IAGtails

International Airlines Group (IAG) posted a EUR -1.860 billion net loss for Q1, it announced on May 7. Excluding special items, this was EUR -535 million. IAG expects that a long recovery to pre-Covid levels will take until at least 2023.

The operating loss of EUR -535 million compares a EUR 135 profit last year. Exceptional items mainly include a EUR 1.3 billion charge on ‘over hedging’ of fuel, taking in mind the much-reduced schedule for the remaining of 2020. This drove the net result down to -1.860 billion.

Revenues were -13.4 percent down to EUR 4.585 billion.

IAG will reduce cash costs from EUR 440 million per week in April/May to 200 million in Q2, reducing operational costs at all fronts including salaries, non-essential spending, and furlough.

Capex will be reduced from the EUR 4.2 billion planned on capital markets day last November to 3.0 billion, which includes 240 million for fleet financing that still needs finalizing.

New deliveries deferred

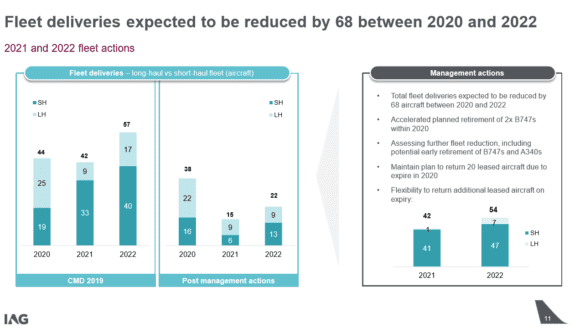

New deliveries will be down by 68 aircraft: 38 (22 long-haul) this year, 15 (9 long-haul) in 2021, and 22 (9 long-haul) in 2022. As a number of long-haul aircraft has been financed already it won’t make sense to defer deliveries of additional Airbus A350s and Boeing 787s, said Group CEO Willie Walsh. Still, there is a significant change compared to the plan presented on Capital Markets Day in November 2019. Walsh said IAG will go back to everything to reduce spending. During the investor’s call, Walsh didn’t say anything on the MoU with Boeing for 200 MAX.

British Airways will retire two 747-400s but more are being looked at, as will be early retirement of some Iberia Airbus A340s. IAG will return 20 aircraft to lessors this year as their contracts will not be renewed. Another 42 aircraft have been identified for returning to lessors next year and 54 in 2022.

Group CEO Willie Walsh said that British Airways is not the only airline within IAG that will suffer job cuts. However, UK legislation demands the airline to follow strict rules and consultation. As reported, BA plans to slash some 12.000 jobs. He hasn’t specified numbers for Iberia, Vueling, Aer Lingus, and LEVEL. Walsh said the plan to end operations at London Gatwick is under consultation but on a personal level, he said he hoped BA would maintain a position at London’s second airport.

Liquidity: 10 billion available

IAG has improved its cash position from EUR 8.6 billion by December 2019 to 9.5 billion by the end of Q1. Currently, the group has 10 billion in liquidity available of which 3.6 billion are unencumbered assets within the fleet.

British Airways has available GBP 0.3 billion from the Coronavirus Corporate Finance Facility from the UK government, while Iberia and Vueling expect approval within the next few days of a EUR 1.1 billion loan that will be 70 percent guaranteed by the Instituto Credit Oficial.

Walsh has always said he would be very much opposed to state aid, especially to failing companies. However, the current situation is different and IAG will request general state aid that is available not just to IAG but to all airlines.

IAG ended Q1 with EUR 7.5 billion in net debt, almost identical to 2019.

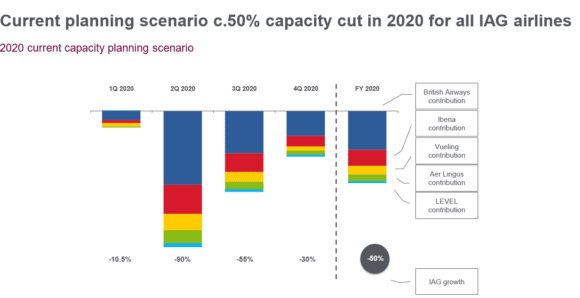

IAG has reduced its capacity in Q2 by 90 percent and hopes to be able to run at -55 percent in Q3 and -30 percent in Q4 but this is only a rough estimate, Walsh stressed. This makes an average of -50 percent for FY2020, for which he is unable to provide further guidance accept saying it will be ‘significantly worse’, echoing what Air France-KLM said earlier today. Walsh will continue to lead IAG until the delayed AGM in September, having originally planned to retire on March 26.

Walsh confirmed that IAG still plans to acquire Air Europa, but will review the terms and price before deciding if the deal can continue. The Spanish airline warned it will not be able to survive if the current crisis continues for much longer.

Views: 5