92514937 3937587486251338 4657825297310154752 n

UPDATE – Higher production deliveries of the Boeing MAX and Airbus A220 program have improved the results of tier-1 supplier Spirit AeroSystems in 2021. However, they were severely impacted by the ongoing production pause of the Boeing 787, which produced a $153.5 million net reach forward loss for the full year, Spirit announced on February 2. Spirit AeroSystems reduces losses but 787 continues to bleed money.

Spirit reported a full-year net loss of $540.8 million compared to $-870.3 million in 2020. The operating loss was $459.2 million compared to $812.8 million in 2020 or $79 million in Q4 (2020: $101.4 million). This includes selling, general, and administrative costs, plus research & development. By segment, Commercial produced a $220.6 million operating loss versus $-620.6 million in the previous year or $-20.2 million in Q4 (2020: $-59.7 million). Aftermarket produced a $50.3 million full-year profit (2020: $37 million) thanks to the inclusion of MRO activities in Belfast and Dallas that were acquired in Q4 2020. Defense & Space reported a $44.3 million profit ($47 million) and saw higher volume on the Boeing 737-P-8 program. Spirit introduced the three new business segments during the year.

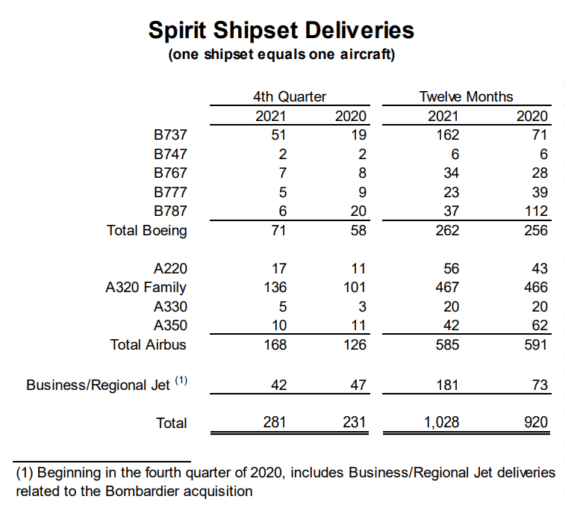

The improved result from Commercial largely comes from higher revenues, up to $3.128 billion from $2.711 billion, or $844.3 million in Q4 versus $689.9 million. Spirit delivered 162 Boeing 737/MAX shipsets compared to 71 in 2020. The 747 was static at six shipsets, the 767 up to 34 from 28 (reflecting higher freighter sales), and the 777 down to 23 from 39. Dreamliner shipsets dropped to 37 from 112, bringing total deliveries to Boeing at 262 versus 256.

Airbus deliveries totaled 585 versus 591 in the previous year. The A320neo-family was flat at 467 (466), as were those for the A330 at 20. The A350 dropped to 42 from 62. A220 wing and fuselage deliveries were up to 56 from 43. Spirit’s business jet deliveries to Bombardier stand at 181 compared to 73, but one should note that the business segment was only integrated into Q4 of 2020. This brings total shipsets to 1.028 versus 920 in 2020, or 281 in Q4 versus 231 the previous year.

Net forward loss charge of 153.5 million on the 787

As in the third quarter, Spirit continues to suffer from the production delays of the Boeing 787. Although Boeing has paused deliveries since May and is waiting for clearance from the FAA to resume them, Spirit has continued to produce Dreamliner segments, notably the nose segment Section 41. It delivered six of them in Q4 and 37 in the full year. Since September 2020, Spirit has been directly involved in identifying and addressing the quality issues that include shimming and skin flatness on the nose segment and around the forward pressure bulkhead.

Of Spirit’s $241.5 million in total net forward loss charges, $153.5 million are related to the 787 program, of which $32.3 million in Q4 due to lower deliveries. These numbers include cash costs for the rework on aircraft that are fully covered by Spirit. It hasn’t discussed claims and compensation with Boeing. Full-year earnings include $217.5 million in excess capacity costs, of which $45.3 million in the final quarter. Abnormal costs related to Covid-19 were $12 million, compensated by $41 million from the Aviation Manufacturing Jobs Protection Program.

Spirits free cash flow improved to $-214 million from $-864 million. Liquidity stood at $1.479 billion on December 31, down from $1.873 billion a year earlier. Total debt is $3.792 billion compared to $3.874 billion.

Preparing for higher rates

In the investor’s webcast, Spirit AeroSystem said its focus this year is on increasing rates of its single-aisle production, which account for eighty percent of revenues. Spirit currently is producing 21 Boeing 737/MAX per month, but Boeing plans to ramp up its production from 26 now to 31 per month in the coming months. Spirit is already looking at 42 per month if Boeing wants to go higher. It is confident it can do these numbers as it has done 42 before in 2016. These rates should get margins to 16.5 percent once the MAX gets to rate 42/month.

Spirit has introduced a 737 automated floor beam assembly line that reduces the number of hours to fabricate. Together with more digitization, this drives efficiencies that allow for higher rates and reduce costs. The supplier reduced its 737/MAX inventory to 97 fuselages and plans to bring this down to twenty by the end of the year, in line with what it said during its Q3-results presentation last November. There is some pressure on the supply chain in Asia, but the impact on costs is limited. It has the capability to in-source or dual-source from internal or local suppliers. For the MAX, sixty percent is domestically sourced.

On the 787, Spirit knows what changes it needs to make to the production process to overcome quality issues once production restarts It is 40-45 percent through all the rework that needs to be done on the 110 Dreamliners in Boeing’s inventory. CEO Tom Gentile said it is waiting for news from Boeing and the FAA as to when Dreamliner deliveries will resume. Unit costs per 787 are loss-making as all costs unload on the remaining number of aircraft it expects to build. This is in contrast to the 777, which is a profitable program and looks good with strong freighter sales and the launch of the 777-8 Freighter.

Airbus will decide later this year on a further ramp up A320neo-family rates from rate 65/month in mid-2023 to maybe rate 70 or 75 in the following years. The Airbus A220 is at four per month now, but Spirit expects Airbus to ramp up to fourteen, which gets it at break-even by 2025.

Spirit’s first quarter will be the most difficult, but the supplier expects improvements over the rest of 2022.

Views: 6