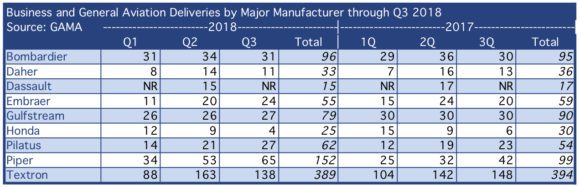

GAMA released its third-quarter statistics for 2018, and the General Aviation segment increased its billings to $4,134,953,455 in the third quarter, up only 0.83% from 2017. The variability in the mix, when compared to 2017, was significant, with 286 piston aircraft delivered (30 more than 2017), 132 turboprops delivered (5 fewer than 2017), and 282 business jets delivered (13 more than 2017) for a total of 568 aircraft during the quarter versus 530 in 2017.

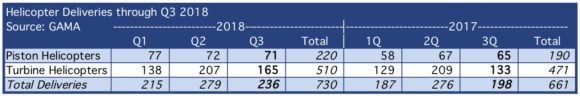

Helicopter shipments were up a remarkable 19.2% year over year to 236 units versus 198, with billings of $966,219,155 up 19.7%. Helicopters are continuing to experience a resurgence in demand with the recovery in oil and gas markets. The following table summarizes the first three quarters and compares them with last year for fixed wing aircraft:

The full GAMA report for Q3 and the first 3 quarters of 2018 can be found here, and for all of 2017, broken out by quarter, here.

By company, the results vary significantly, as shown in the following table comparing first three quarter shipments from this year to last. Bombardier, Pilatus and Piper were ahead of last years pace, with Daher, Embraer, Gulfstream, Honda, and Textron falling behind 2017 deliveries.

The helicopter market has been up in each quarter year over year, as shown in the following table showing helicopter shipments by quarter for 2018 and 2017:

Airbus has been off year-to-year on deliveries, with Bell and Robinson showing substantial gains and Leonardo a small gain year-to-year, as shown in the following table:

The Bottom Line:

General aviation is showing slow growth in revenues, with billings slightly ahead of inflation, as the industry has not rebounded. While deliveries are up, the mix to smaller aircraft has resulted in stagnant revenues for the sector in the third quarter. The helicopter market has shown resilience with double-digit growth over 2017.

The fourth quarter is typically the best for general aviation, and it will be interesting to watch to see if the fourth quarter provides further improvement. Our forecast projects a slow but steady growth for the business aviation market, driving revenues in the general aviation sector, led by new large cabin business jets from Gulfstream and Bombardier that are just entering the market.

Views: 6