2022 05 04 1

Higher production volumes on the Boeing MAX program are the main driver behind better first-quarter results of Spirit AeroSystems. The Tier 1 supplier to Boeing, Airbus, and Bombardier reported thirty percent higher revenues and a 69 percent lower net loss on May 4. Higher MAX volumes benefit Spirit AeroSystems in Q1.

Spirit Aerosystems produced a $52.8 million net loss, compared to $-171.6 million in Q1 2021. The operating loss was $42.2 million compared to $125.9 million last year, resulting in an operating margin of -3.6 percent versus -14 percent last year. Group revenues of all three business units improved to $1.175 billion, up from 901 million.

The Commercial business unit improved its revenues to $938.4 million from $696.1 million. The loss was $3.4 million versus $-82.9 million in Q1 last year, translating into a -0.4 percent operating margin compared to -11.9 percent in the previous year. Excess capacity costs totaled $49.8 million, net forward loss charges of $23.8 million, and $26.2 million in cumulative catch-up adjustments related to the MAX supply chain costs. Omicron in January resulted in $9.5 million in abnormal costs.

Delivery of MAX shipsets doubles

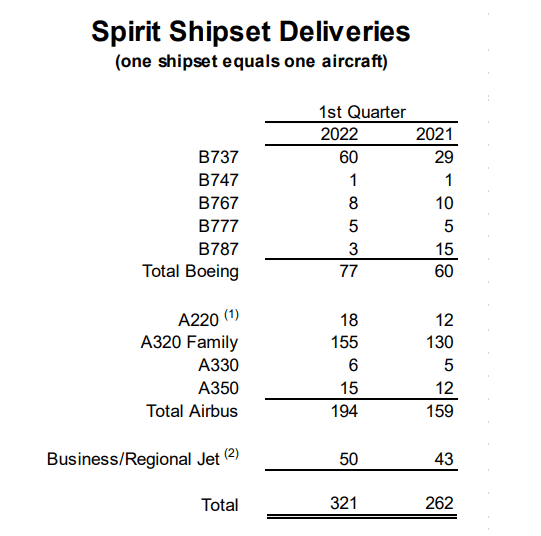

Spirit doubled the production of MAX fuselages and segments from 29 in Q1 last year to sixty this first quarter, which significantly contributed to the higher revenues while excess capacity costs went down. The Wichita-based company has recently increased MAX production to 31 shipsets per month compared to a rate 21 in Q4. It currently anticipates that this rate will be maintained for the rest of the year. This is in line with what Boeing said during its Q1 results earnings call on April 27, when Chief Financial Officer Brian West stated that Boeing wishes to stabilize the MAX rate at 31 for some time.

Spirit CEO Tom Gentile said in February that it was preparing to go up to rate 42 if requested. Today, he said that based on rate 31, Spirit expects to deliver 315 MAX instead of 350 shipsets this year. The slower rate increase means that it will take longer to get to burn down the inventory and get to twenty shipsets which was the original plan for the end of this year.

Overall, shipset deliveries to Boeing increased from sixty last Q1 to 77 this first quarter, but those for the 747 and 777 were static at five, and for the 767 down by two sets to a total of eight. Spirit delivered just three 787 shipsets versus fifteen last year as Boeing reduced Dreamliner production to just two per month and continued to pause deliveries over production quality issues. The 787 was the main factor in 21 percent lower widebody revenues. Gentile said that 2022 should see the delivery of twenty 787 shipsets. Spirit took a $153.5 million net reach-forward loss on the 787 program in 2021. The aforementioned $23.8 million forward loss in Q1 is partly for the 787 and partly for the Airbus A350 program.

Deliveries to Airbus included 194 shipsets, up from 159 in Q1 last year. A320neo-family deliveries were up to 155 from 130, those for the A220 to eighteen from twelve, for the A330 to six from five, and for the A350 to fifteen from twelve. For the A220 program, Spirit now reports wing end items instead of pylon end items. Business jet deliveries to Bombardier increased to fifty from 43.

Aftermarket revenues increase thanks to more MRO activities

Spirit’s Defense and Space unit produced the highest profit at $20 million, up from $12 million in the same period of last year, predominantly from higher Boeing 737 P-8 production and development programs. Revenues were up 3.3 percent to $158.5 million. As MRO activities and the need for spare parts increased, revenues of Aftermarket recovered with the same 66.7 percent as D&S and reported an $18 million profit, up from $10.8 million. Revenues increased by 51.7 percent to $77.8 million.

The cash flow was $-270 million versus $170 million last year, reflecting the higher working capital from increased production. Spirit also made its first of four quarterly repayments to Boeing of $31 million each, having received a $123 million advance payment in 2019 to bridge a period of lower rates.

Spirit AeroSystems continues to negotiate with Boeing and Airbus on higher production rates, but hasn’t received any new numbers from Boeing. On the A320neo, Spirit is ready for rate 65 from mid-2023 and rate fourteen from mid-2025. Gentile says he wants to be agile when it comes to rates. Although Spirit experiences supply chain disruptions, they are limited. The conflict between Russia and Ukraine has some effects on titanium supplies, but Spirit has an inventory for twelve to eighteen months of production and is working on other sources. Gentile adds that sourcing titanium is usually done by airframers. On a different level, sanctions on Russia have an impact on its small workshare on the Irkut MC-21.

Inflation risks are mitigated with long-term contracts through 2023, but in some contracts, Spirit will need to offset higher costs with customers. But if inflation remains high, this will have an impact on MAX program margins. Labor is also under pressure, although Spirit has now recalled almost all of its staff in Wichita that was furloughed earlier. In June next year, the renewal of the contract with the mechanist’s union IAM is up, but Gentile said that Spirit is preparing for this.

Spirit hasn’t offered guidance for 2022, but higher rates, the restart of the 787, and new projects should result in additional medium-term earnings. Like the A350F, for which it has started engineering work, the Airbus CityAirbus NextGen wing program, the repair program for the MAX of nacelles and wing control surfaces, and the support program on the re-engining of the B-52 bomber.

Views: 2