2024 03 11 14 19 55

Everyone in the industry has been watching India’s commercial aviation market growth. We have been tracking this market for several years.

We updated our India airline model this morning, and something popped out. Here’s the model.

Many curves go from the bottom left to the top right. Note we added Air India Express, which is, in essence, another new airline along the startup, Akasa.

The traffic volume is impressive. The recovery had a few hiccups, but the market is up. India now fits into our tier-one domestic traffic model., along with the EU, US, and China.

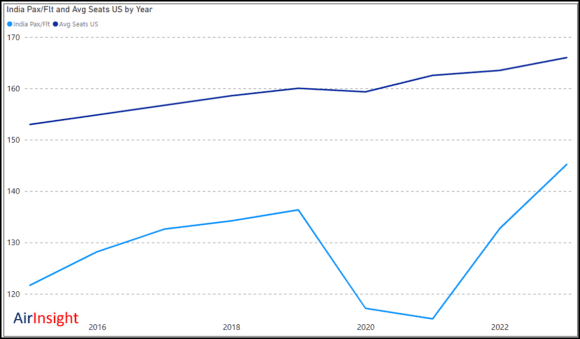

The passenger/flight table is what caught our eye, though. Here’s why.

The US is a far more mature air travel market. The dark blue curve shows the average number of seats per flight in the US, while the light blue curve lists the average number of passengers per flight in India’s domestic market. Based on the data, our model forecasts that by 2030, India could see ~200 passengers per domestic flight. That is less than six years from now.

As India continues its significant air travel recovery and headlong growth, it is clear that India’s airlines need larger aircraft. Specifically, they need to acquire MoM aircraft. The US market has seen demand for the MAX 10 build, with all three big network airlines ordering the MAX 10. These airlines are also building their fleets of A321s, along with Jetblue and Alaska with the MAX 10.

Indigo, Vistara, and Air India have moved towards the A321. Akasa has one MAX 8-200, but this may not be sufficient. Also, the single-aisle MoM aircraft has the highest backlog. The Indians had better get moving; last summer’s orders weren’t enough, and hopefully, they have swap rights for larger models.

Views: 1