look at the US airline market for 2019. First the impact of fuel on the fleet using the latest data (Form 41 through September). For some aircraft, fuel costs are relatively high. As we have noted before, the MAX has excellent fuel burn numbers.

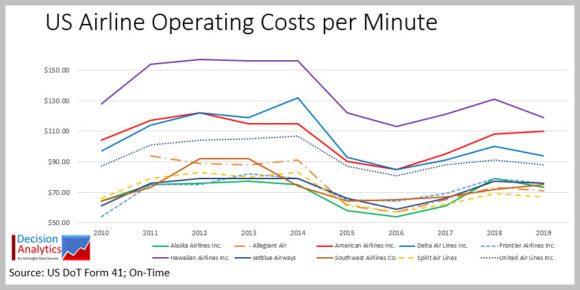

The drop in fuel costs helps airlines like Delta with its older and less fuel-efficient MD-88 and 717s. But as fuel costs drop, the overall picture on flight operations is also interesting to see. The next chart shows the average cost per airline operational minute. This data is also through September 2019.

As labor costs rise, the drop in fuel prices could not have come at a better time. Not everyone was seeing a dip in their cost curves. Also, the lower fuel costs benefit US domestic travel as this market is not being impacted by Coronavirus, so load factors remain high. US domestic traffic is larger than US-China traffic. As the published data catches up with current markets, it will be interesting to see where the airlines end up.

Views: 1