298720844 5639085426156648 3170739876276334713 n

While significantly improving its Q3 results year-on-year, International Airlines Group (IAG) hasn’t fully matched its 2019 results like main rivals Lufthansa Group and Air France-KLM have done. IAG ended the third quarter with a €1.208 billion net profit, with Vueling and IAG Loyalty contributing strongly to the result. Vueling leads the recovery back to 2019 levels at IAG.

The €1.208 billion net profit compares to €-452 million in Q3 2021. Consolidated revenues were €7.329 billion versus €2.709 billion, with passenger revenues at €6.416 billion versus €1.999 billion and cargo revenues down to €373 million from €405 million. Other revenues increased to €540 million from €305 million. Passenger unit revenues were up 22 percent and yields by 23 percent over 2019. Expenses were up to €6.121 billion from €3.161 billion, with non-fuel unit costs up 25 percent driven by lower capacity, the strong US dollar, and non-passenger businesses like BA Loyalty. IAG ended the quarter with a net profit after tax of €853 million compared to €-574 million in 2021. The group already reported a profit for Q2.

The results compare to Q3 2019 like this: operating profit €1.425 billion, consolidated revenues €7.310 billion, expenses €5.885 billion, net profit €1.008 billion. Revenues were almost on par then but take into account that they were higher this year despite capacity restrictions at London Heathrow and without the Asia/Pacific network remaining substantially closed. This affected capacity, which was at 81.1 percent of 2019 levels. Without these restrictions, revenues would have been even higher. Still, passenger unit revenues were 21.9 percent up from 2019. A €120 million negative FX exchange also affected the results, so Q3 2022 actually came quite close to Q3 2019.

The January-September results show an operating profit of €770 million (2021: €-2.487 billion), consolidated revenues of €16.680 billion (€4.921 billion), total expenses of €15.910 billion (€7.408 billion), and a net profit of €199 million (€-2.622 billion). The operating margin for all airlines was 16.5 percent. IAG ended September with €13.5 billion in liquidity and net debt of €11.1 billion.

Vueling margins best within IAG

Spanish low-cost airline Vueling operated at 103 percent capacity of 2019 levels thanks to higher utilization. Vueling continued to see strong demand on the domestic market, which pushed passenger unit revenues up by three percent and yields by seventeen percent over 2019. But the new bases at Paris Orly and London Gatwick also performed better than expected. Load factors were consistently over pre-pandemic levels at 93 percent. Q3 revenues grew to €1.021 billion from €466 million last year, the post-exceptional result to €259 million from €20 million. Vueling’s operating margin was an impressive 25.4 percent, the best of all IAG airlines.

Aer Lingus’ operating margin was 21 percent, which reflects the strong recovery at the Irish carrier. Last Q3, its post-exceptional operating result was €-79 million, but this jumped to €139 million this year, although a change in accounting policies makes a direct comparison impossible. The reopening of Ireland gave a boost to air travel, with passenger revenues reaching an adjusted 103 percent of 2019 levels and unit revenues up by fourteen percent despite a ten percent lower capacity. Capacity was at ninety percent, but the North Atlantic network operated at 102 percent. Revenues ended at €611 million from €130 million. Aer Lingus could have done even better, but operational issues at Dublin and Heathrow held back growth and short-haul revenues.

Iberia produced a post-exceptional operating result of €246 million versus €23 million in Q3 2021, which is ninety percent of 2019 levels. Revenues were €1.635 billion, up from €845 million and up five percent over 2019. This resulted in an operating margin of fifteen percent. Iberia performed strong on its European network and North and South Atlantic routes, with leisure revenues strong and business revenues continuing their upward trend. Premium leisure revenues exceeded those in 2019 by some twenty percent. Load factors on long-haul routes were over 2019 levels. The Iberia results include those of LEVEL.

British Airways reported the lowest operating margin, at 12.2 percent. BA was restricted by the capacity cap that was imposed by London Heathrow this summer but that will end on October 31. It operated at 74 percent capacity and also was still missing large junks of its Asian network. Bookings for Tokyo and Hong Kong have only been just accepted again from November. Total revenues were €3.357 billion versus €1.093 billion last year and recovered to 89 percent of 2019 levels. The operating result was €411 million, up from €-379 million. Unit revenues were already ahead by twenty percent of Q3 2019.

Outlook

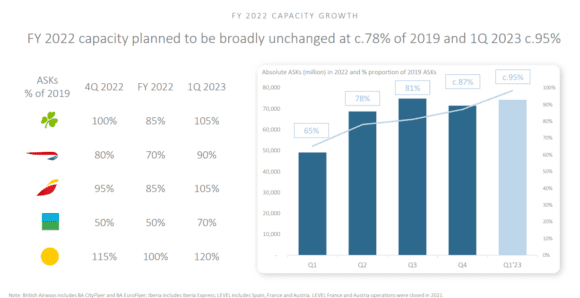

Forward bookings are strong and back at ninety percent in volume and 100 percent in revenues compared to 2019, led by the Spanish domestic market. In response, Vueling will grow its capacity in Q4 to 115 percent of pre-pandemic levels and to even 120 percent in Q1 next year. On capacity, Aer Lingus, Iberia, and British Airways are trailing Vueling. Average capacity will end at 78 percent this year but recover to 95 percent in Q1. CEO Luis Gallego said that the plans for the rest of 2023 have not been finalized as it waits for how the market will develop.

To build more resilience into its operations, British Airways continues to hire new staff. Some 2.000 staff have already been recruited, with another 4.000 to follow until April. IAG has negotiated various new labor contracts, with those in place for 2022 at Aer Lingus, IAG Cargo, and Iberia. At BA, a new agreement was reached for cabin crew and ground staff but an agreement with the pilots is subject to the ballot. New contracts for next year need to be negotiated at Vueling, Aer Lingus, and Iberia.

IAG expects to close 2022 with a pre-exceptional profit of €1.1 billion and significant positive free cash flow from operating activities. The airline group has hedged fuel at 68 percent in Q4 and 63 percent for Q1 2023, plus provisions in place for the following quarters.

IAG announced orders for 87 narrowbody aircraft with Airbus and Boeing this week. It will take delivery of previously ordered aircraft in Q4, including an A320neo and A321neo for Iberia. Financing of other aircraft is in progress or committed, with the sale and leaseback of one A350-900 for Iberia concluded and three more having been arranged.

Views: 11