IAGtails

International Airlines Group (IAG) has revised its medium-term growth forecast. Available Seat Kilometers (ASK) is expected to grow by on average 3.4 percent annually until 2022 compared to the previous guidance of 7.4 percent. This number has already been revised a couple of times.

As a result, the guidance of profit per share has been lowered from 12 to 10 percent, the airline group announced at its Capital Market’s Day on November 8.

The latest forecast reflects a slow-down of the economy IAG is expecting for the next three years. British Airways and Aer Lingus will add just 3 percent capacity in 2020. The Irish airline will significantly grow the transatlantic network, taking advantage of Norwegian leaving the Irish market as it lacks to have the proper aircraft (Boeing MAX) to operate from there. Aer Lingus’ short-haul network will be reduced next year and go negative.

Iberia will grow 2 percent capacity long-haul to Los Angeles, Tokyo, and the Canary Island, but short-haul will see reductions. Low-cost airline Vueling will see no growth as it thinks growth will not be sustainable.

Low-cost subsidiary LEVEL (active both long and short-haul) expects the biggest growth with 30 percent, but even that is below the original plan. CEO Willie Walsh stressed IAG will continue with LEVEL as the group thinks there is a niche for it but was frank when he said: “If we can’t make it work, we won’t”.

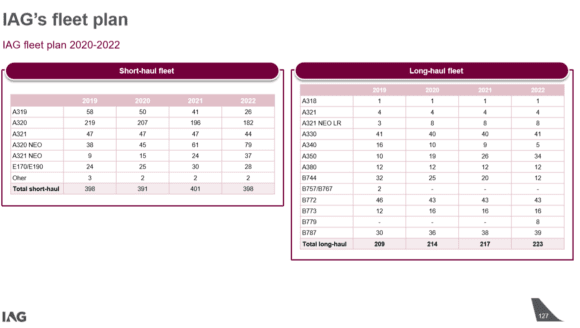

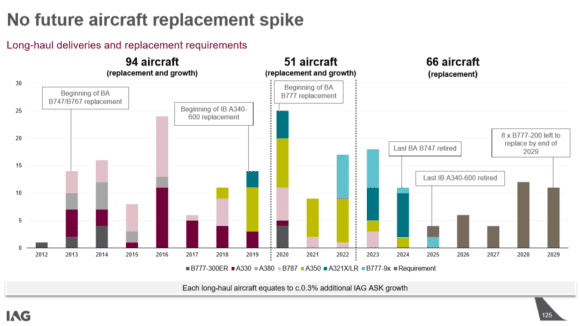

IAG is expecting to add and replace 51 long-haul aircraft in the 2020-2022 period. These include more Boeing 787-9s, and Airbus A350s. In 2022, the first Boeing 777-9s will arrive, two years after the first 777s will be retired. From 2023, more 777-9s will join BA and the last 747-400s will leave the fleet in 2024. Iberia will have the last A340-600 retired in 2025.

The replacement of 43 777s will continue until 2029 when only 8 -200s remain in the BA-fleet. Upgrading the long-haul cabin to include the new Club Suite has started this year and will last until 2025 to be completed.

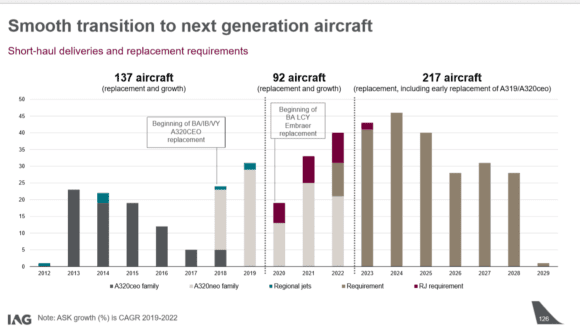

Talking short-haul, 92 aircraft will be either retired or delivered between 2020-2022, including replacement of BA’s Embraer E190-fleet that operate out of London City. Most new deliveries in this period will be A320neo and A321neo’s but from 2023 until 2029 see replacement and arrival of 217 new airliners. Most of them will be Boeing 737 MAX’ that will replace Airbus A319/A320/A321s at Vueling and British Airways Gatwick. The Letter of Intent for 200 MAX 8s and 10s signed at the Paris Air Show still needs confirmation. The fleet-renewal includes 62 aircraft that don’t necessarily need replacing yet but from an economic and environmental perspective are better to be retired early from 2023.

Fleet renewal will result in significant cost savings in fuel of up to EUR 360 million by 2022 as well as reduce carbon footprint. On average, IAG will spend EUR 4.7 billion per year in gross Capex, of which 85 percent or 4 billion is fleet. Of this, 89 percent is for replacement and 11 percent for growth, said Chief Financial Officer Steve Gunning.

At the same time, IAG has some 40 owned short-haul and some 20 long-haul aircraft that are nearing their end of life that can be parked if capacity should be reduced. The same applies to leased aircraft which can have an extension of their lease contract. Between 2020-2022, this includes 38, 48, and 55 aircraft. Again, this gives IAG flexibility.

During a series of presentations, Walsh and others went at length to stress the strength of IAG, its sustainable profitability, return on investment and shareholder return, strong balance sheet, and unique structure that allows for strategic thinking. Walsh takes it as a compliment that Ryanair has copied its group structure with a corporate parent and individual operating airlines, something Lufthansa reportedly is having a careful look at.

IAG has reduced its costs since 2011 by almost 11 percent and says it cost-efficiency positions it to weather any particular cycle it is up to.

IAG has set it a priority to improve customer satisfaction and its net promoter score, which should be at 33 points compared to this year’s 24 and 2017’s 27. At British Airways the introduction of new cabin products like Club Suite, lounges, and menu-quality is expected to boost this score, said Director of Strategy Alistair Hartley.

Another boost in sales is expected from the further implementation of IATA’s New Distribution Capability-standard of bookings and ancillary purchases which is really taking off within the industry. British Airways and especially Iberia have seen a surge in NDC-demand as part of the digitization of air travel, driving efficiency and lowering costs.

On the sidelines, Walsh said he will retire from IAG’s leading position before he will be 60 in October 2021. On contract negotiations which BA’s union BALPA, negotiations are still ongoing and should be concluded positively before Christmas.

Views: 4