310412101 5453177511426290 5026959216943897376 n

A net foreign exchange loss of €269.2 million related to unhedged lease liabilities in US dollars is the main reason that Wizz Air’s half-year loss almost tripled. Despite other headwinds like high fuel costs, the ultra-low-cost airline produced a positive second quarter and the first half of its financial year 2023. High currency costs bit Wizz Air once again.

In HY1 (March-September), Wizz Air carried 26.5 million passengers, up from 12.5 million in the same period of FY22. It carried 12.9 million passengers between June and August, which was a record for the airline. Revenues from passenger tickets and ancillaries reached €1.2 and €1.0 billion respectively, with total revenues per available seat kilometer (RASK) up by 32.4 percent to €4.48. The ticket price was on average €82.9. The load factor was 86.9 percent. Q2 revenues were €1.385 billion, and the net profit was €68.2 million compared to €-6.5 million last year.

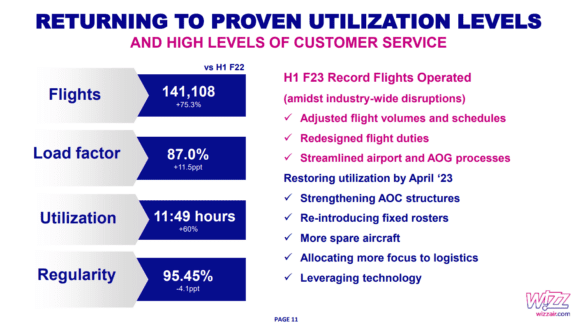

Demand was strong during the summer period and Wizz Air escaped the operational troubles that it suffered in Q1 FY23, when it was forced to cancel many flights due to staff shortages and other issues. “Our operational performance has recently normalized and we are now back in line with our historically low levels of cancellations and flight disruptions”, CEO Jozsef Varadi says in the earnings release.

Total revenues reached €2.194 billion versus €880.4 million last year. Operating at a higher level resulted in higher operating expenses, notably staffing costs, airport fees, maintenance costs, and fuel costs. Total expenses increased to €2.258 billion from €932.3 million in HY1 FY22. Fuel costs were up to €1.033 billion from €256.9 million. Although hedged, fuel costs were adversely impacted by the high US dollar. For the full year FY23, fuel is hedged at 54 percent.

This translated into an operating loss of €-63.8 million compared to €-51.9 million last year. EBITDA reached €374 million in Q2 and was €217.8 million in HY1 versus €164.3 million. Net cash from operating activities was €473.9 million. The net loss for HY1 was €384.8 million, up from €120.9 million last year. The total non-cash FX charge on currency costs, which already hurt Wizz before, was €285.5 million compared to €16.5 million in FY22. To protect it better against currency fluctuations, Wizz has signed more currency leases in euros and included caps for interest rates. Wizz Air ended September with €1.630 billion in liquidity and total liabilities of €6.5 billion.

Rumania

After Rumanian airline Blue Air suspended flights in September, Wizz Air jumped on the occasion by moving five aircraft to Bucharest while also adding capacity at Bacau, Cluj-Napoca, Isai, and Sibiu. It temporarily moved three aircraft from its base in Chisinau (Moldavia) as the proximity of the country to Ukraine made it vulnerable to airspace closure. Wizz doesn’t want to risk losing more aircraft in Ukraine, with still three of them in Kyiv since February.

Wizz continued its expansion in Italy, adding 750.000 seats from October by basing two additional aircraft in Rome (seven in total) and one in Milan (six), while reducing the based fleet in Palermo to one aircraft. It also based a fifth aircraft in Vienna (Austria) and a seventh in Sofia (Bulgaria). Wizz Air Abu Dhabi now has a fleet of eight aircraft after four were added and plans to grow the number of inbound and outbound flights. In the UK, Wizz closed its base at Doncaster, which resulted in the closing of the airport. The airline also will expand its activities in Saudi Arabia, having operated the first service from Rome to Damman on September 28, but the plan is the establish a joint-venture airline with Saudi investors.

Wizz Air’s ‘to-do list’ and accomplishments in tHY1 FY23. (Wizz Air)

Outlook

Wizz Air plans to operate this winter at a 35 percent higher capacity over 2019. With higher fares, RASK should be up by mid-single digits in HY2. Varadi said that the airline will keep a strict eye on costs and limit costs per available seat kilometer (CASK) excluding fuel increases to single-digit levels. “While the macroeconomic backdrop remains challenging and uncertainty for consumers has heightened, we have put in place measures to mitigate the impact on our costs. We expect to continue to see the seasonal effect of lower utilization on our ex-fuel CASK during the second half of the year, but are on track to return to pre-COVID-19 utilization levels in spring 2023. (…) Whilst there remains some uncertainty during the winter period in relation to macroeconomic and input costs, the combination of a return to proven levels of both ex-fuel and fuel CASK in April 2023, and the continued diversification and growth of our network supported by fleet expansion plans leaves the Company well positioned to drive profitable growth in the future.”

In October, Wizz Air took delivery of the 170th Airbus, an A321neo. The airline exercised purchase rights for another 75 A320neo family aircraft in September, bringing the total number of aircraft ordered with Airbus to 482. In HY1 FY23, it took delivery of 21 aircraft, of which twelve were financed with a sale and leaseback and nine through JOLCO transactions. Six A320ceo aircraft were phased out. In HY2, the carrier will take delivery of fourteen more A321neo’s and phase out nine A320ceo’s. With more A321neo’s coming in, the average number of seats per aircraft has grown to 216.

Views: 3