Icelandair is confident it can recover from “a challenging” 2018, in which the airline posted a net loss of $55.6m compared to a $37.5m profit in 2017. The challenges were partly self-inflicted, as some strategic mistakes on routing and sales and marketing have cost the airline dear.

A small airline based on a small island with few citizens, Icelandair has been able to secure itself a share of the Transcontinental traffic over the last year by offering cheap routes between Europe and the US via Iceland. It benefitted the island as well as the airline and continued to do so in 2018, with international passenger traffic up 2% to 4.2m, with load factor down 1.7% to 81%. Of them, 51% flew through Reykjavik, connecting 23 cities in North America with 26 cities in Europe or a combined 670 city pairs within the network.

Changes in this US/Europe network over the year have had a negative impact on performance and costs, admits president and CEO Bogi Nils Bogason. A change to its sales and marketing operations didn’t work out either. So while revenues were up 7% to $1.510bln, the result was behind expectations with costs increasing. Fuel costs were up 27%, aircraft leasing costs +68% and salaries +16%. Icelandair’s overall operating expenses at $1.434bln were 15% higher compared to the previous year. Lower fares and strong competition (from Iceland’s WOW, amongst others) didn’t help.

Yet, Icelandair’s cash position improved to $299.4m, +74m.

Icelandair says it expects a ‘significant improvement’ of results, after implementing a raft of changes. These include correcting the imbalance in its network by shifting 18% extra capacity to Europe and only 3% to North America, where flights to Baltimore and Dallas will be discontinued. There will be a re-scheduling of flights to spread them more over the morning and relieve pressure at Keflavik Airport. Dusseldorf will become a new destination in Europe.

Also to be implemented is a punctuality and operational performance improvement, a reduction of operational costs by 40%, better utilization of its crew, a new management revenue system, higher ancillary revenues and outsourcing.

Before April, Icelandair will increase its share capital by 625m kroner by offering shares to holders of pre-emptive shares.

Guidance for FY2019 is positive, but Icelandair expects a difficult Q1 as Easter falls within Q2.

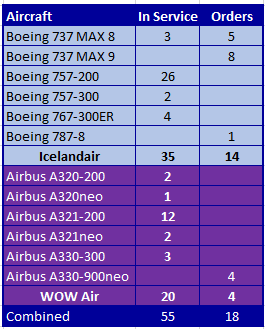

In 2019 Icelandair will add 9.7% capacity and aims for 4.6m passengers. It will take delivery of three Boeing MAX8s and three MAX9s this year, five MAX9s and two MAX8s in 2020 and only one of each the year after that. Icelandair has finalized the sale and leaseback with BOC Aviation and SMBC of seven MAX. On January 1, 2019, Icelandair’s fleet consisted of 35 aircraft, including three MAX, 28 757s and four 767s.

No word in the annual report on the failed attempt of Icelandair to purchase WOW last November, after the proposal met resistance from the shareholders. Since then, WOW tries to finalize a deal with Indigo Partners that – if successful – could give Icelandair some new troubles.

An Icelandair MAX8 crossing a canal near Amsterdam Schiphol Airport. (Richard Schuurman)

Views: 1